- Office vacancies are approaching an all-time high nationally.

- Industrial occupancies softened due to new development but remain strong.

- Both asset classes are expected to see additional vacancy increases throughout 2023.

- Rents continue to hold broadly in office and have posted record growth in industrial.

- Capital markets favor industrial more than office, though the latter looks to be an intriguing countercyclical play.

Both office and industrial faced softening fundamentals in Q1. Office vacancies ended the quarter at 16.1%, just 0.2 percentage points shy of matching the all-time high. Given the current trajectory of occupier downsizing and lease expirations, the market is expected to exceed that level in the months ahead. Industrial vacancies increased as well, but not due to falling demand. Quarterly occupancy gains of nearly 74 million square feet are well above the pre-pandemic norm and only behind the record-setting years of 2020 and 2021. Construction is the cause of softening fundamentals in the industrial market. A total of 131 million square feet were completed in Q1, with an additional 622 million square feet underway.

Rents continue to defy gravity on the office side, with asking rents holding up remarkably well. However, concessions like free rent and TI packages are on the rise, causing effective rents to fall. On the other hand, industrial rents expanded by nearly 27% over the past 12 months. This growth is due to ease as new developments come online, offering occupiers more options.

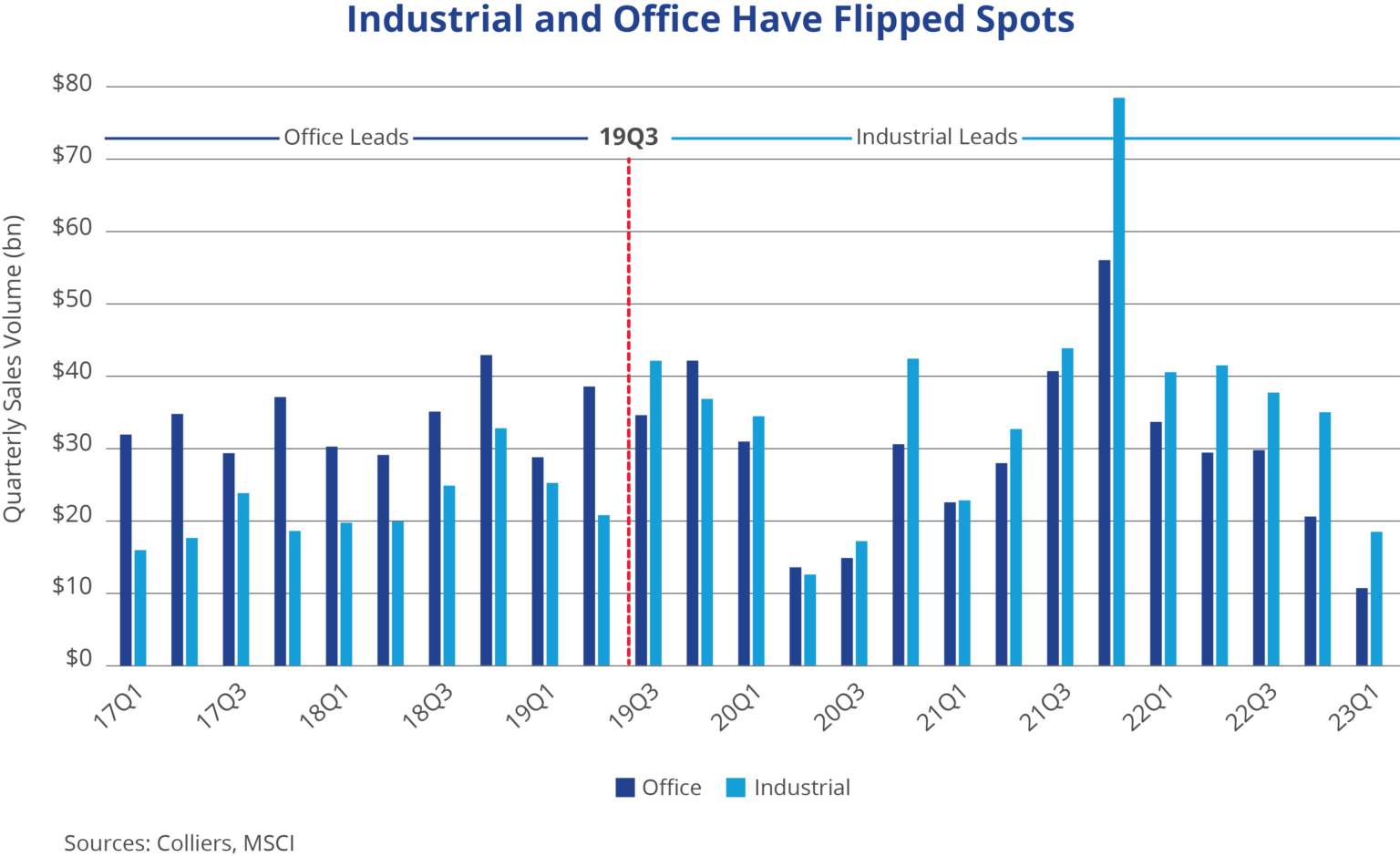

Industrial is the more liquid asset class today. In fact, industrial sales volume has been stronger than that of office in 13 of the past 15 quarters dating back to 2019 Q3. Prior to that, industrial had never topped office in any quarter, per data from MSCI. Office is in the headlines of late, and much of the press is negative, creating a tremendous opportunity for risk capital willing to deploy. Cash-rich investors that can pick their spots – think location, tenancy, building quality, etc. – stand to capitalize on the market dislocation.

Aaron Jodka

Aaron Jodka

Nicole Larson

Nicole Larson