- Multifamily accounts for 40% of investment sales year-to-date.

- Sun Belt markets remain the leading investment targets, with no signs of that changing.

- On the year through April, 23 markets have already topped $1 billion in annual sales volume.

- Sales volume has cooled, though up 7% over one year ago. It had been running at a 200% year-over-year pace as recently as November/December 2021.

- Sound fundamentals and higher housing costs including increased mortgage rates should keep multifamily on solid footing.

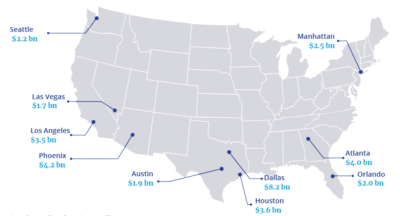

Multifamily continues to lead overall investment sales figures by a wide margin. Year-to-date in April, four of every 10 dollars has been invested in multifamily properties, in line with the pace of 2020–21. Total volume broadly matches industrial and office sales combined. The Sun Belt still dominates in U.S. multifamily investment sales, with seven of the top 10 markets in the Southeast and Southwest. Metros with the strongest population growth, per the U.S. Census Bureau — Phoenix, Houston, Dallas, Austin, and Atlanta — all made the top 10. In fact, the top 10 account for 41% of the nation’s sales through April.

Dallas, the leader in total U.S. sales, has been the number one multifamily investment market every year since 2016. Its $8.2 billion in sales volume through April is larger than that for the entire Midwest region and nearly matches the Northeast region’s sales. Phoenix, at $4.2 billion, and Atlanta, $4.0 billion, round out the top three. Los Angeles led the West in volume at $3.5 billion (ranking fifth), while Manhattan led the Northeast at $2.5 billion (ranking sixth). Thirteen other markets outside of the top 10 exceeded $1.0 billion in year-to-date sales volume. These include (from largest volume): San Antonio, Raleigh/Durham, Miami, Denver, Boston, Tampa, Nashville, Charlotte, Northern New Jersey, San Diego, Washington, D.C.’s Maryland Suburbs, Chicago, and Palm Beach.

$1B+ Q1 Volume Markets

There are no indications that multifamily will fail to lead sales volume for the foreseeable future. Strong demographic trends in growth corridors in the Southeast and Southwest, high single-family housing costs across the nation, elevated mortgage costs, and low unemployment all point to multifamily’s continued strong performance.

Download the report.

Aaron Jodka

Aaron Jodka

Nicole Larson

Nicole Larson