- Predicting interest rate movement is no easy task.

- Figuring out future rate direction has major implications for a real estate investment thesis.

- Rate expectations are driving decisions to buy, sell, or hold.

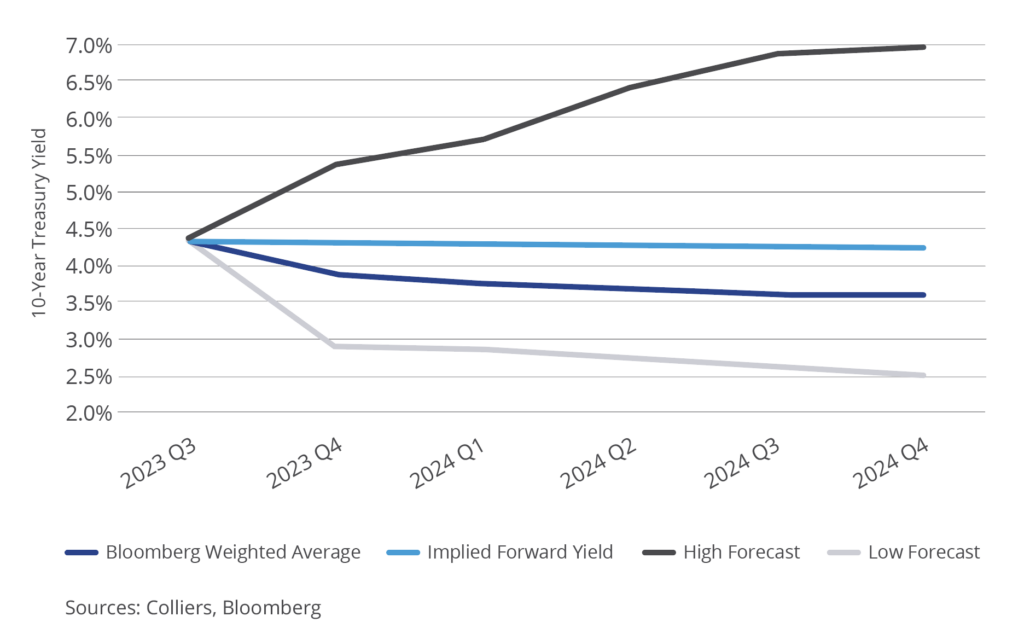

- As with most projections, there are differing opinions. A Bloomberg survey of analysts shows a wide variance in outlooks.

- The Federal Reserve has been embracing a “higher for longer” stance, suggesting that interest rate movement may not be imminent.

The 10-year Treasury topped 4.5% to start the week. Whether rates stay around these levels, the highest since 2007, or fall back down will affect real estate capital flows. The industry has been adjusting to higher borrowing costs since the Fed began raising rates to combat inflation. As a result, for the first time in a long while, real estate has competition from other yield-producing assets. In policy statements issued after its most recent FOMC meeting, the Federal Reserve revealed it would stick with its “higher for longer” narrative, implying that fundamentals and asset-level performance will be even more important. Historically, investors acquired real estate as a hedge against inflation and for income.

Where will rates ultimately go? There isn’t an easy answer. Chatham Financial’s forward curve suggests a slight reduction in the 10-year Treasury over the next few quarters before a longer-term upward trend takes over. This scenario would indicate no benefit to owners holding out for a lower-rate environment before selling their assets. On the other hand, a Bloomberg survey of 50+ financial institutions, economic forecasting shops, and colleges and universities offers a slightly more optimistic trendline for the 10-year. The median forecast calls for Treasury yields to fall to around 3.5% during 2024. While there is no indication that rates will return to the levels of 2021 and early 2022 anytime soon, rates in the mid-3% range would be a welcome sign to the real estate community. Plenty can happen to change these trajectories, including upcoming inflation figures, geopolitics, recession, and Fed commentary.

Aaron Jodka

Aaron Jodka