- Strong rent growth and high homeownership costs will drive capital to multifamily.

- Industrial buyers are chasing massive mark-to-market rent adjustments.

- Office investors can play a return-to-the-city strategy or target suburban buys.

- Strong retail performers offer investors confidence in tenants’ business models.

- Many hotel properties have better performance metrics than ever.

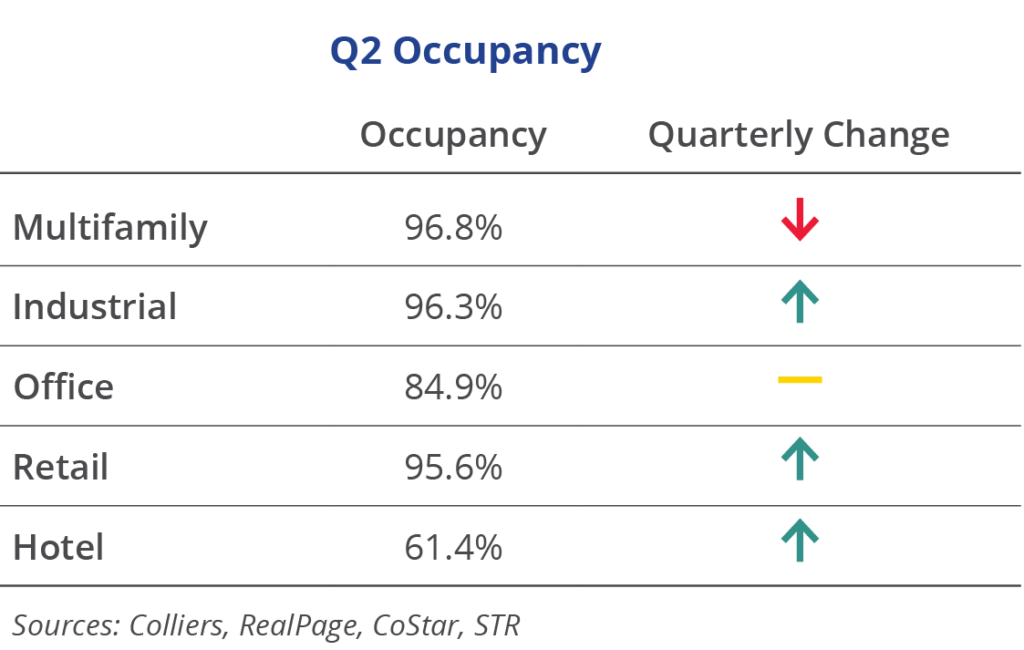

Property fundamentals improved across most asset classes in Q2, good news for NOI, and in turn, asset valuations. While the market is dislocated at the moment, that will pass. Investors willing to allocate capital today, even with higher borrowing costs or with more equity in a deal, are poised to benefit from continued healthy market dynamics.

Multifamily

Occupancies slipped marginally in the multifamily market, ending Q2 at 96.8%, per RealPage. While this is a quarterly decrease of 0.8 percentage points, occupancies are up from one year ago. Given recent occupancy levels, it is hard to imagine that they will just keep rising. Rent growth continues with a 3.1% quarterly gain and 14.5% over the past year. Florida markets dominate the top five rent-growth markets, all growing by more than 22% annually. Attracted by strong rent growth and the high cost of homeownership keeping households in the rental pool, investors will continue to flock to multifamily.

Industrial

Vacancies fell to a new low of 3.7% in Q2 and rents continued their upward march, increasing 12.5% over the past year and accelerating the rate of growth. Meanwhile, construction continued at a rapid pace, with more than 613 million square feet underway at midyear. Development is showing signs of easing, with projects likely being delayed due to today’s financing markets. This is likely to further drive rent growth and provide continued opportunities for owners to make massive mark-to-market rent adjustments at lease renewal.

Office

Absorption has been positive in three of the past four quarters, allowing vacancies to end Q2 at 15.1%. Office is best described as showing signs of stabilization. The majority (53%) of markets posted positive absorption during the quarter and rents continue to hold, with virtually no movement quarter-over-quarter. CBD markets have had a harder go of late than the suburbs. This offers potential opportunity for investors who get in front of a return-to-the-city movement. Those believing in a secular shift to the suburbs can take advantage of that investment thesis as well.

Retail

Inflationary pressures are causing a shift in where consumer dollars are flowing (i.e., gas spending), but overall retail property performance remains healthy. Vacancies fell 0.1 percentage points in Q2 to 4.4%, while rents rose 1.6% on the quarter. Demand has been, and continues to be, driven by restaurants, grocers, discounters (primarily dollar store concepts), and big-box retailers. Retailers have adapted to new spending habits and shopping styles, proving the resiliency of the tenant base. This offers promise for investors — as Darwinism would suggest that the stronger retailers will be the ones who survive.

Hotel

Hotel performance continues to rebound rapidly. Occupancies have improved to top 61% per STR, but nationally, they still have room to run before returning to pre-pandemic levels. Meanwhile, ADR has set a new record, although much of the growth is concentrated in the luxury and upper upscale categories. This is leading to massive RevPAR gains, even with limited business travel to date. Hotel investors have flocked back, finding many properties with better performance metrics than before the pandemic.

Colliers Insights Team

Colliers Insights Team

Nicole Larson

Nicole Larson

Steig Seaward

Steig Seaward