- The office market is facing secular shifts and cyclical phenomena simultaneously.

- Capital is avoiding today’s office market relative to history but is actively seeking distress.

- Owners and investors must navigate the changing sources of market demand, demographic trends, and lower occupancy requirements.

- They also need to prepare to hold assets and deal with refinancings, capital, and operational needs.

- Repositioning plays will be limited, but could prove fruitful.

After three straight years of negative absorption, the office market ended 2022 with a vacancy rate of 15.7%. With roughly 1.4 billion square feet of lease expirations before 2026, additional headwinds are likely. The office market finds itself in a state of uncertainty. Occupier decision-making has slowed, preferences are shifting, and broad demographics point to secular and cyclical changes occurring all at once. As a result, the definition of a “stabilized” market may have changed. Owners today face unprecedented pressure to adapt and evolve.

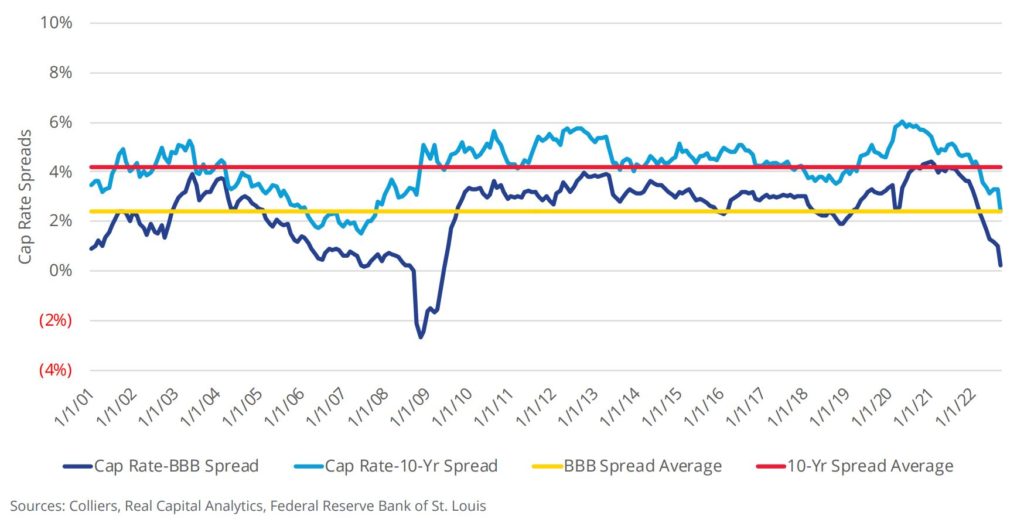

Investors face an environment of rising cap rates, with price discovery still opaque. Investment sales activity has slowed substantially. Public markets suggest an average office cap rate in the mid-to-high 7% range to north of 8%. Institutional owners are beginning to take markdowns, as seen with the latest NCREIF data. Comparing historical BBB bond rates to cap rates suggests cap rates still must rise further.

Owners are expected to hold onto their best product, liquidating their most challenged assets first. To do so, they must prepare for capital needs and refinancings. These refinancings could prove challenging as values may no longer support current terms, meaning an additional equity gap will need to be filled. Value-add and opportunistic capital is waiting in the wings to pounce on such opportunities. Some investors are looking to adaptive reuse, such as office-to-residential conversion or office-to-flex/industrial, by increasing clear height and building functionality. ESG is a driving force that will cause capital to be reinvested in assets to meet local requirements and institutional investor mandates, as well as those of occupiers. Outdated and underinvested commodity offices will be left stranded. Future-proofing investments will be imperative.

oday’s Quick Hits is based on our recently released The Future of Office report. In it, we investigate the important trends in fundamentals and capital markets today and into the future. To read more, please click the button below.

Aaron Jodka

Aaron Jodka

Nicole Larson

Nicole Larson