- Investment sales activity fell 15% compared to 2021’s record level.

- It was a tale of two markets, with a record-setting first half and a sluggish second.

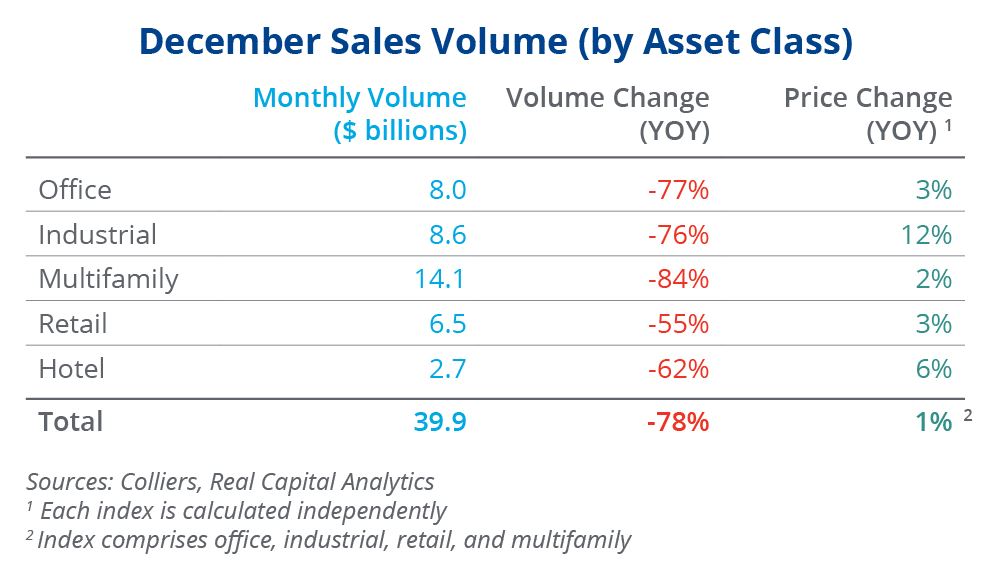

- December volume was down 78% compared to one year prior, the most significant decline since the Global Financial Crisis.

- RCA’s CPPI index began to show price declines in Q4.

- Office had the largest annual volume pullback at 25%. Retail was the only asset class to post gains, at 4%.

What a difference a year makes. At this time last year, we were discussing record-shattering sales volume. However, after a roller-coaster 2022, conditions have changed. On the surface, 2022 was a strong year, with sales volume totaling $687.8 billion, the second strongest on record. Digging into the data further reveals a second-half slowdown, with December 2022 volume down 78% compared to December 2021. Higher borrowing costs, stubborn inflation, and recession fears, among other headwinds, have cooled the investment sales market. Inflation is showing clear signs of easing, potentially offering the Fed a chance to slow its rate hike cycle. This would stabilize the cost of capital and get more buyers back to the table. A near-record amount of uninvested capital remains on the sidelines, indicating that a rebound is a question of which month, not which year.

Office

Office faced the largest slowdown in volume of the major asset classes, declining 25% in 2022. Cap rates showed a clear sign of upward pressure, particularly in CBD locations, and ended the year at 5.9%, up 0.6 percentage points, based on transactional sales. RCA’s smoother hedonic pricing series showed a more muted uptick. Only one market in the top 25, Nashville, posted record sales volume. Of the top five markets for volume, Manhattan, Dallas, Boston, Atlanta, and Los Angeles, only Atlanta posted an annual increase in volume.

Industrial

The record-setting pace of 2021 was going to be challenging to match in 2022. Through the first seven months of the year, industrial was running ahead of 2021’s pace, but higher borrowing costs crimped activity later in the year. Volume fell 15% on the year. Contrary to other asset classes, RCA is still showing price increases for industrial. Cap rates barely moved. The top markets for volume were Dallas, Los Angeles, Inland Empire, Chicago, and Northern New Jersey. Dallas was the lone market to post volume gains, moving from fifth in 2021 to first in 2022. It also set a record for Dallas industrial volume.

Multifamily

Multifamily volume was down 17% year-over-year but 84% from December 2021 to December 2022. Despite this slowdown, it remains the top market for total investment sales by a wide margin. Cap rates showed limited upward pressure based on transactional data, which is lighter than market participants have experienced. Four markets set all-time volume records in 2022, led by Charlotte, Nashville, Chicago, and Philadelphia. The top markets for sales were Dallas, Atlanta, Houston, Phoenix, and Los Angeles. This list is very similar to 2021. Denver, previously ranked fifth, fell to fourteenth.

Retail

Retail was the only asset class to post an annual sales increase, up 4% on the year. The sales of centers, which increased 29% on the year, drove this boost. It is worth noting that, unlike other asset classes, 2021 did not set record volume for the retail property type. Transactional cap rates showed signs of expansion, though RCA’s hedonic series showed slight cap rate compression. The top five sales markets remained the same, with a subtle shift in rank. Los Angeles held on to first, followed by Atlanta, Chicago, Dallas, and Houston. Boston, Sacramento, East Bay, Orlando, San Jose, and Nashville set volume records in 2022.

Hotel

Hotel volume was broadly flat from 2021, and once additional transactions are tallied, 2022 will likely top that year’s numbers. Record hotel sales occurred in 2007. Despite strong fundamentals, transactional cap rates showed signs of upward pressure, with RCA’s hedonic cap rate series displaying the most substantial increase of all asset classes. Still, price growth was among the strongest in Q4. Dallas, Nashville, Tampa, and Fort Myers set all-time volume records in 2022. The top five markets for volume were Dallas, Orange County, Los Angeles, San Diego, and Nashville.

Aaron Jodka

Aaron Jodka

Nicole Larson

Nicole Larson