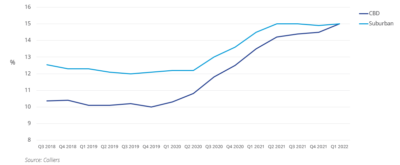

- Office vacancy rose in Q1 by 0.2 percentage points to 15%. CBD and suburban vacancies have converged.

- Industrial vacancy fell to an all-time low of 3.9%.

- Office construction is now 25% below peak levels.

- Industrial supply is nearly 60% higher than this time one-year ago, with 581.1 million square feet under development.

- Industrial had 33 markets post occupancy gains greater than one million square feet.

At the start of the year, the U.S. office and industrial markets posted differing fundamentals tracks. The office market vacancy recovery stalled, though the market held relatively stable, while industrial continued its record-setting pace. Vacancies ended the first quarter at 15% in the office market, and a record-low 3.9% in industrial.

Industrial Fundamentals

Construction is moving in opposite directions for the two property types. For office, construction activity has slowed. There is 121.9 million square feet currently underway, which is down 25% from this cycle’s peak of 164 million square feet, seen in Q3 2020. The New York metro area has by far the largest amount of ongoing construction, at 26.9 million square feet, followed by the San Francisco Bay Area with 9.1 million square feet and Washington D.C. with 8.5 million square feet.

A total of 96.9 million square feet of industrial space was built during the first three months of the year, and a record 581.1 million square feet were under construction at the close of the quarter. This is nearly 60% above the total underway this time one-year ago. The Dallas-Fort Worth industrial market is the most active, evidenced by the 7.3 million square feet delivered and the 72.0 million square feet under construction.

Rents continue to hold in the office market while they are rising in industrial. Vacancies across CBD and suburban markets have converged, and sublease space increased in the quarter. However, more companies are returning their office staff to work, signaling a rebound in physical occupancy and tenant activity. Industrial is facing supply chain issues, but strong fundamentals performance continues to pull in a record pace of investment capital.

CBD and Suburban Vacancies Have Converged

Download the report.

Colliers Insights Team

Colliers Insights Team

Steig Seaward

Steig Seaward

Marianne Skorupski

Marianne Skorupski