- Quarterly and annual sales totals obliterated previous records.

- Multifamily and industrial generated new all-time highs for sales volume.

- Multifamily captured 44% of all investment dollars in 2021.

- Pricing growth rose rapidly across all asset classes, led by industrial, while office was the “slowest” at 14.1%.

- Investors still have record amounts of capital to deploy — 2022 looks to be another strong year.

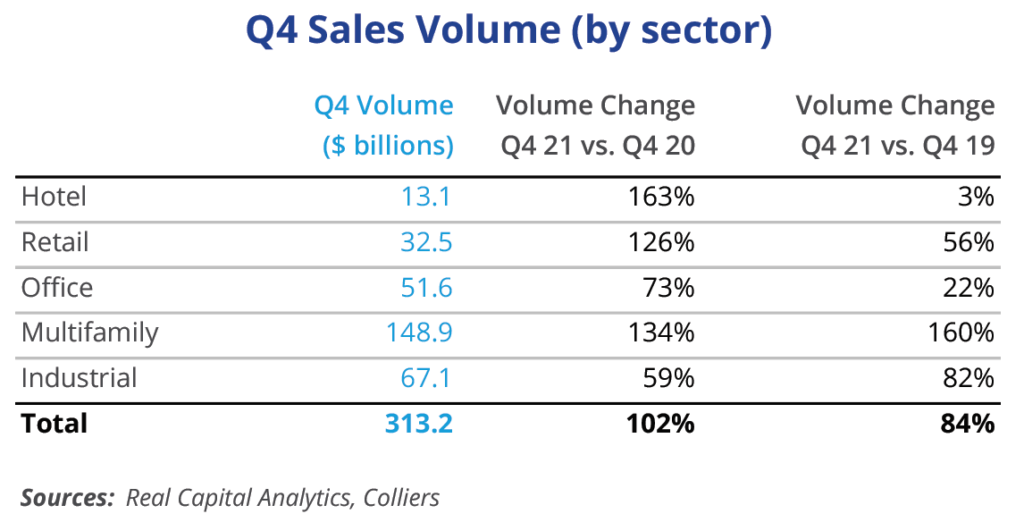

What a year: Q4 data shattered previous quarterly totals, and full-year stats also set a new all-time high. A confluence of pent-up investor demand, low interest rates (expected to rise during 2022), tax law changes, shifts in investor focus to multifamily and industrial, and the typical year-end push sent sales volume soaring to $762 billion, 36% more than 2019’s previous record. In Q4 alone, sales of $313 billion reached 58% above Q3’s record levels.

Office

Overall office investment volumes increased 57% year-over-year. Growth was actually stronger in suburban and secondary markets than in CBD sales or in the top six markets. Q4 suburban volume of $35 billion was the second-strongest on record, behind only that in Q1 2007. In 2021, office values increased 14.1%, per RCA’s CPPI, tying 2005 value growth for the strongest annual gains in the series. Five markets set all-time volume records in 2021: Boston — at the top because of its life science market — San Jose, Austin, Palm Beach, and Baltimore.

Industrial

Industrial investors can’t get enough product. Q4 volume of $67 billion grew 54% more than Q3’s previous record, while year-over-year total volume of $166 billion beat 2019’s former record by 42%. To say industrial is a hot asset type is an understatement, and it ranked first in our Annual Investor Outlook Report as the most popular asset for 2022. Pricing surged 29.2% over the year, the strongest in all property types. Each of the top 25 investment sales markets posted record industrial volumes in 2021, a truly astounding fact. Los Angeles, Chicago, Inland Empire, Dallas, and Atlanta were the top markets.

Multifamily

Multifamily sales hit marks never before seen. Quarterly volume of $149 billion for multifamily alone was in line with average quarterly volume of all asset types between 2015–2019. Annual volume topped $335 billion, more than $142 billion — or 74% — higher than 2019’s previous multifamily record. Investment shifted to this asset class, totaling 44% of 2021’s volume and sending cap rates to all-time lows with pricing surging 23.6% year-over-year. Nearly all top-25 investment markets posted all-time highs in volume, except for the Washington, D.C., and Virginia suburbs and Manhattan. Dallas, Atlanta, Phoenix, Houston, and Denver were the top five markets of the year.

Retail

Retail came roaring back at year-end, with Q4 volume of nearly $33 billion the single-highest quarterly total on record. Only one other quarter has had volume of more than $30 billion (Q3 2018). Annual volume pushed $77 billion, the fourth highest on record. Sales of shopping centers more than doubled year-over-year, while portfolio volume nearly tripled. Pricing is escalating rapidly, up 21.5% over the past year, with that of centers increasing the most, 24%. Single-tenant retail and drugstores had weaker growth, of 7.5% and 3.8%, respectively. Dallas, Phoenix, Seattle, and Boston retail sales brought record figures for the year.

Hotel

Investors plowed $44.5 billion into hotel investments in 2021, a healthy showing and the third-highest annual total on record. Pricing increased 16.8% on the year, more than triple the overall volume in 2020. Quarterly volume of $13 billion skewed toward full-service hotels, which had the best overall price gains, 28.9%, the second-best showing in any subset, behind only warehouse (which was up 32%). Record sales volumes were generated in Atlanta, Austin, and Las Vegas in 2021; Atlanta, Los Angeles, Austin, Manhattan, and Orlando were the top five in sales.

Download the report.

Aaron Jodka

Aaron Jodka

Nicole Larson

Nicole Larson