- Artificial intelligence and machine learning (AI/ML) are capturing headlines.

- With their potential to revolutionize work, efficiency, health, and productivity, investment dollars are flooding into the sector.

- A record $15 billion in venture capital (VC) investment went to AI/ML in Q2.

- This influx of capital and AI/ML’s potential are setting the stage for real estate-related demand.

- San Francisco stands to benefit the most on the office side.

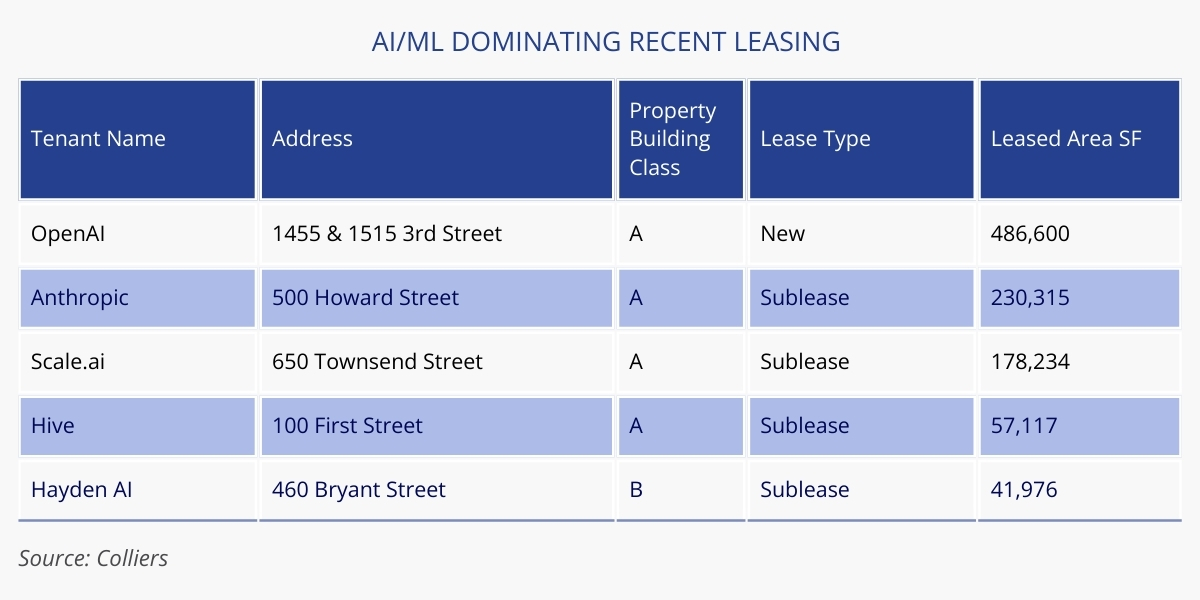

The San Francisco office market has been one of the hardest hit in the country. Vacancies have escalated from 4.5% pre-pandemic to a record high of 30.0% in Q2 of this year, and sublease makes up the highest share of vacancy compared to any other major market. This and other factors have resulted in high-profile office transactions trading at low prices, including 550 California Street, at $114/SF. Investors believe that their lower basis will set them up to capture future demand and at a more competitive rent than nearby properties. While every cycle is different, San Francisco has historically been a volatile office market, with vast swings in vacancy and rents. This pattern was observed during the dot-com cycle and subsequent bust, as well as during the Global Financial Crisis and tech-led recovery. Today, the market is looking for its next demand driver and may have found it with AI/ML. Over the past year, of the 10 largest non-renewal leases in San Francisco, AI/ML has accounted for 70% of demand.

Aaron Jodka

Aaron Jodka

Today, San Francisco is looking for its next demand driver and may have found it with artificial intelligence/machine learning.

AI/ML office demand is solely concentrated in San Francisco proper. While nationally, major tech companies such as Microsoft, Google, Amazon, Oracle, and Meta are investing in the space, it has yet to generate net new office demand. While leases have been signed in other cities, they are not market movers and are typically for smaller, sub-10,000 SF spaces. In San Francisco, companies such as OpenAI, Anthropic, and Scale.AI have been gobbling up space or are on the hunt. The market’s wide availability of plug-and-play sublease space makes it a prime candidate for growth companies who can’t project their space needs two years into the future. AI/ML has driven 25% of leasing in recent quarters, and these companies dominate active tenants in the market. San Francisco looks to be the tip of the spear and stands to benefit from the surge in investment and future office space needs of this industry.

Derek Daniels

Derek Daniels