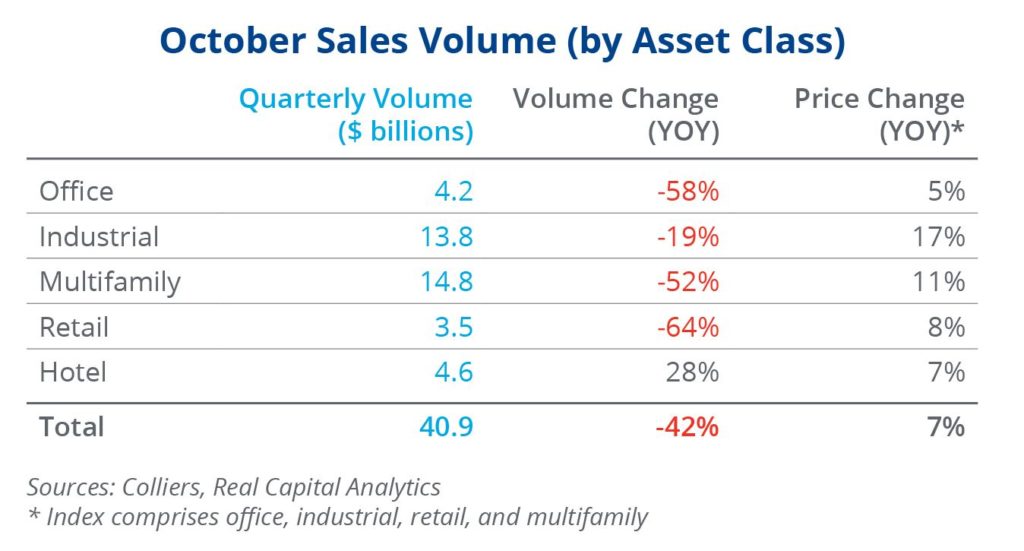

- Overall volume was off by 42% compared to year-ago figures.

- Hotel was the only asset class to post year-over-year sales volume increases.

- Multifamily, office, and retail were all off by more than 50%.

- Industrial was down 19%, despite Prologis acquiring Duke Realty.

Office

Office sales volume continues to face pressure. October’s volume of $4.2 billion is reminiscent of pandemic-level activity. CBD markets are facing the most significant challenges, with monthly volume falling shy of $1 billion. Transactional cap rates continue to hold, though the RCA CPPI index showed an annualized price decline of 3.7% from September to October. This reduction is light compared to what dealmakers are experiencing.

A few headline deals closed in the month, including 101 Hudson Street in Jersey City, NJ, 175 Water Street in Manhattan, and Allstate’s headquarters in Glenview, IL. Allstate’s campus is scheduled for demolition, with the new owners planning to rebuild it as an industrial property.

Industrial

Prologis’ acquisition of Duke Realty gave industrial a boost in October. However, outside of this massive transaction, activity was sluggish. Individual asset sales were down 56% compared to last year, showing the impact of rising interest rates on investment sales. Transactional cap rates are on the rise, as is pricing, albeit at a slower clip. Over the past year, industrial leads all asset types in price appreciation.

The largest individual industrial sale of the month was Nuveen’s purchase of 14001 Rosecrans Avenue in La Mirada, CA, for $151.2 million, or $448 per square foot.

Multifamily

Multifamily is showing softness in transactional data. Cap rates are flattening, and RCA’s CPPI index indicates that prices are falling at an annualized rate of 7%. Overall volume is down more than 50% year-over-year, and the most recent sales totals are below the 2015-19 average. There was a lack of portfolio activity, which weighed on overall sales statistics. Rising interest rates are biting the multifamily market the hardest, given the record low cap rate environment.

The largest single-asset trade in the month was the 1,015-unit Presidential City in Philadelphia, which sold for $357 million, or $352,000 per unit, at a quoted 4.6% cap rate.

Retail

Retail transactions are rapidly declining, the most of any asset type in October. This decrease was driven by a lack of portfolio and entity-level sales. Individual asset trades were off 41% year-over-year, broadly in line with the decline in volume across the broader commercial real estate sales market. Cap rates continue to hold based on trading activity, as going-in rates for retail are higher than other asset types. Those working through transactions today have seen pricing adjustments.

The month’s largest deal was the $110.7 million acquisition of Paseo Colorado in Pasadena, CA. This lifestyle center, built in 2001, traded for $199 per square foot.

Hotel

Hotel was the only asset class to post year-over-year sales volume increases, thanks to the $2.8 billion acquisition of Watermark Lodging Trust by Brookfield Asset Management. This sale included more than 7,300 hotel rooms across numerous states. Outside of this large transaction, the market was more muted. Individual asset sales were down 50% compared to last October, indicating the challenges in getting deals done today.

In the largest single-asset trade of the month, a joint venture acquired the 235-room Four Seasons in Nashville, TN, for $165 million, or $702,000 per room, continuing this city’s hot streak.

Aaron Jodka

Aaron Jodka