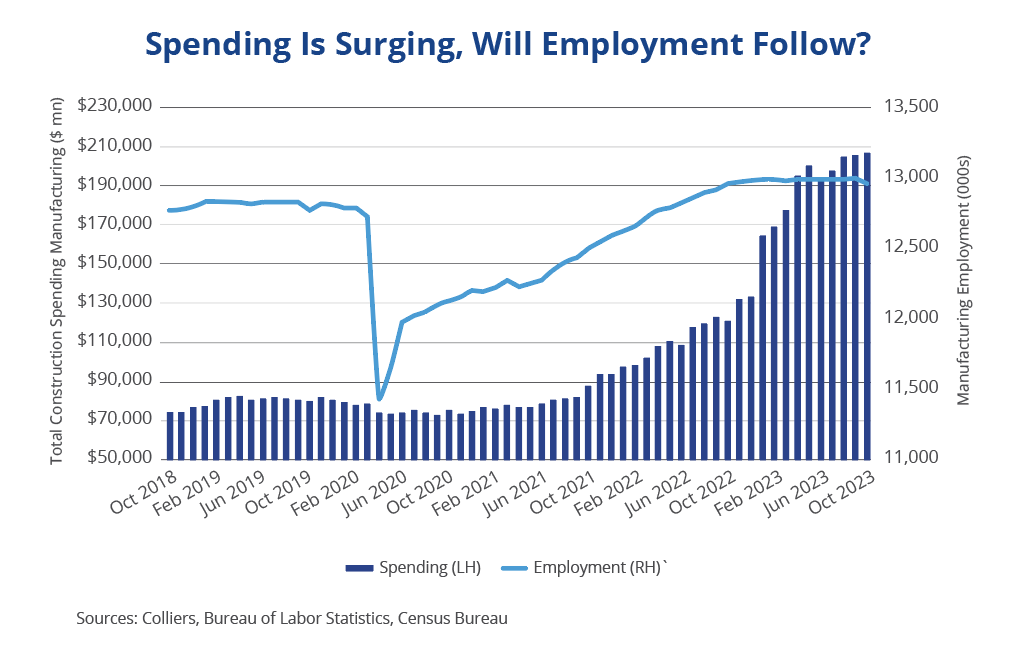

- Manufacturing employment in the U.S. has grown 7% in the past 10 years.

- The U.S. shed manufacturing jobs for 30 years, between the 1980s and 2010.

- Meanwhile, total construction spending on manufacturing has nearly tripled.

- Major government programs are promoting the investment rebound.

- Investors stand to benefit from the physical and human supply chains needed to support this massive manufacturing resurgence.

The United States’ surging manufacturing capabilities are creating sizeable commercial real estate investment opportunities. Supporting the expansion of the country’s manufacturing base and real estate investment opportunities, past Quick Hits have highlighted the infusion of billions of dollars through onshoring/reshoring/friendshoring and the Inflation Reduction and CHIPs Acts. Over the past ten years, investment in manufacturing has nearly tripled, per data from the Census Bureau. This growth rate has been recent, with investment doubling since early 2022. Employment hasn’t yet followed suit, up 7% over the same time frame. The pandemic caused a massive reset in employment levels before the recent recovery. The country’s multi-decade manufacturing employment slide abated in 2010 and has since trended upward, save for the hiccup during the pandemic.

Aaron Jodka

Aaron Jodka

Over the past ten years, investment in manufacturing has nearly tripled with investment doubling since early 2022.

It’s only a matter of time before jobs and real estate funding follow the dollars, providing investors with numerous plays to capitalize on this trend. Industrial strategies have captured most of the headlines to date, but other asset classes will also benefit. With employment comes the need for housing, be it single-family or multifamily. Retail and entertainment have historically followed rooftops, while major employers require overnights in hospitality properties. In addition, highly skilled and paid workers create knock-on effects, supporting additional employment and economic growth.