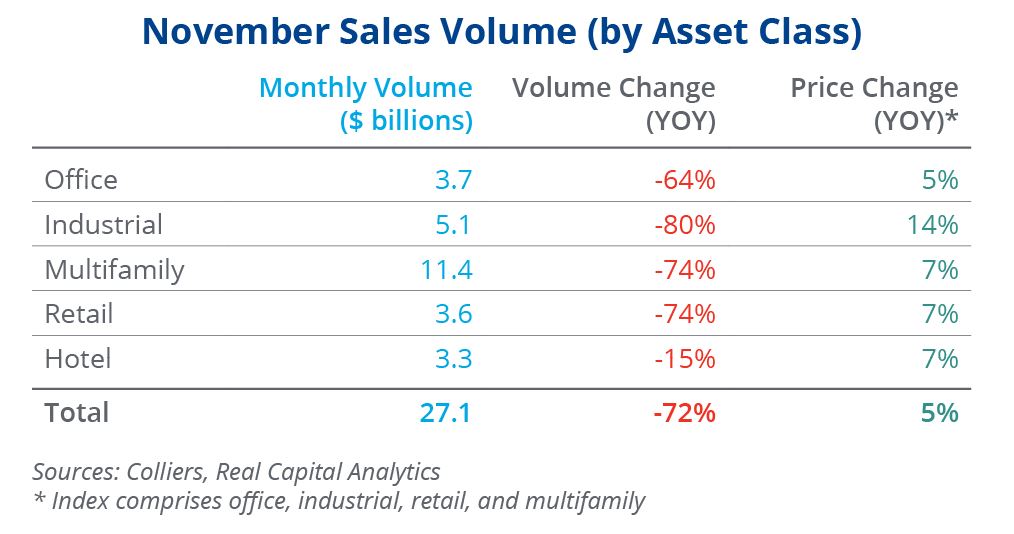

- Investment sales volume is down 72% in November compared to one year ago.

- Year-to-date volume aligns with 2021’s record levels, thanks to strong numbers posted in early 2022.

- There is no indication that December volume will match last year’s pace, cementing 2022 as the second-strongest year of all time.

- In November, industrial and multifamily faced the most substantial volume pullbacks, down 80% and 74%, respectively. They still rank as the top draws for capital.

- Hotel stands out with the lowest volume decline in November at 15%. Year-to-date, volume is up 7%, while retail is up 14%.

Office

Office volume is facing strong headwinds, with year-to-date volume down 12%, the most significant decline of all asset classes. Monthly volume was off 64% in November compared to last year. Suburban properties are the driving force here, as CBD sales have been stunted for some time. In fact, CBD volume has fallen below $1 billion in the past two months. The last time that occurred was during the Great Financial Crisis.

The month’s largest deal was the sale of 1330 Sixth Avenue in Manhattan for $320 million ($597 per square foot). RXR and Blackstone sold it to a joint venture led by Empire Capital Holdings. Other leading deals were in Sunnyvale, CA; Saint Louis Park, MN; Columbus, OH; Malvern, PA; and Burlington, MA.

Industrial

Industrial volume is falling off. This drop is a function of higher borrowing costs and the amazing sales pace that industrial experienced in 2021. Still, while volume is down, it looks worse than it is. Compared to the pre-pandemic average monthly volume from 2015-2019, November volume was down 29%.

The month’s largest deal was TA Realty’s acquisition of the Medley Commerce Center in Medley, FL, outside Miami. This 12-property, 1.1 million square foot sale rang up at $241 million, or $227 per square foot. In Minnesota, a 15-property portfolio traded to Capital Partners and Investcorp for $248.9 million. The deal included one retail property, a Home Depot.

Multifamily

Similar to industrial, headline figures showing a 74% volume decline in multifamily look harsh. This asset class has led the country in sales volume since 2015, but compared to the 2015-2019 average, November volume is down 19%. In addition, transactional cap rates are proving sticky, as RCA is showing a lack of movement.

The month’s largest deal was a 3-property portfolio on Manhattan’s Upper East Side. Solow Realty sold the assets to Black Spruce Properties and Orbach Group for $835 million. Meanwhile, THEA at Metropolis in Los Angeles sold at a reported 4% in-place cap rate, while a 6-property Boston-area portfolio sold at a 4.4% cap rate on last year’s income.

Retail

Rising interest rates are crimping retail investment volume, too. Cap rates are higher in this asset class, so the pressure hasn’t been as intense as with lower-rate property types. November’s retail volume was down 74% compared to 2021 but up 14% year-to-date, the strongest showing of all asset classes. Retail stands a chance to match last year’s volume. However, it is worth noting that while 2021 was a record sales year overall, it was not for this asset class.

The month’s largest deal was an 8-property portfolio on Long Island for $375.8 million. Several properties within the portfolio are grocery-anchored, a popular investment target. Other top deals included sales in Nashville, TN, and Turlock, CA, outside Modesto.

Hotel

Hotel volume was down just 15% from November 2021, and year-to-date activity is up. November’s sales volume, compared to monthly averages pre-pandemic (2015-2019), is up slightly. The hotel market’s strong fundamentals performance in recent quarters is a key factor, as are higher going-in cap rates. In addition, debt is still accretive in this asset class, helping deals to get done.

November’s top deal was an 88-property, $1.1 billion portfolio sold by Highgate Holdings and Cerberus to Flynn Properties and Varde Partners. The Montage Laguna Beach sold for $647 million, or nearly $2.5 million per room. Meanwhile, the Four Seasons Resort Jackson Hole traded for $2.5 million per room at a quoted 6.6% cap rate.

Colliers Insights Team

Colliers Insights Team

Steig Seaward

Steig Seaward

Marianne Skorupski

Marianne Skorupski