- Revista data shows that medical outpatient building rents are rising.

- Medical occupiers are “sticky” tenants who typically require substantial capital investment into their space.

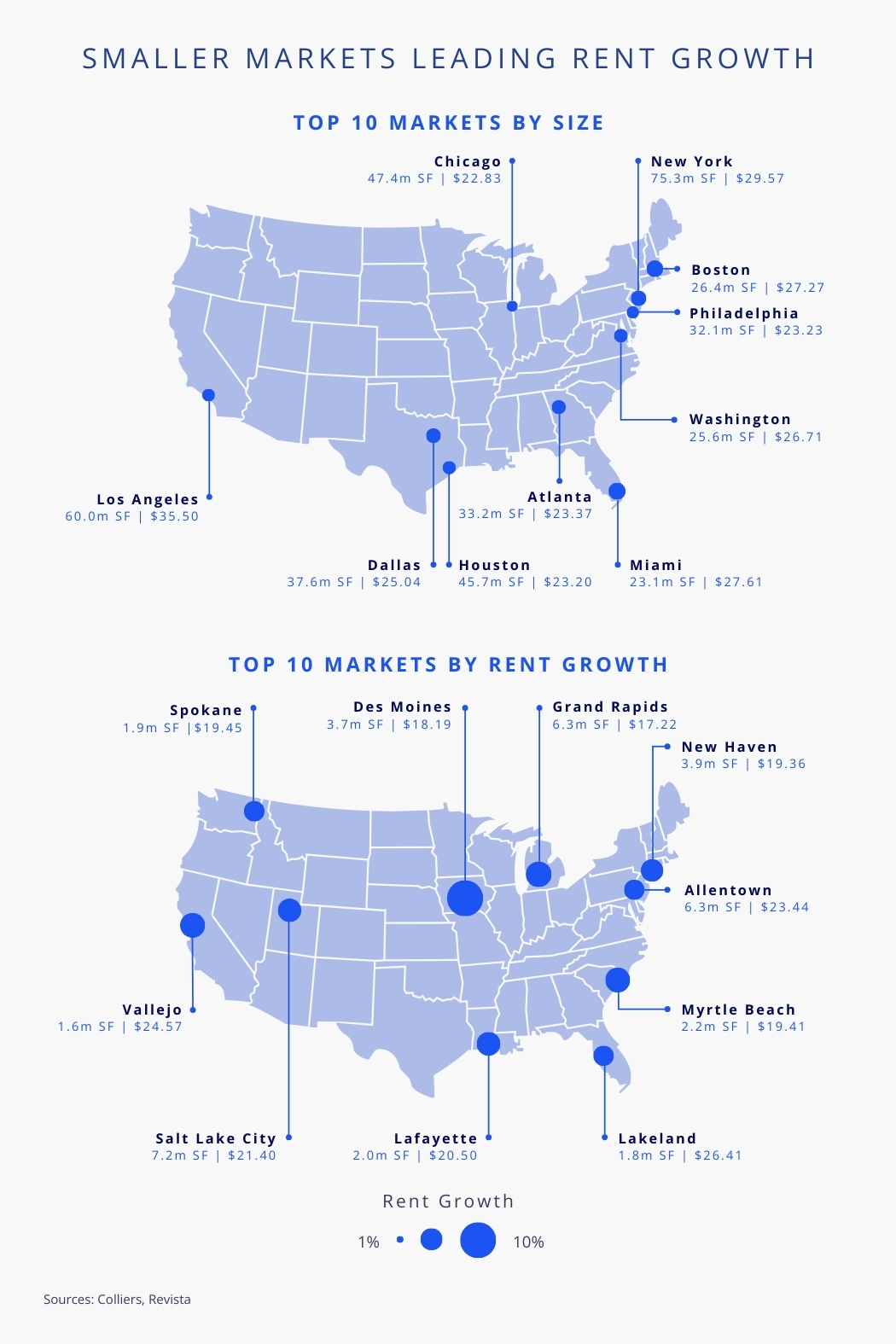

- Some of the smallest markets by inventory, outside the top 100, are seeing the most substantial gains.

- Des Moines, IA; Grand Rapids, MI; and New Haven, CT, lead in rent growth for the top 100 metros. Salt Lake City and Allentown, PA, are leading in rent growth among the top 50 metros.

- With elevated borrowing and construction costs, rents can continue to escalate.

With completely different demand drivers, medical outpatient buildings continue to demonstrate strong fundamentals in juxtaposition to the broader office market. While rent growth in the U.S. office market has generally flattened, conditions for medical outpatient buildings have consistently improved across most U.S. metros. Fundamentals are in far better shape, with vacancies hovering around 7.5% nationally. Rents are still rising, up 2.2% year-over-year, per Revista. While a few of the largest markets in the country are posting above average gains, including Miami (3.7%), Boston (2.9%), Dallas (2.8%), and New York (2.8%), those posting the most significant increases are smaller markets by inventory, with five of the top 10 falling outside the top 100 in total square footage.

Aaron Jodka

Aaron Jodka

Smaller markets like Des Moines and Grand Rapids are leading in rent growth, while high construction costs and limited new development allow for additional expansion.

Smaller, tertiary markets have been leading the country in rent growth. Des Moines, IA, has seen a 9.6% increase over the past year, followed by Grand Rapids, MI, with 6.1%, and Myrtle Beach, SC, with 6.0%, making them the strongest markets. Myrtle Beach; Vallejo, CA; Lafayette, LA; Spokane, WA; and Lakeland, FL, all rank within the top 10 for rent growth but fall outside the top 100 in market size. Salt Lake City and Allentown, PA, are the only markets in the top 50 by inventory to experience rent growth within the top 10. Additionally, Miami is the only top-10 market by inventory to fall within the top 20 for rent gains.

It’s no secret that the cost of construction remains elevated. Revista reports that the average cost/SF for medical development was at an all-time high of $528 in Q2. Building on hospital campuses, where the cost of construction can top $1,000/SF, is more expensive. These projects tend to be in-patient facilities, which are more costly to develop. With patients seeking delivery of care closer to home, off-campus development is gaining traction. Overall, however, medical outpatient construction is falling. The cost of occupancy for tenants is high, as medical users tend to invest substantial capital into their space, increasing their probability of renewal. Combined with construction costs limiting new groundbreakings, the recipe for continued rent growth is in place.