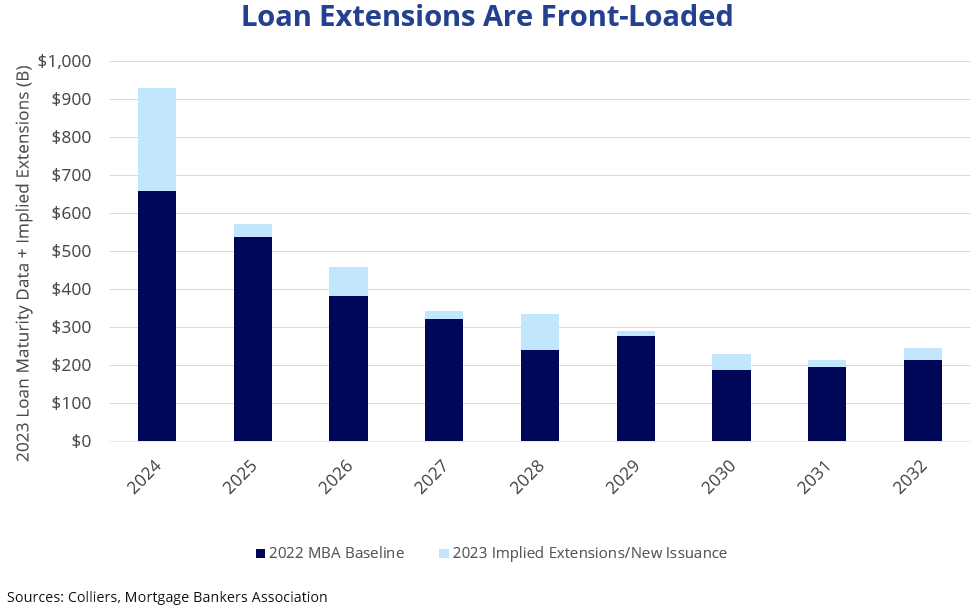

- The Mortgage Bankers Association (MBA) is tracking $929 billion in maturities in 2024.

- About $270 billion of that total are implied loan extensions.

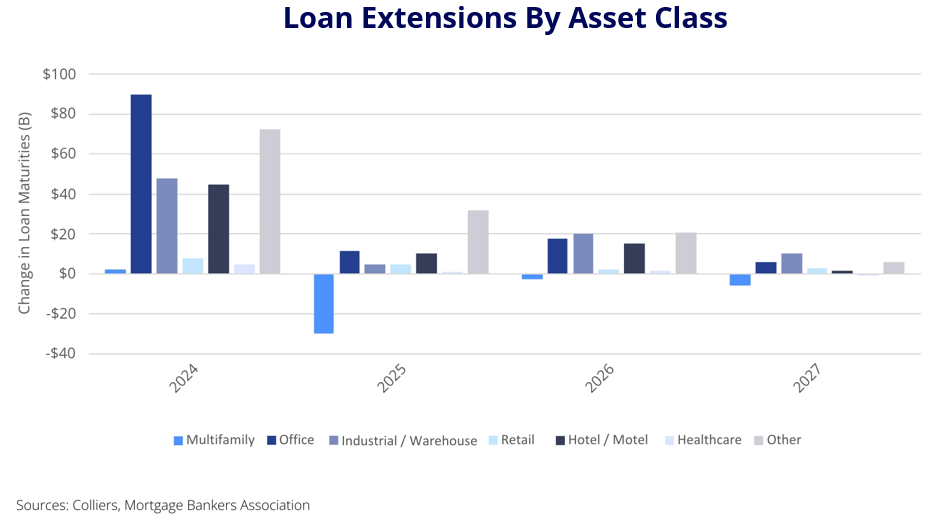

- The lender types with the biggest increase in maturities are CMBS, CDO, other ABS, and depositories.

- Office experienced the largest change, followed by “other,” which includes asset classes such as self-storage, mixed-use, and manufactured housing.

- Given current lending conditions, many loans set to mature this year will be extended again to a 2025 maturity.

The MBA’s latest loan maturity report drove headlines across the industry. A total of $929 billion in loan balances, or one-fifth of outstanding commercial real estate debt, is due to mature this year. This figure is much higher than estimates from sources like Trepp, which is tracking $544 billion. Between 2024 and 2028, aggregate totals for the MBA and Trepp are similar, though the MBA is front-loaded, while Trepp shows higher maturities into the later part of that date range.

Aaron Jodka

Aaron Jodka

A total of $929 billion in loan balances, or one-fifth of outstanding commercial real estate debt, is due to mature this year.

To better understand these figures, we examined the MBA’s loan maturity reports from 2022 and 2023. We used the 2022 version as a benchmark, released in 2023 and based on year-end 2022 figures. Our comparison revealed that the difference in 2024 loan maturities rose by $270 billion. Depositories (banks) led the way at $114 billion, followed by CMBS, CDO, and other ABS at $97 billion. In addition, credit companies, warehouse, and other increased by $53 billion. Admittedly, this may not be a perfect analysis, as loans can be refinanced and renegotiated, and new loans are made throughout a 12-month period. However, because it is uncommon to issue one-year paper, we assume that the difference between the 2022 and 2023 figures represents loan extensions, at least in the near term.

Aaron Jodka

Aaron Jodka

Office saw the most significant change in maturities in 2024, up $89 billion.

Looking at asset classes, office saw the most significant change in maturities in 2024, up $89 billion, followed by “other,” including self-storage, mixed-use, and manufactured housing, which increased $72 billion. Recent growth in this category’s alternative, or specialized, asset classes has added a new dynamic to refinancing and liquidity. Industrial/warehouse and hotel/motel increased between $45 and $48 billion. Multifamily barely moved and is projected to decrease in the years ahead. This drop is counterintuitive, given the heavy lending in this space in 2021 and 2022, and many bridge loans are coming due.

CMBS spreads have come in, offering a bright spot in the lending market. Examples of single asset single borrower (SASB) loans have shown good movement, suggesting increased demand for these securities. This may allow for refinancing or new issuance, providing liquidity in the marketplace.

Meanwhile, banks face additional regulatory scrutiny, suggesting they will not soon be a major source of new loans. Without forced action, of which there will be some, as the year progresses, 2024 loans will be pushed out into the future. When we reexamine the data in 2025, this will be the new high-water mark for maturities.

Nicole Larson

Nicole Larson