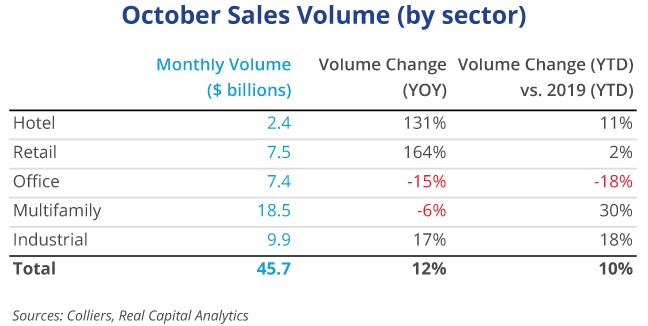

- A total of $45.7 billion traded in October, a 12% increase from 2020. Once the data settles, volume is likely to be in line with 2019 figures.

- Multi-property sales drove volume in the month across property types.

- Office, retail, and hotel investment is broadening.

- Industrial and multifamily sales are still setting records.

- With numerous announced deals, Q4 should be another banner quarter for sales volume.

Office

Office investment is expanding with volume led by numerous portfolio deals. While these portfolio deals were not as large as some of the industrial deals this year, they are a strong indicator of the rebound in the property type. DigitalBridge Group acquired three properties from Vantage Data Centers in Santa Clara, CA, for $539 million. TIAA acquired a minority stake in two assets (one was office) from Alexandria for nearly $380 million in San Francisco. Longfellow Real Estate Partners acquired a five-property portfolio in San Diego from PS Business Parks for $315 million, while Boston Properties sold three buildings in Lexington, MA, for $192 million.

Industrial

Large-scale portfolios drove October’s volume in the industrial market. Equus Capital Partners’ 74-property acquisition — concentrated around Phoenix — from Presson Corp for $1.1 billion was the headline. Arcapita, headquartered in Bahrain, acquired 39 properties (29 industrial) from Arden Group for $517 million, continuing the trend of international capital chasing industrial properties. Three separate Massachusetts portfolios also traded. Headlined by 330 and 350 Bartlett Street in Northborough, which sold to Blackstone / Link, for $153.5 million, setting a new benchmark for pricing in the market.

Multifamily

Continuing the theme of other asset classes, multi-property sales also drove multifamily volume in October. In the two largest deals, Starlight Investments, Sherrin, and unnamed institutional investors traded 4,600 units for $1.3 billion throughout the Southeast and Southwest. Daiwa House Industry bought out its partner in the HAP Eight apartments in New York built in 2020; the 112 units sold for $2.5 million per unit. Other top deals took place in Colorado, Washington, Florida, California, Arizona, and Massachusetts.

Retail

Retail center sales are picking up. In the largest deal of the month, Kimco and BREIT bought out Jamestown in a Florida portfolio of six properties, all anchored by a Publix. Luxury retail is also making a comeback. The Saks Fifth Avenue in San Francisco traded to a joint venture of Lincoln Property Co. and Cara Investment GmbH for $156 million, or $1,156 per square foot. Following that trend, Union Investment purchased an urban storefront property along East Oak Street in Chicago for $120 million, or $3,750 per square foot. Tenants include Prada, Dior, and Chanel, among others.

Hotel

Hotel properties had strong sales in October as well, and two deals topped $300 million. The Naples Beach Hotel & Golf Club, with 284 rooms, sold for $362.5 million, or nearly $1.3 million per room, in Naples, FL. MSD Partners and The Athens Group are the new owners. Beemok Capital purchased the Belmond Charleston Place in Charleston, SC, with 442 rooms, for $350 million. These are two of the largest single-property hotel sales of the year. The next five largest deals, all in Florida for more than $100 million each, were in Key West, Miami, Fort Lauderdale, West Palm Beach, and Clearwater.

Aaron Jodka

Aaron Jodka

Nicole Larson

Nicole Larson