- Multifamily is driving overall real estate investment.

- Investment is following demographic and migration patterns to the Southeast and Southwest.

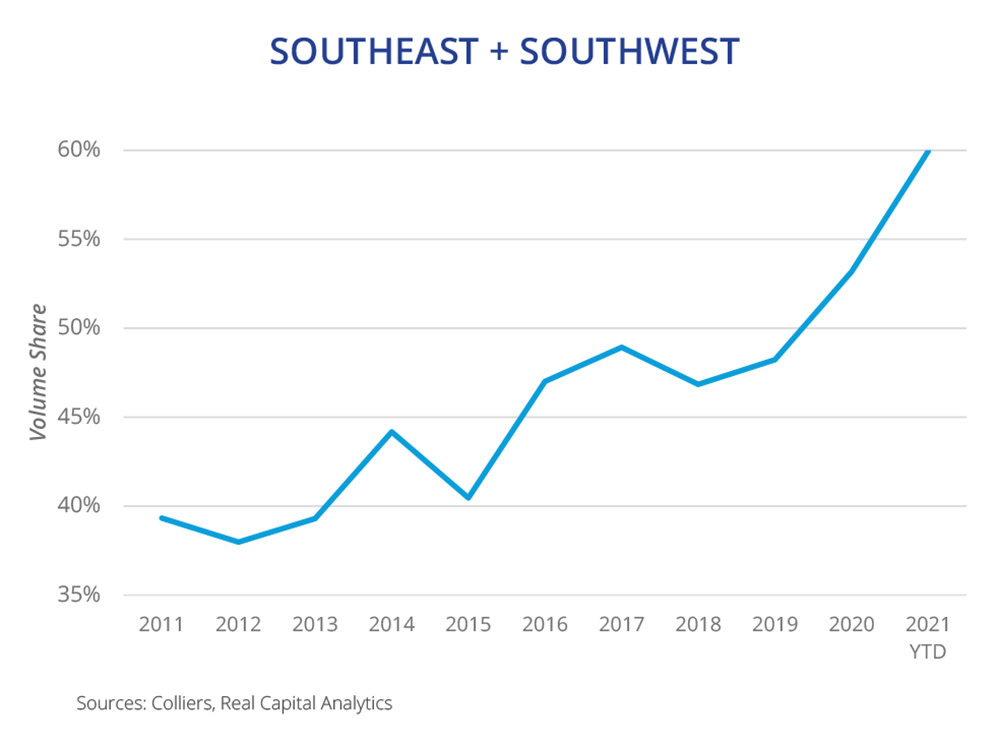

- Over half of all multifamily investment was in the Southeast and Southwest in 2020; this year that has reached 60%.

- Hundreds of thousands of new units are underway, setting the stage for continued strong investment in America’s growth corridors.

Multifamily is on a roll, accounting for one-third of investment in 2021 as cap rates fall and sales prices rise. Investors are more active in the pre-sale market than at any time in recent years, paying fully stabilized prices for assets still in lease-up. Readily available financing and low interest rates keep this asset class highly liquid. In fact, since 2015, multifamily investment has outpaced that of office — which, outside of 2012, had never happened before, per Real Capital Analytics (RCA) data.

Multifamily sales activity and the flow of capital is changing as investors follow population and migration patterns. The U.S. Census Bureau’s recently released 2020 population figures show the continuation of decades-long trends of faster growth in the Southeast and Southwest. In fact, North Carolina, Florida, Texas (2), Colorado, Montana, and Oregon will all gain a House seat as part of this shift.

Investors have noticed, and since 2012, the Southeast and Southwest have garnered a higher share of total investment volumes. For the first time, in 2020, these two regions combined drew more than half of all multifamily volume. Through the first quarter of 2021, that number continued to rise to 60%, driving record-high pricing in both regions and cap rates below those in the Mid-Atlantic, Northeast, and Midwest, per RCA. Southwest cap rates are now in line with those in the West, averaging below 5%. More sophisticated investors are increasing competition across markets and sending capital to secondary and tertiary markets in these regions.

Nationally, developers are still underway on more than 570,000 units, per CoStar, which will offer new opportunities for portfolio growth. With hundreds of thousands of these units going up in the Southeast and Southwest, capital should continue pushing into America’s growth markets.

Aaron Jodka

Aaron Jodka