- CMBS delinquencies rose nearly 1.5 percentage points in 2023 to 4.51%.

- The drivers of delinquency have changed since 2021. Office has been the most significant contributor to rising rates.

- Retail is the only asset class to post a decline in delinquency year-over-year.

- Many loans were extended in 2023; it is expected that 2024 will be a year of more action, forced or otherwise.

- Forecasts for non-agency CMBS issuance are promising, with an expected 39% increase in 2024.

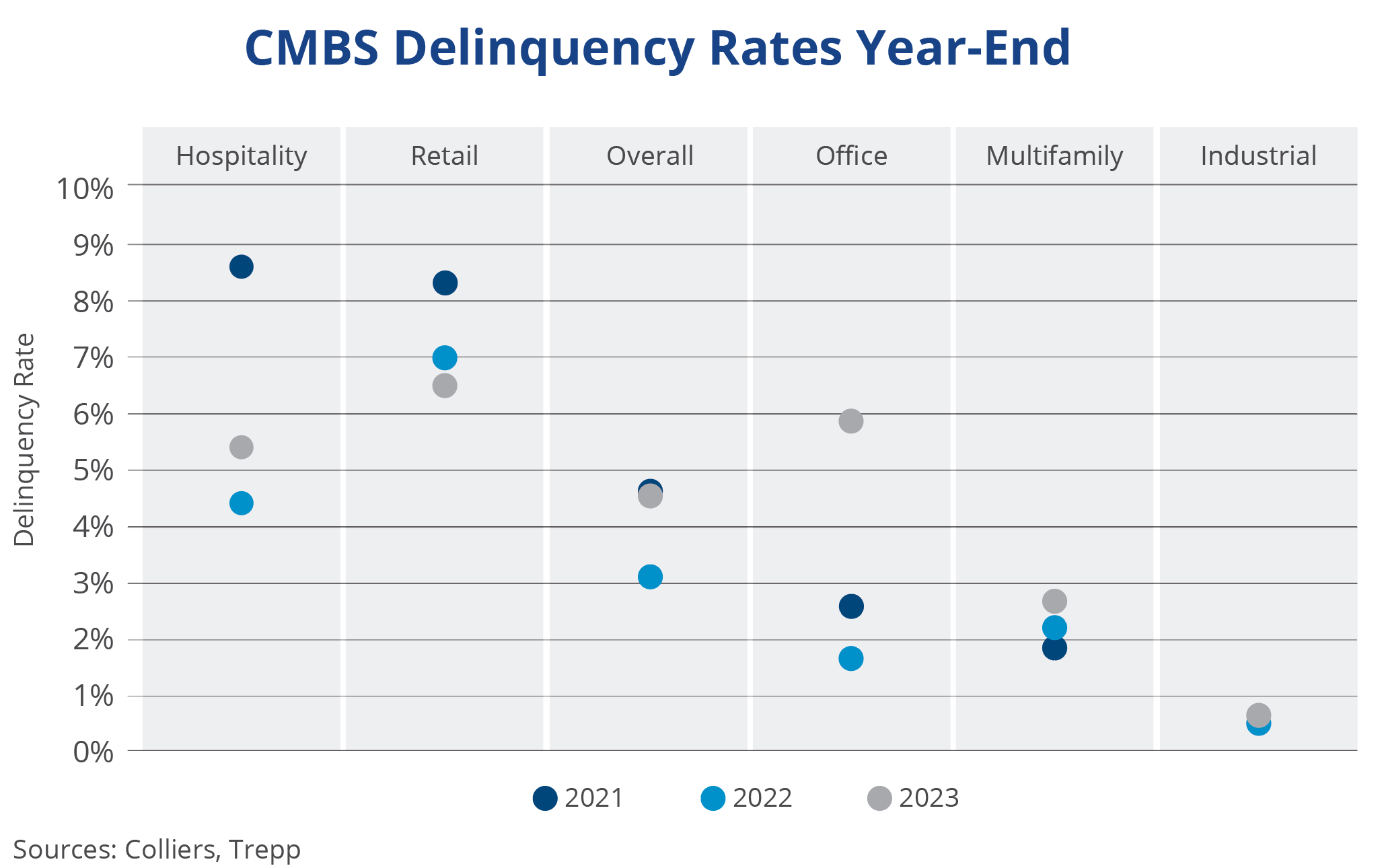

Unsurprisingly, with last year’s soaring borrowing costs, CMBS delinquency rates rose. They ended the year at 4.51% overall, broadly in line with year-end 2021 levels, per Trepp data. All asset classes posted an increase in delinquency compared to 2022, except for retail, which has had stubbornly high delinquency for some time. Retail also had the highest overall delinquency rate.

The biggest story of 2023 was office. Office loan defaults moved the most, increasing 4.24 percentage points on the year. Per analysis from Moody’s, nearly 70% of office CMBS loans were not paid off at maturity, particularly those with higher balances. Deals with sub-$10 million of debt paid off about 90% of the time, while those with $100 million or more only did so at a 26% rate. Their analysis suggests that 76% of office CMBS loans are at risk of being unable to refinance in 2024.

Aaron Jodka

Aaron Jodka

The drivers of delinquency have changed since 2021. Office has been the most significant contributor to rising rates. Retail is the only asset class to post a decline in delinquency year-over-year.

At this time last year, delinquencies had risen each month of 2022 Q4. In 2023, November and December posted a decline in delinquency rates, though a large single-borrower industrial loan delinquency in October caused sizeable volatility. Where will the market head in 2024? All-time highs in delinquency peaked in July 2012 at 10.34%, nearly matching rates seen during the pandemic in June 2020. The market is still far from those levels, though additional stress is expected. Many loans were modified or extended in 2023 on the CMBS side and with other lender types, pushing maturity into the future.

It is expected that 2024 will be a year of more action. Lenders may force the issue through short sales, REO, loan sales, and other methods, while some borrowers will simply walk away. The Fed’s plan to lower borrowing costs in 2024 is welcome news to the industry and certainly some help, though rates, even if reduced from current levels, would still be well above origination in recent years. Past cycles have shown that working through loan maturities and delinquencies will take time.

Overall, non-agency CMBS issuance fell 44% in 2023 to $39.33 billion from the prior year, a substantial drop-off from the cyclical high of $110.56 billion in 2021, per Commercial Real Estate Alert. The outlook for 2024 is more optimistic, with forecasts calling for a rebound in non-agency volume to close to $55 billion. This certainly bodes well for liquidity, something the market has been starved of for several quarters.