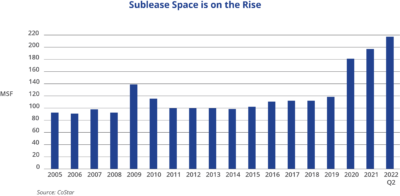

- Sublease space is totaling approximately 218 million square feet nationally, up nearly 15 million square feet from one year ago.

- Tenants are still working through their space needs, suggesting that more sublease space could be on the way.

- Life sciences properties are beginning to face sublease pressure too.

- Sublease space offers value to occupiers but is driving a small share of absorption overall.

- Investors are scrutinizing occupancy, lease roll, and sublease metrics during the sales process.

After a short reprieve in the second half of 2021, the amount of sublease space is rising again. Space soared during the early stages of COVID-19, topping levels seen in the Great Financial Crisis by a wide margin. Second quarter statistics have now set a new all-time high, at nearly 218 million square feet across the country.

Of the top 10 office markets, the average sublease availability rate is 3.5%, ranging from a low of 2.5% in Washington, D.C., to a high of 7.9% in San Francisco. The Class A CBD sublease rent is 30.1% lower than direct space across those 10 markets. Sublease rent is just 18.7% lower in Boston compared to 51.5% in Houston, showing wide discrepencies across markets.

To get some additional perspective, we spoke with Michael Lirtzman, Head of Office Agency Leasing, U.S.; Frank Petz, Office Lead on the Capital Markets Board of Advisors; and Stephen Newbold , National Director of Office Research.

Michael Lirtzman: The biggest difference between sublease space hitting the market today and at the onset of the pandemic is one of intent. Early in the pandemic, we were seeing space introduced to the market driven by uncertainty — these occupiers were unsure whether or not they would re-occupy and when, and were generally testing the waters. Today in most cases, we are seeing new sublease inventory driven by space from users who have made the affirmative decision not to re-occupy, whether fully committing to hybrid or full work-from-home strategies. We have seen an uptick in recent large-scale sublease offerings. This change in direction is of some concern.

Frank Petz: Tenants are firming up space needs, and more are now resigned to a permanent component of their workforce being at home. It’s not uncommon for space offerings to include new buildout, furniture, and equipment. On the life sciences front, sublease terms being offered are short — two to three years — in an effort to slow the cash burn and keep options open for anticipated growth in the future. This creates opportunities for startups to find space in low-vacancy-rate markets. Owners are looking carefully at leasing directly with a sub-tenant and extended term. Owners value any tenancy they can secure.

Stephen Newbold: Given the record amount of sublease space on the market, there are an increased number of top-quality sublet options available with high-end finishes. As firms continue to evaluate their post-COVID real estate needs, such space will remain a cost-competitive, short-to-medium-term option until there is greater clarity on economic and business direction.

Download the report.

Aaron Jodka

Aaron Jodka

Nicole Larson

Nicole Larson