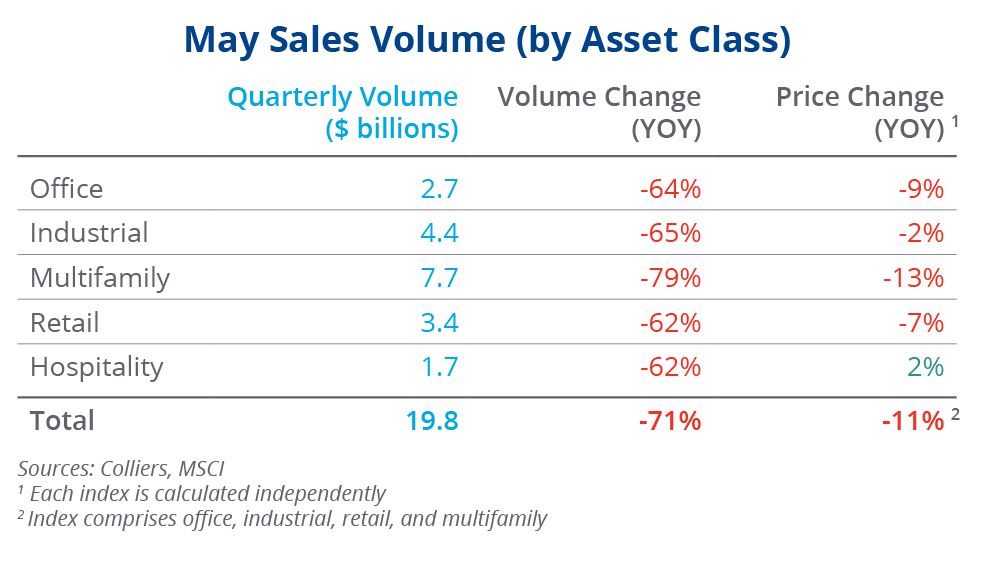

- In May, the $19.8 billion traded was 71% lower than last year’s volume.

- This isn’t a surprise, as volume peaked on a four-quarter rolling basis in Q2 2022.

- Values continue to adjust, but market participants are happy about the Fed’s recent interest rate pause.

- Multifamily and industrial volume have had the largest annual declines, while multifamily and office have had the strongest price adjustments.

- The market may be approaching its low point, though sales data lags. Both offerings and portfolio activity are picking up, signifying a thawing market.

Office

Office volume was again stunted, which is likely to persist in the near term. CBD activity remains light, while suburban volume is stronger overall. Generally, trades are still small, and conversion plays are picking up.

The largest deal of the month was the Flatiron Building in Manhattan, for $161 million, or $894 per square foot, when GFP Real Estate bought out its partners. The Torrey Pines Research Center, a life sciences asset in San Diego, traded for $86 million, or $1,049 per square foot, to DivcoWest, at a sub-5% cap rate. In Washington, D.C., 2100 M Street NW, a 291,000-square-foot asset, sold to Post Brothers for $66.8 million, or $230 per square foot. It will be converted to residential.

Industrial

Industrial continues to have stronger liquidity than office. To this point, larger industrial portfolios have been few and far between, though that is changing, and multiple $1 billion-plus portfolios on the market today indicate that there are buyers for such deals again.

The largest industrial trade of the month was the multiple-property Corona Lakeside Logistics Center in Corona, CA. The 730,000-square-foot properties traded for $325 million, or $445 per square foot, showing the continued strength of the Inland Empire industrial market. Other large deals took place in Arizona, Ohio, and New Jersey. In Marlborough, MA, Moderna purchased a recently completed cGMP facility from Oxford Properties for $91 million, or $650 per square foot.

Multifamily

Multifamily is still the most liquid asset class, totaling $7.7 billion in sales in May, but that volume has also had the sharpest drop-off over the past year. Offerings are picking up, indicating that sales volume should rise in the months ahead. The top deals of the month were outside of Florida and Texas, where the rapid increase in insurance costs is causing deals to stall.

The top sale was the 1,869-unit Lake Meadows in Chicago for $161 million, or $86,100 per unit. Other large deals took place in California, Arizona, and New York. The under-construction Aventon Mikasa in Charleston, SC, traded for $96.4 million, or $286,900 per unit. Forward sales have dropped off in recent quarters, and their return would boost overall liquidity.

Retail

Retail volume was down 62%, similar to volume for other asset classes outside of multifamily. Retail remains the most liquid in the sub-$50 million tranche, and deals below $25 million trade with higher frequency and ease. In May, just two sales topped $100 million.

One of the few malls to trade in recent memory, the 1.1-million-square-foot Westfield Brandon, in Brandon, FL, was sold in May to North American Development Group for $220 million, or $192 per square foot. The reported cap rate was 10%. Other top deals in California and Massachusetts represented nine of the top 10 retail deals in the month.

Hospitality

Hospitality volume of $1.7 billion was 62% less than last year, due to a lack of portfolios or large-scale resorts trading. But private buyers looking at SBA loans are finding success and a source of capital, helping to keep that segment of the market active.

The largest deal of the month was the 279-room Claremont Resort & Spa in Oakland, CA, sold to Ohana Real Estate Investors for $163.3 million, or $585,300 per room. Meanwhile, the 190-room St. Regis in Chicago traded for $134 million, or $705,300 per room. Magellan Development Group retained an interest in the property in the sale to Gencom Group and GD Holdings.

Aaron Jodka

Aaron Jodka

Nicole Larson

Nicole Larson