Co-authored-by Craig Hurvitz, Director, National Industrial Research | U.S.

- Industrial vacancies are on the rise due to an increase in deliveries.

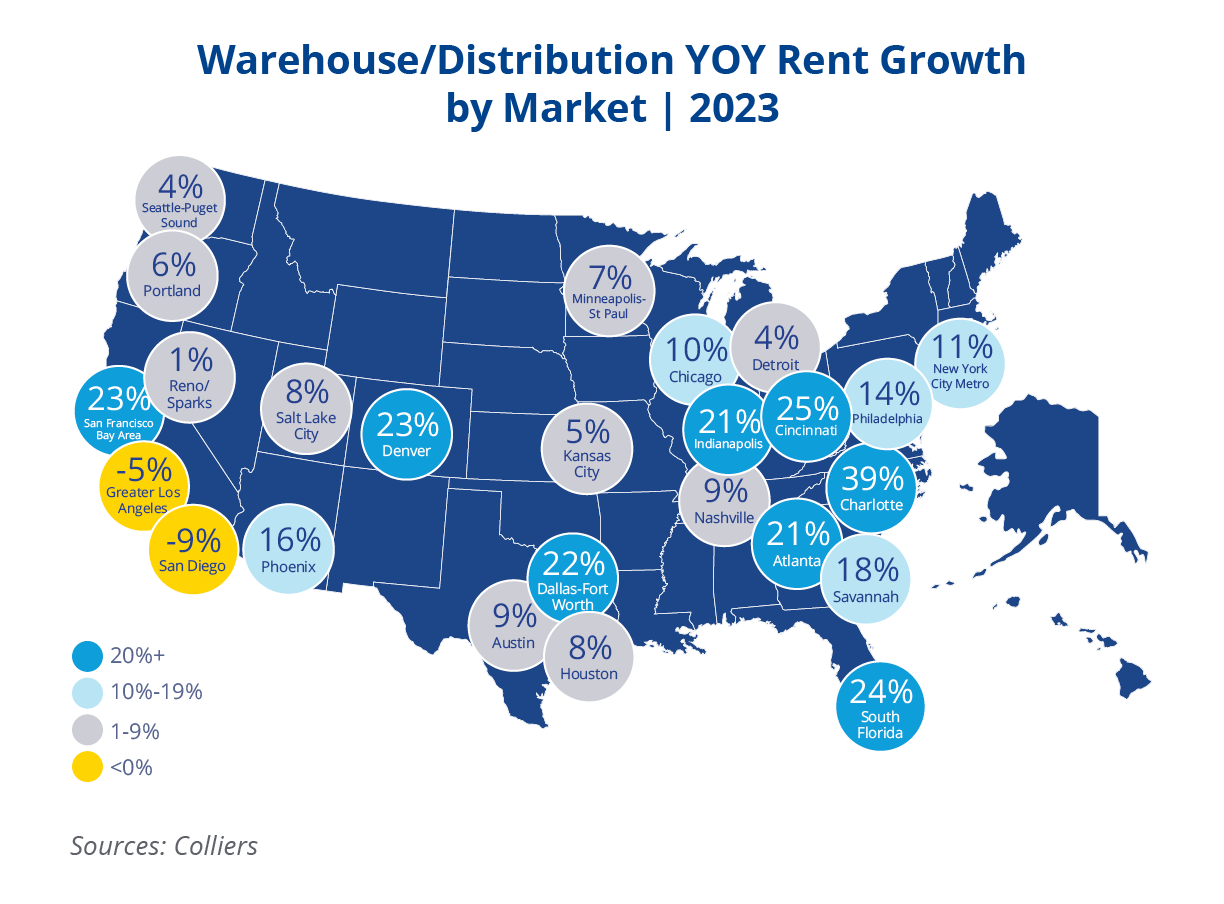

- While rent growth has generally remained strong, marked differences emerged throughout 2023.

- With demand reverting to slightly below pre-pandemic levels, rent growth is expected to cool in 2024 and 2025.

- Investors will have opportunities to uncover strategic targets as a result of changing market conditions.

- Understanding supply/demand dynamics within markets and submarkets can allow investors to outperform.

Warehouse and distribution rental rates increased by an average of 55% nationwide over the past three years, primarily in 2022 and 2023. While rent growth slowed slightly during the second half of last year, it varied greatly by market and even submarket. Rising vacancy rates and increased competition due to a surplus of new supply in many markets, combined with demand normalizing slightly below pre-pandemic levels, economic concerns, and high interest rates, resulted in slower rent growth in 2023.

Nearly all primary and secondary industrial markets witnessed double-digit rent growth during 2022. Some markets, including Greater Los Angeles, San Diego, Phoenix, Charleston, and Philadelphia, saw average rents increase by an unprecedented 30% or greater year-over-year, which proved unsustainable. As a result, during 2023, rents in many of those markets saw increases that were more in line with historical averages. Additionally, some markets reversed course during the year, and rents began to contract. Rents were down 5% in Greater Los Angeles, 9% in San Diego, and more than 10% in Charleston in 2023.

Craig Hurvitz

Craig Hurvitz

“Warehouse and distribution rental rates increased by an average of 55% nationwide over the past three years, primarily in 2022 and 2023.”

Growth remained robust in other markets, including Charlotte, South Florida, Atlanta, Dallas, and the San Francisco Bay Area, and eclipsed 20% year-over-year. These markets generally outperformed the U.S. average during 2023, recording continued strong demand relative to their inventory base, lower vacancy rates, and fewer new supply concerns. Dallas was the exception.

While rental growth proved uneven market-by-market, it was often even more inconsistent at the submarket level. While Greater Los Angeles rents contracted 5% on average during 2023, the East San Fernando Valley submarket, an established infill area with limited new supply, saw rents increase by more than 12% year-over-year. Meanwhile, rents decreased by 11% year-over-year in the Inland Empire-East submarket and 6% in the Inland Empire-West submarket. These areas are where much of the new supply was recorded during the year, and vacancy has increased the fastest.

The forecast for industrial rents in 2024 and into 2025 shows continued normalization towards historical averages between 4% and 8% growth. Competition will limit gains or result in rents contracting in markets and submarkets with excess new supply compared to expected demand. Fewer construction starts and a contracting development pipeline will ultimately lead to supply and demand returning to equilibrium. As vacancy stabilizes and begins to fall again, a lack of new product will eventually result in upward pressure on rental rates. This will happen more quickly in some markets than others, offering outsized investment returns.

Aaron Jodka

Aaron Jodka

Nicole Larson

Nicole Larson