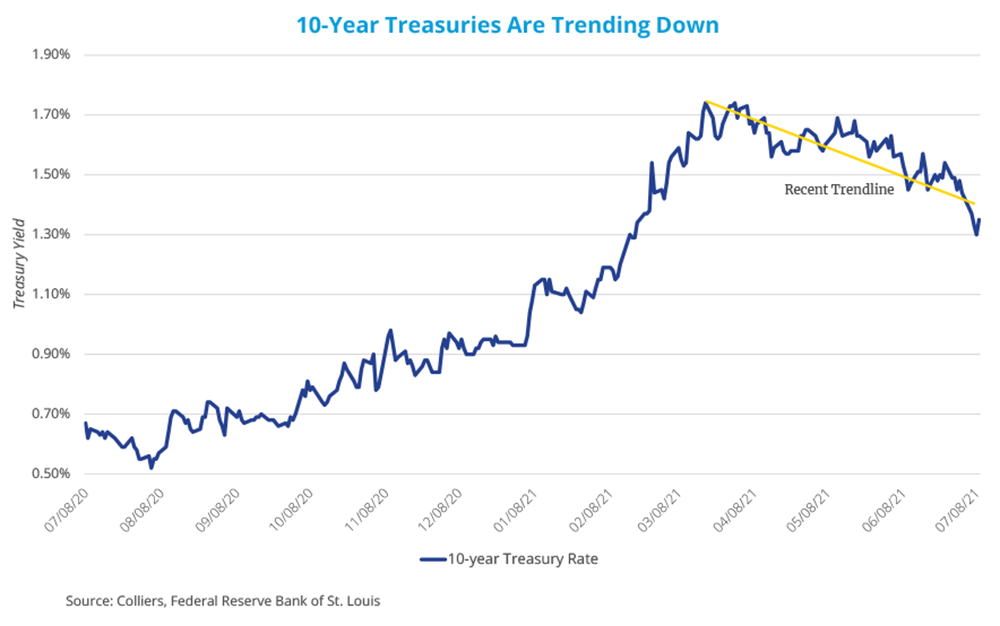

- Recently, 10-year Treasuries have fallen to multi-month lows after trending downward since March.

- Bond rates are seen as a guide to future growth projections.

- AAA CMBS spreads are creeping up as the benchmark 10-year compresses.

- Real estate remains attractive in a low-interest-rate environment.

- The longer rates stay low and the lower they get, the more real estate stands out.

U.S. interest rates are falling. Benchmark 10-year Treasuries just marked their lowest point since February, trading at sub-1.3% on Thursday, July 8. Recent macroeconomic events, such as the assassination of Haitian president Jovenel Moïse on July 7 and Jeff Bezos stepping down as CEO of Amazon, have been factors. So were minutes from the Fed’s Federal Open Market Committee meeting released July 7, which noted continued uncertainty in the economic outlook and the potential to taper asset purchases sooner than planned. Rising fears about COVID-19, particularly globally around virus variants, are another consideration, and the ISM Services Index for June disappointed as well.

However, a deeper look shows that interest rates have generally been trending downward since March 19. This is despite headlines about inflation (which the bond market would suggest is transitory) and improving job growth. Bond rates are generally considered guides for long-term growth expectations, and based on recent movement, Wall Street appears to be looking past 2021 into late 2022 and beyond. Remember that pre-pandemic, expectations for U.S. GDP growth were relatively muted due to a lack of labor availability. While there is slack in the workforce today, given GDP expectations in the near term, that is unlikely to hold. Low unemployment will be back before we know it.

Refinance opportunities look appealing today. While rates are still near historical lows, CMBS spreads have moved up to about 230 basis points, keeping all in interest rates around the 4% range. Predicting interest rate movement is notoriously difficult: HSBC expects 10-year Treasuries to fall to around 1% by year-end; Morgan Stanley and JPMorgan expect rates to rise to 1.8% and 1.95%, respectively. U.S. yields, still much higher than those in other developed nations across the globe, are attractive to foreign capital and should drive more commercial real estate purchases. Where interest rates might be at year-end is an open debate, but given where they are now, it’s still a good time to be in commercial real estate and will remain so for the foreseeable future.

Aaron Jodka

Aaron Jodka

Nicole Larson

Nicole Larson