- Venture capital (VC) investment is slowing, but this was to be expected.

- First-half volume is down 12% from 2021’s record-setting year.

- Life sciences gets a lot of attention, but other sectors receive larger VC investment totals.

- VC funding is concentrated in California, New York, and Massachusetts, creating commercial real estate demand.

- While volumes are lower in 2022 than 2021, they remain well ahead of historical norms, and uninvested capital is at a record high.

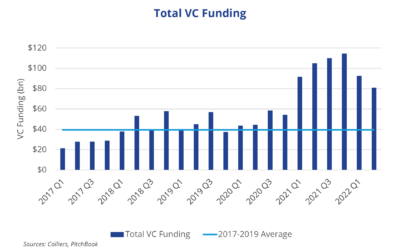

Rising interest rates, elevated inflation, and lower equity valuations have caused venture capital (VC) investment to cool. This is not a shock as investment in 2021 was by far the highest on record. Plentiful liquidity and low interest rates promoted outsized VC investment, as investors were in a risk-on mindset. Total VC funding in 2021 doubled 2020’s levels, per data from PitchBook – point being, 2021 should not be the benchmark. Despite the pullback over 2021, year-to-date investment has already nearly matched full-year 2020 levels. Further, Q3 funding is trending to be in line with the 2017–19 quarterly average of nearly $40 billion.

There is no denying that VC investment is a key driver of commercial real estate demand. As companies grow, they need physical space. California, New York, and Massachusetts are the top three destinations for VC funding. Much is made of VC funding to life sciences, but in the larger scheme of things, life sciences investment pales in comparison to that in other sectors. TMT (telecom, media, and technology), SaaS (software as a service), Fintech, AI and machine learning, and mobile all drew more investment in 2021 than did life sciences. Year-to-date, all except mobile are running ahead of life sciences. Investors are sitting on a record pile of uninvested capital – $290 billion – the vast majority of which was raised in 2021 and 2022. This suggests strong future investment to come. These diverse industries and sectors (along with others not mentioned) will be important drivers for office and industrial absorption, while creating jobs and fueling retail spending and housing demand.

Download the report.

Aaron Jodka

Aaron Jodka

Nicole Larson

Nicole Larson