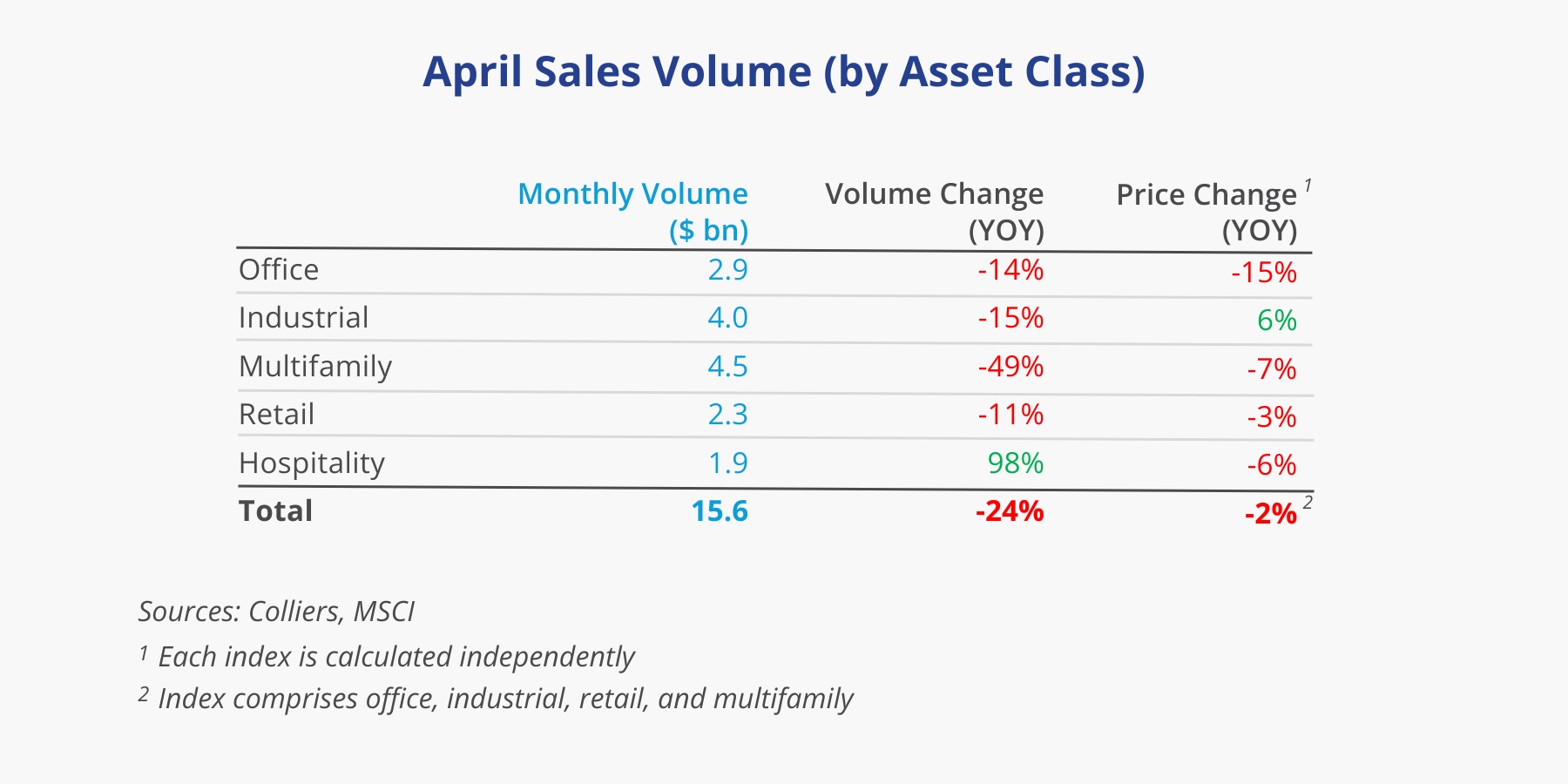

- April sales data was the weakest so far in 2024.

- The rise in the 10-year Treasury over the month stalled deals and will likely reverberate in May.

- Multifamily continues to hold the crown as the highest trading asset class.

- Hospitality had the largest jump year-over-year, up 98%.

- The market is still trying to find equilibrium, so monthly data is expected to remain volatile.

Aaron Jodka

Aaron Jodka

Hospitality volume surged 98% from last April, the likely low point in this cycle.

Office

Office recorded $2.9 billion in sales in April, marking a return to normalcy after a significant deal in March skewed the monthly figures. Overall office sales volume is down 14% year-over-year. CBD sales topped $1 billion in back-to-back months but have decreased by 5% over the past year.

The month’s largest deal was 1740 Broadway in New York City. Yellowstone Real Estate Investments purchased the debt on the asset for $185.9 million, or $308/SF. The new owner is considering a residential conversion.

Industrial

With $4 billion in sales, industrial activity is down 15% from last April, marking the lowest monthly total since the pandemic. Cap rates continue to move upward, enticing new buyers to the market.

A notable deal this month was KKR’s acquisition of a four-property portfolio of assets around Houston for $240 million. The purchase was a mix of flex and warehouse space, with three assets delivered in 2021. The allocated price translates to $215/SF.

Multifamily

After showing signs of stabilizing, volume continues to slip in the multifamily market, down 49% over the past year, the sharpest decline of all asset classes. Just $4.5 billion traded in April, the lowest monthly showing since February 2012.

One of the month’s top deals was AEW’s acquisition of the 370-unit The Ranch at Moorpark in Moorpark, CA, for $133.2 million, translating to $360,000/unit. Institutional buyers are returning to the market, which should bolster volume going forward.

Retail

Retail sales totaled $2.3 billion, similar to levels seen around the pandemic and representing an 11% decline from year-ago levels. However, a trend toward volume stabilization continues.

There were no blockbuster transactions in April. The largest deal was the 451,000 SF Plaza & Shoppes at Sunset Hills in Sunset Hills, MO, for $84.5 million. Broadstone Net Lease Inc. is the buyer and paid less than the $90.4 million the previous owner spent to acquire it in 2015.

Hospitality

Hospitality volume surged 98% from last April, the likely low point in this cycle. Volume is more in line with the prior month, with $1.9 billion transacting. Fewer assets were traded, suggesting that while more expensive properties are being sold, overall deal velocity remains muted.

The highlight of the month was Host Hotels & Resorts acquiring two Nashville properties for $530 million. The 721 doors traded at $735,000 per room at a quoted 7.4% cap rate, continuing Nashville’s momentum in the hospitality space.