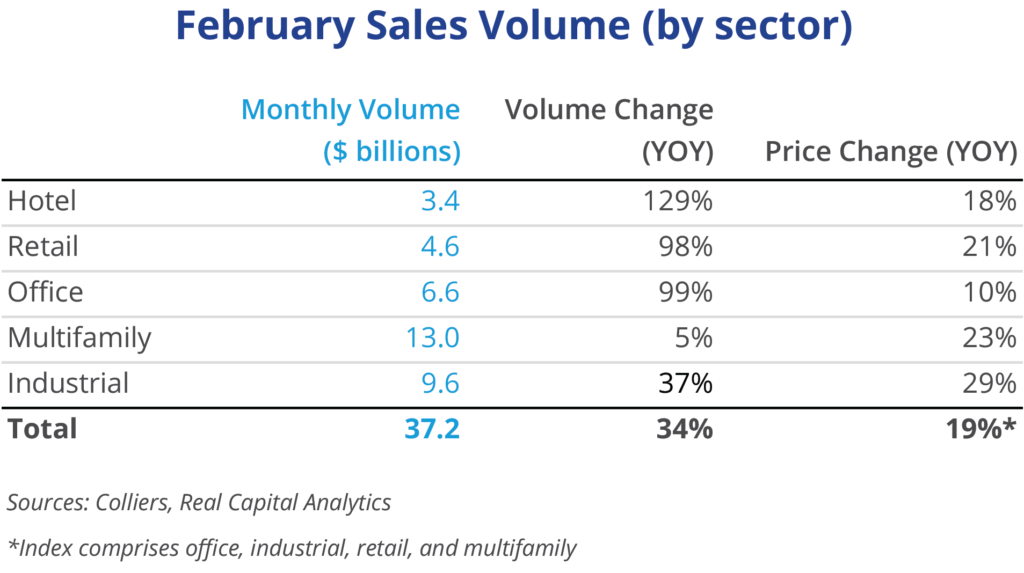

- Total sales volume of $37.2 billion in February was up 40% from 2021 levels.

- Multifamily and industrial continue to lead in volume.

- In markets like Chicago and Washington, D.C., increasing office volume is a good sign for a broader rebound for that asset class.

- A portfolio of power centers traded, indicating further thawing in the retail investment landscape.

- Hotel markets, such as Boston and New York, with slower-to-recover fundamentals, are recording increased sales volume.

Office

Office sales were led by markets that have, until recently, been relatively quiet. A $580 million, five-building portfolio in and around Washington, D.C., is a pending sale from JBG Smith to Fortress, while two Chicago office buildings traded in February. The Leo Burnett Building at 35 West Wacker Drive sold to Opal Holdings from UBS Realty for $415 million, or $352 per square foot; its prior sale in December 2011 was $401 million. Also trading was 200 West Jackson Boulevard in Chicago, for $130 million, to Nightingale Properties, which plans renovations. The in-place cap rate was 8%. Properties around New York City, in Jersey City, Brooklyn, and White Plains, also traded.

Industrial

The 38-property, 7.3 million-square-foot portfolio acquisition by Farallon Capital Management was the top deal of the month at $555 million. Amazon warehouses were popular buys in February. A newly built 3.9 million-square-foot facility in Christiana, DE, sold for $392 million, or $101 per square foot. In Jacksonville, FL, a 278,000-square-foot building just completed in 2022 sold for $60 million, or $215 per square foot. The higher cost of land and construction is reflected in record pricing for industrial assets. Industrial leads all asset types with price growth over the past 12 months.

Multifamily

The newly built 356-unit Roadrunner on McDowell in Scottsdale, AZ, sold for $534,539 per unit to KB Investment Development Company. The Phoenix metro area had the fastest home price growth in the country in the past year. Leading all sales was the 1,955-unit, six-property portfolio that GVA Management and Leste Group acquired for $380 million. Its properties are in high-growth markets in South Carolina, Tennessee, and Texas. Las Vegas and Seattle area properties also headlined some of the largest sales in the month. Showing that value can still be found, 75 Tresser Boulevard in Stamford, CT, sold for $131.1 million; built in 2014, it last sold in 2014 for $120.5 million.

Retail

The Necessity Retail REIT dominated transactions in February, acquiring a 44-property portfolio, largely power centers, for $547.2 million. The assets are mostly east of the Mississippi River. The 27,000-square-foot retail condo at 1600 Broadway in New York City, M&M’s flagship store, traded to Paramount Group REIT and BVK for $7,093 per square foot. In another trade, the 740,000- square-foot Providence Town Center in Collegeville, PA, a lifestyle center, sold for $161.8 million, or $219 per square foot. Finmarc Management and KPR were the buyers, and the deal was one of the largest single-asset retail sales post pandemic.

Hotel

Hotel investment continues to expand, even in markets with slower-to-recover hotel fundamentals, such as Boston and New York. As the outlook improves for travel, particularly business travel, major cities are seeing an influx in sales volume. In Boston, Varde Partners and Hawkins Way Capital acquired the 1,216-room Sheraton Boston, one of the largest hotels in the city, for $233 million. Both The Hotel at Times Square (203 rooms, $59.5 million) and the Roger Smith Hotel (134 rooms, $41.4 million) sold in New York. Meanwhile, the Hyatt Centric Chicago Magnificent Mile sold to NW Memorial Hospital, which plans to use it for patients’ families and conference space. Leisure markets such as Newport Beach, CA; Kahului, HI; Fort Lauderdale, FL; and Jekyll Island, GA; also had notable transactions.

Aaron Jodka

Aaron Jodka