Highlights

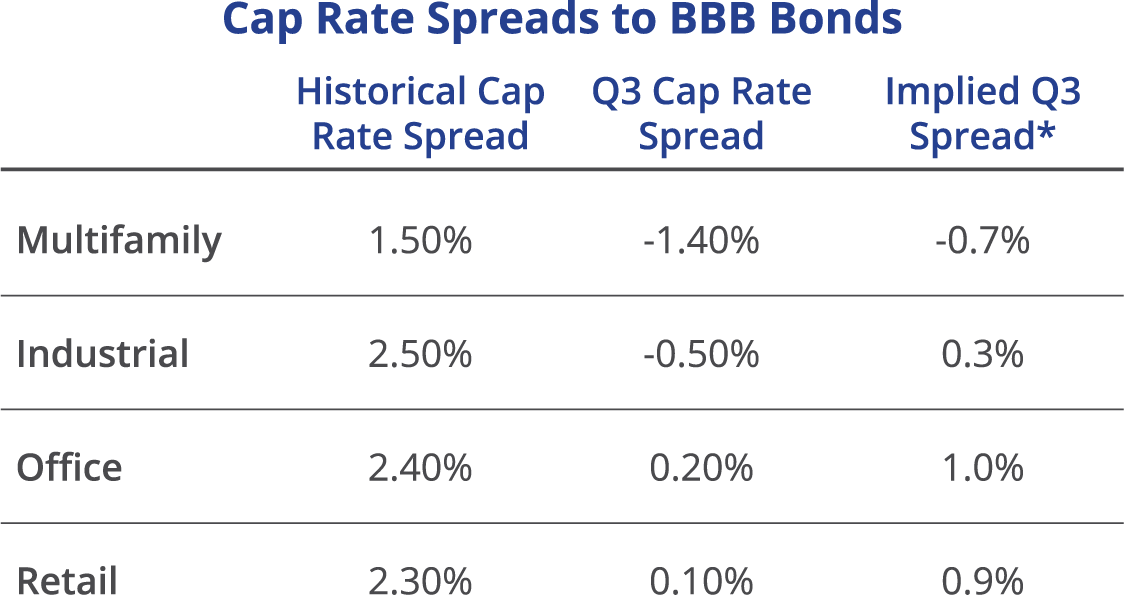

- With BBB bond rates rising rapidly, cap rate spreads are now at historically low levels.

- Both multifamily and industrial cap rates have a negative spread to BBB bonds as of Q3.

- Transactional data has yet to show cap rate expansion, but market participants are noticing movement.

- An implied cap rate, assuming a 75-basis-point increase in cap rates, still leaves multifamily in a negative spread position.

- As the Fed fights inflation, interest rates are expected to remain volatile, and sellers will likely hold onto their assets unless they need liquidity

Last April, we wrote about rising rates and the narrowing of cap rate spreads. BBB bond rates topped 4% at the time, and by late September, they exceeded 6% for the first time since 2009. Inflation has proven persistent and not transitory. The Fed has aggressively increased its overnight lending rate, causing bonds to move sharply upward, and has also signaled that more rate increases are to come. Meanwhile, transactional cap rates have yet to move upward. While this data is lagging, our teams are observing a higher-cap-rate environment as they advise clients.

Spreads at the end of Q3 were at levels unseen except during the Great Financial Crisis (GFC), when BBB bond rates blew out, causing cap rate spreads to go negative. This phenomenon was indicative of the ongoing concerns of corporate liquidity and the broader financial system, rather than being purely about bonds vs. real estate. Prior to the GFC, multifamily spreads ranged from flat to slightly negative; at the time, aggressive underwriting, high leverage, and less stringent lending standards were par for the course. Today’s spreads suggest that cap rates have to rise, assuming that BBB bond rates remain at similar levels. Likewise, cap rate spreads to 10-year Treasuries have never been lower in multifamily and industrial, and they remain above pre-GFC levels in office and retail.

As noted above, transactional data has yet to show cap rate expansion. Broadly, with exceptions on some deals, cap rates are up 50–100 basis points across asset types and regions. Based on a midpoint of 75 basis points, the implied cap rate suggests a low, though more normal, spread level for office and retail and remains at historically low figures for multifamily and industrial. As borrowing costs have escalated, pricing pressure has increased. Cap rates are in an expansion phase. Inflation must be tamed, and once that occurs, interest rates are likely to adjust again, potentially falling. How long this will take is still debatable. Many sellers are holding onto their assets unless they have a liquidity event, such as pending loan maturity, meaning buyers will have fewer new sales offerings than usual.

Aaron Jodka

Aaron Jodka

Nicole Larson

Nicole Larson