- Office investment in Chicago is picking up from cyclical lows, with opportunistic buyers leading the recovery.

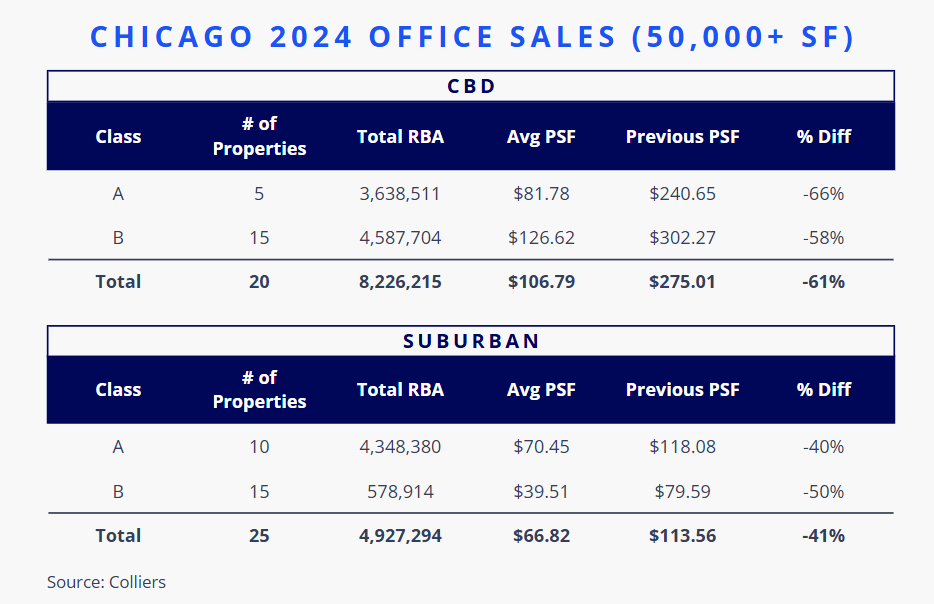

- Properties in both the CBD and suburbs are trading at substantial discounts to prior sales, presenting new entrants with a compelling value play.

- Vacancies remain high at 24.1% in Chicago and its suburbs, and absorption has yet to turn the corner.

- With billions of dollars of upcoming loan maturities, office investors will have additional acquisition opportunities.

Chicago’s office market is undergoing a significant reset, creating a pivotal moment for investment as office usage continues to evolve. Companies are reevaluating their space needs while navigating workers’ return to the physical office. For highly selective investors, securing the right basis remains crucial. With Chicagoland office vacancy at 24.1%, investors are focusing on key factors such as asset location, quality, and cost basis.

Today’s most active buyers in the Chicago office market are opportunistic private investors and newcomers to the office investment landscape with limited capital backstop. These buyers are positioning themselves to establish a foothold in this major city market, with some aiming to attract tenants quickly by lowering lease rates. However, a few well-capitalized buyers are willing to invest in asset improvements, including increased TI packages, modern amenities, and upgraded systems. Those reinvesting capital are banking on long-term occupancy gains and may be less inclined to significantly lower face rates.

Meanwhile, some investors are motivated to buy in the current market, seeing potential in converting properties to more lucrative uses, such as residential. However, the feasibility of this strategy depends on factors including initial cost basis, demand, and local government cooperation.

Aaron Jodka

Aaron Jodka

With recent properties trading at discounts of up to 80% from their previous sales, Chicago office presents a compelling value play.

In 2024, a greater number of Chicago CBD and suburban office buildings were acquired at distressed pricing. Class A CBD office buildings sold at an average discount of 66% from their previous value, while Chicago suburban Class A office assets saw an average decline of 40%. Some sellers are motivated to offload these properties, while growing signs of distress in the office market prompt lenders to force the issue.

The Chicago office market presents both opportunities and challenges. Lenders and owners recognize that Chicago office valuations are historically depressed and will likely remain so through at least 2025 into 2026. Outside of debt funds, lenders are hard-pressed to capitalize buildings with less than 60% occupancy. A meaningful shift in leasing activity is needed before Chicago offices are considered on the upswing. In the meantime, a unique window remains open for self-capitalized buyers and tenants currently in the market.

Sandy McDonald

Sandy McDonald Ronna Larsen

Ronna Larsen