- Quick-service restaurants and personal services are driving retail leasing.

- The food and beverage segment accounted for a historic high of nearly 20% of all retail leasing over the past year.

- While foodservice development is up 13.2% compared to last year, grocery construction is up 60%.

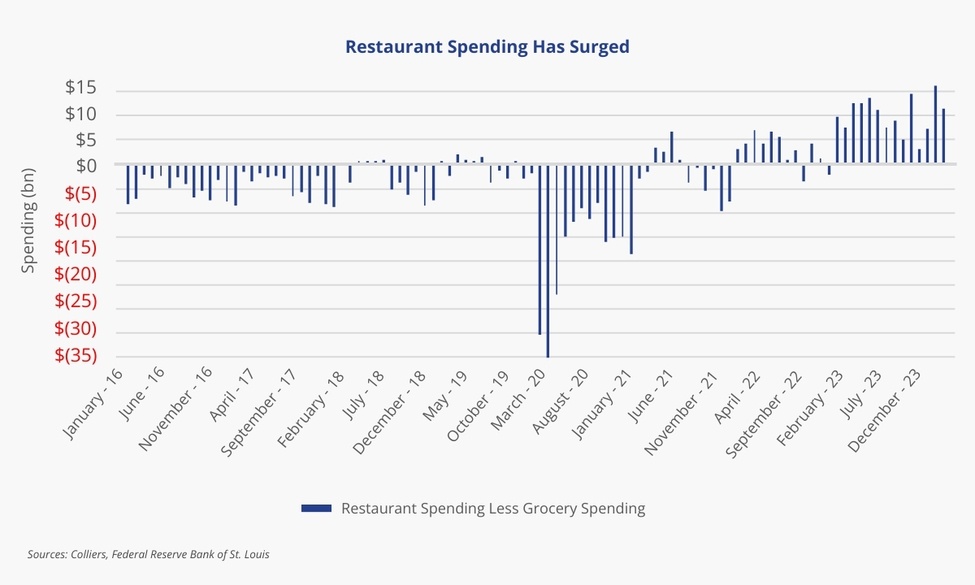

- Foot traffic at grocers far outpaces that of restaurants, but spending on dining out has consistently topped grocery sales since early 2021.

- Navigating changes in consumer spending and behavior can lead to alpha in a retail investment portfolio.

Leasing remains concentrated in smaller spaces of under 2,500 SF, where activity is overwhelmingly driven by growth from quick-service restaurants and personal services. Tenants such as Starbucks, Crumbl Cookies, Yum Brands, and Restaurant Brands International (owner of BK, Tim Hortons, Popeyes, and Firehouse Subs) have all signed up for dozens of new locations over the past year. Propelled by record spending on outside-of-the-home food purchases, retail tenants in the food and beverage sector accounted for a historic high of nearly 20% of all leasing activity over the past year.

The industry has continued to benefit from Americans eating out more frequently following the pandemic and greater adoption of mobile pre-ordering and food delivery services.

Aaron Jodka

Aaron Jodka

Propelled by record spending on outside-of-the-home food purchases, foodservice drove nearly 20% of retail leasing over the past year.

While restaurant and grocery visits have fluctuated over the years, there is a noticeable trend of stronger and more consistent recovery and growth in restaurant visits, particularly post-pandemic. This movement suggests a shift in consumer behavior toward eating out more frequently, potentially driven by lifestyle changes and the convenience of dining options. Historically, spending at grocery stores outpaced that of restaurants every month, dating back to at least 1992, outside of a couple of months in 2018 and 2019. However, since early 2021, restaurant spending has consistently exceeded that of grocery stores. The USDA Economic Research Service notes that total food expenditures hit $2.6 trillion in 2023, up from $2.4 trillion the year before. This increase was driven by a surge in food-away-from-home spending, which rose from $1.3 trillion to $1.5 trillion year-over-year, reaching a record-high share of 58.5%.

Forecasts suggest a normalization of trends, with spending growth on dining out cooling and reverting to pre-pandemic levels. Currently, 4.3 million SF of foodservice is under construction across the U.S., an increase of 13.2% from 2023. Meanwhile, grocery development of 2.3 million SF is up 60% over the same time. Understanding the changes in consumer behavior and spending patterns can offer investors outsized returns in their portfolios.

Nicole Larson

Nicole Larson