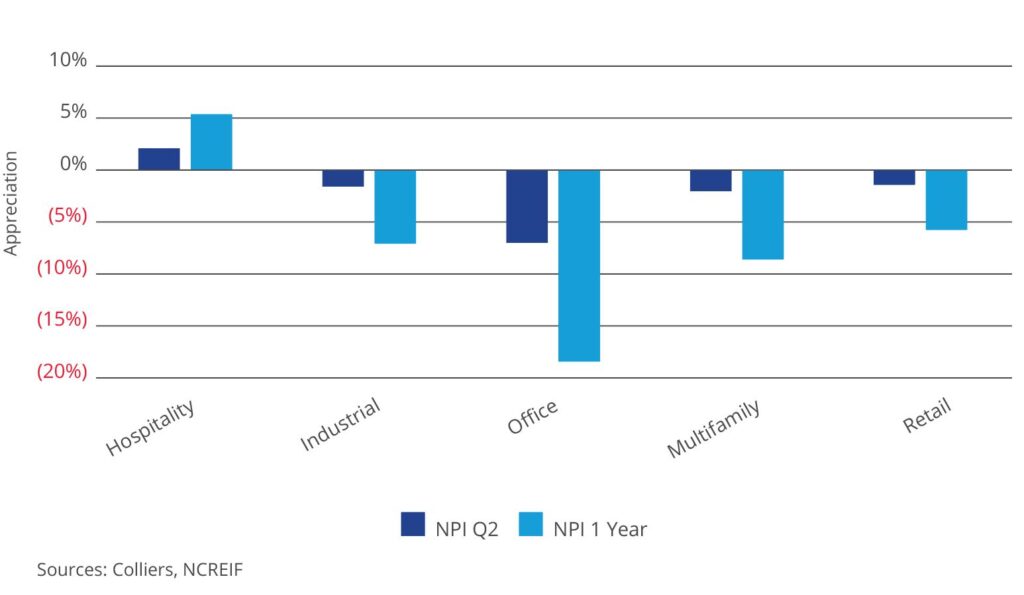

- Second quarter total returns were negative across the NCREIF Property Index (NPI).

- Values increased for hospitality, the only asset class to post gains.

- Industrial and multifamily value losses were less than in Q1, while office and retail value losses were greater.

- Office values have declined the most over the past year, more than twice as much as multifamily.

- Distress remains very limited across the NPI. Elevated benchmark rates have investors’ attention.

The second quarter marked an interesting shift in the NPI. Value losses overall accelerated from Q1, but not across the board, and were primarily driven by one asset class. To be fair, one data point does not make a trend; however, for two straight quarters multifamily and industrial value declines have decelerated. Values are still falling but at a reduced rate, while hospitality is bucking the trend, with values growing by 5.36% for the past four quarters. Retail values fell by 1.44%, doubling losses from the prior quarter, while office values fell 7% in Q2, and 18.41% over the past year.

Time will tell if this trend holds in future quarters, and interest rates have been stubbornly high at the start of the third quarter, which is weighing on valuations. REIT performance through the first half of the year has been positive, with back-to-back quarters of gains, per the FTSE Nareit All REITs index, perhaps a positive leading indicator. A deeper look at NCREIF data shows that distress doesn’t appear to be imminent. In Q2, 30% of properties in the NPI wrote values up, and even office had better than 20% posting gains. A negligible number of properties had negative equity in Q2, at less than 0.5% of the index; in contrast, that rate peaked at 7% in the GFC era. That said, for 500 properties NOI is below interest payments, indicating more challenges in the quarters ahead. Just five properties were returned to lenders last quarter from the NPI; another 47 were underwater but not returned.

Aaron Jodka

Aaron Jodka