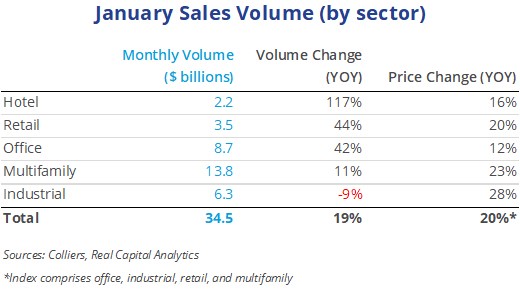

- January investment started the year strongly at $34.5 billion, up 19% from 2021 levels.

- Medical and life science transactions were a driving force in the office market.

- Multifamily remains as popular as ever. Industrial volume was down slightly from January 2021. Retail property sales were up from 2021 levels.

- Hotel sales volume will continue to spike thanks to the announced Blackstone/Starwood purchase of WoodSpring Suites, which continues the push of private equity into extended-stay properties.

- Price growth has been substantial, with retail, multifamily, and industrial posting gains of 20% or greater in the past year.

Office

Office investment is off to a healthy start in 2022, up 42% from year-ago figures. January’s largest deal was Google’s previously announced purchase of St. John’s Terminal in New York for $2 billion. Medical office was popular in the month: a 10-property portfolio was recapitalized by two unnamed global investors for $703 million, and a 23-property portfolio recapitalized by Remedy Medical Properties with Kayne Anderson for $350 million. Life science remains a major force in investment sales, with headlining deals in Palo Alto, CA; Green Knoll, NJ; Andover, MA; and San Diego, CA. The specialized asset is pulling in billions of dollars in institutional capital.

Industrial

The year started out with bang, with completed or pending sales of multiple industrial portfolios. A total of $6.3 billion traded in the month, down 9% from one year ago. Once the sale of the $4.9 billion Hillwood global portfolio to CBRE Investment Management closes, volume will pop again (U.S. properties totaled an estimated $3.3 billion and 1.9 million square feet). Prologis sold two portfolios: a 5.4-million-square-foot, 75-property portfolio, to Equus Capital Partners for $910 million; and a 19-property, 1.8-million-square-foot portfolio, for $145 million to Taurus. Valuations have never been higher, pricing increased 28% over the past year, and investor interest is through the roof.

Multifamily

After shattering previous sales records last year, the multifamily market started 2022 with $13.8 billion in sales volume, 11% above 2021 levels. Pricing is up 23% in the past 12 months. In the largest deal of the month, a nine-property portfolio of 2,700 units in North Carolina, mostly in the Raleigh/Durham area, sold for $475 million to Harbor Group International. Other headline sales include the 300-unit Millennium at Metro Park in Arlington, VA, for $200 million; and The Talisman, a 286-unit property in Redmond, WA, for $173 million, or more than $600,000 per unit for both. Limited single-family housing supply will keep the multifamily market red-hot in the near term.

Retail

After a record-breaking year-end, retail investment is off to a solid start in 2022, at $3.5 billion in January, up 44% from year-ago figures. Price gains have also been strong, up 20% since January, 2021. The largest deal was for a four-property portfolio of 390,000 square feet on Long Island, NY, for $130 million. Conversions and covered-land plays are also popular. The Home Depot in Watertown, MA, now a rapidly growing life science cluster, traded for $96.3 million, or $612 per square foot. Since that is well above the average price for such an asset, the sale suggests a potential life science exit strategy for this retail space in the future.

Hotel

The year started out with another Blackstone/Starwood joint venture, their plans to acquire WoodSpring Suites from Brookfield Asset Management for $1.5 billion, following their 2021 purchase of Extended Stay America. Hotel sales volume is historically more erratic than that of other asset classes, but this pending deal gives 2022 volume a jump-start. The pending sale of the 244-room Mandarin Oriental in Manhattan is for $134.2 million, or $550,000 per room, to Reliance Industries. It last sold in 2007 for $380 million. Also trading in Manhattan was the Hyatt Centric Wall Street, a 253-room hotel, for $85 million, or $335,000 per room, continuing the string of discounted pricing for Manhattan hotel assets.

Download the report.

Aaron Jodka

Aaron Jodka