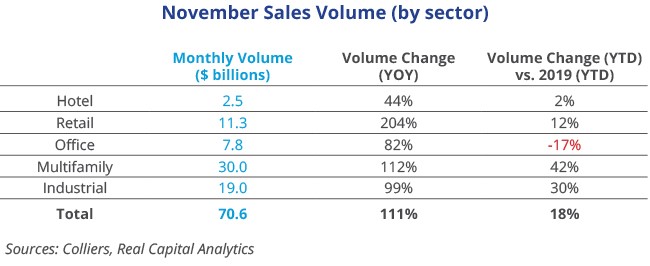

- November sales volume of $70.6 billion is the highest November figure on record.

- Office sales continue to trail the volume of most other asset classes, slowing monthly since summer.

- Industrial pricing leads that of all asset classes, increasing 22.1% annually. All property types have increased by at least 14%.

- Multifamily volume continues to amaze. Cap rates have never been lower.

- December is set to break sales volume records.

Office

Investors are still relatively less enthused about office than the other asset types. Volume has cooled for three months straight, though a number of announcements suggest December may be strong. Single-tenant assets remain popular and drove two of the larger sales in the month. The largest was the newly built Lowe’s Technology Center in Charlotte, NC, which sold for $318 million, or $840 per square foot, to Apollo Global. This marks a new high-water mark for price per square foot in Charlotte. In Glenview, IL, Allstate’s 1.9-million-square-foot campus was purchased by Dermody Properties with a short-term leaseback but an ultimate plan for redevelopment into industrial.

Industrial

Industrial’s run is far from over, and in November, multiple billion-dollar transactions took place. The largest was GIC’s acquisition of a 328-property portfolio from EQT Exeter Property Group for $6.8 billion. Cross-border capital is still hungry for industrial assets. BREIT acquired a 92-property portfolio from Cabot Properties for $2.3 billion, part of a buying spree in which more deals are forthcoming. Pricing continues to escalate: multiple deals traded in the month north of $500 per square foot.

Multifamily

Speaking of billion-dollar transactions, multifamily investors remain on the hunt for assets. Ivanhoe Cambridge acquired a 31-property portfolio from Greystar, 9,900 units for $3.6 billion; SREIT bought 62 properties with 15,500 units from Strata Equity Group for $3.5 billion. With strong capital flows into multifamily, monthly and year-to-date volume is double that of 2020. Multifamily housing starts are picking up but not fast enough to meet demand.

Retail

Retail’s liquidity improvement hasn’t slowed. Total volume for the month topped $11 billion, the strongest showing since mid-2018. The largest deal of the month was Aurora Capital Associates’ joint venture with EMS Capital, acquiring 530 Fifth Avenue in New York. The nearly 60,000-square-foot urban center, which wraps around the block from 44th Street to 45th Street, traded for $3,200 per square foot. In Charlotte, Regency Centers spent $181 million for Blakeney, a center anchored by Harris Teeter, Target, Marshalls/Home Goods, Best Buy, and others. Life science owner Alexandria purchased a former Sears in San Bruno, CA, for $206 per buildable foot, to demolish it and redevelop the site.

Hotel

Portfolio activity is back in the hotel world. Lone Star Funds acquired five properties consisting of 2,300 rooms for $551 million. Blackstone, which bought numerous hotel assets in 2021, acquired another 1,900 rooms from Condor Hospitality Trust for $305 million. Other portfolio trades occurred in Washington, Texas, Oregon, New York, Connecticut, and Maryland, among others. The improvement in leisure travel has stabilized hotel fundamentals in markets across the country. Investors have noticed and liquidity has improved as a result.

Download the report.

Aaron Jodka

Aaron Jodka