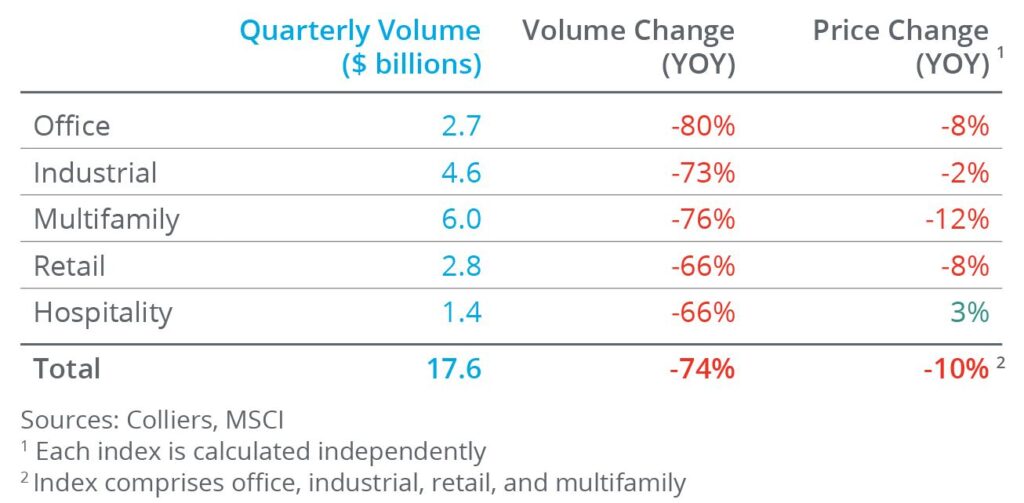

- Deal volume slumped in July, to $17.6 billion.

- This marks the lowest-volume month of 2023 and breaks a three-month streak of volume gains.

- Multifamily posted the strongest sales overall, at $6.0 billion. Retail sales of $2.8 billion topped office volume.

- Hospitality pricing continues to grow year-over-year, but overall asset value pricing has declined 9.6% since 2022, per MSCI’s RCA CPPI.

- The recent rise in the 10-Year Treasury is causing deals to stall, which could weigh on overall Q3 volume.

Office

Office volume is down 80% year-over-year. Large transactions are few and far between while investors await more pricing clarity, a Catch-22 resulting in a lack of sales. The largest deal of the month was for the RBC Gateway in Minneapolis, MN, built in 2022, which sold for $225 million, or $424 per square foot, to Spear Street Capital.

Industrial

Year-to-date, industrial volume is down 51%, which is better overall than volume for hospitality, office, and multifamily. While sales totals were lower than for multifamily, industrial is arguably the most liquid asset class, thanks to strong mark-to-market rent upside. Deals are still trading at low cap rates, such as in a two-property portfolio sale in Northborough, MA, to LBA Realty. The 390,000-square-foot properties, built in 2019 and 2020, traded for $78.9 million, at a 4.5% cap rate.

Multifamily

Still the monthly volume leader, multifamily volume is down 76% from last year. Large deals are still trading, but more infrequently. The highlight of the month was Apartment Income REIT’s announced joint ventures on 3,500 units, for a total reported value of $1.2 billion and a 5.6% cap rate. Other large single-asset deals had cap rates in the high-4%-to-low-5% range.

Retail

Retail volume outpaced that of office in July. This is not typical but has occurred in four of the past seven months. The largest transaction of the month was for $165 million, or $183 per square foot, for the Westfield Mission Valley in San Diego. This marks another disposition from the Westfield portfolio, this time to LOWE and Real Capital Solutions.

Hospitality

Hospitality volume remains muted, despite the strength of the asset class overall. The largest deal of the month was the sale of the 432-room Kāʻanapali Beach Resort in Kāʻanapali, HI, to Outrigger Enterprises for $280,600 per room. Other leading deals included the DoubleTree Resort in Paradise Valley, AZ, and The Inn at Rancho Santa Fe, CA, at $100 million or above each.

Aaron Jodka

Aaron Jodka