Co-authored-by Jeffrey Myers, Research Director, Boston | U.S.

- Long-term demand drivers for the life sciences industry are strong.

- Deliveries in 2023 reached an all-time high, causing vacancies to rise.

- The S&P Biotechnology Select Industry Index (SPSIBI) has risen significantly from its 2023 trough.

- Early IPO activity could indicate a thaw in the market.

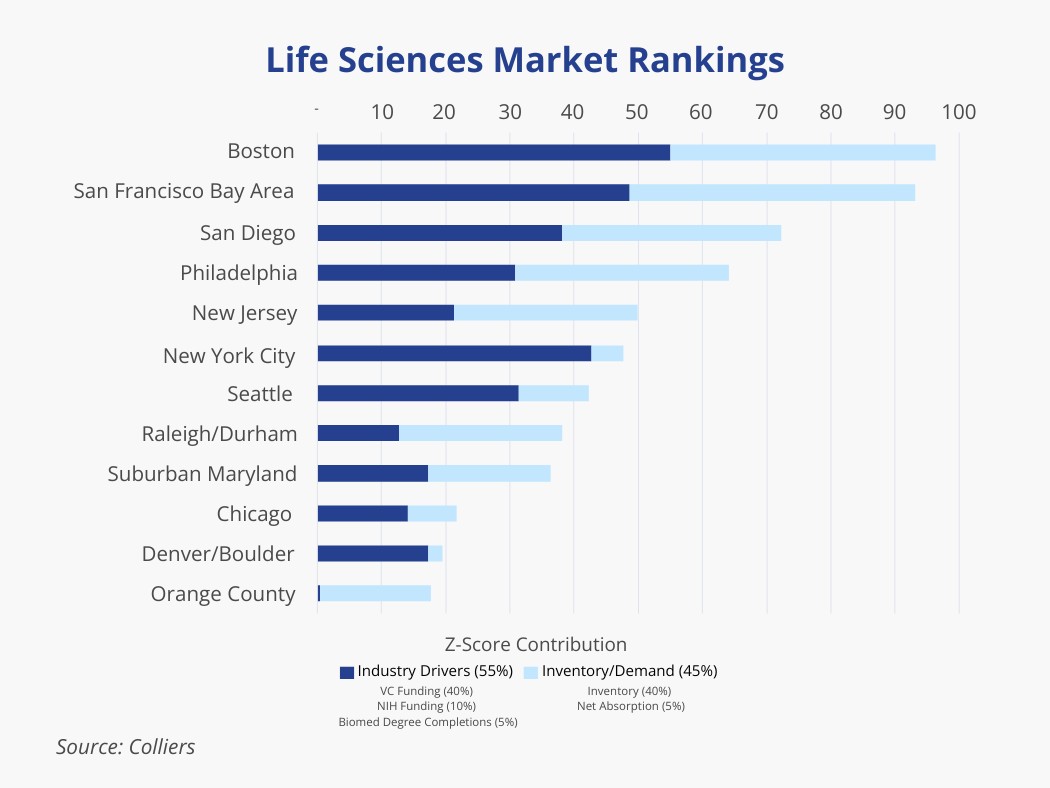

- Colliers has created a ranking system to provide further insight into the hierarchy of major metro areas, helping investors understand the dynamics within established and emerging markets.

The life sciences industry faced a wave of new deliveries last year, sending vacancies up across markets. In fact, more than 20 million SF came online nationwide. This surge was concentrated in the major markets, with another 36 million SF underway. Besides direct vacancy in new buildings, sublease availabilities are also growing. Some companies are placing sublease space on the market under financial duress. Others may be trying to monetize underutilized space, having leased defensively when vacancies were tighter. Overall, about half of the major markets tracked had negative net absorption in 2023, and vacancies in most metros increased during the year. To fill space, some landlords are building out speculative suites that reduce the time to occupancy for prospective tenants, while others are offering more tenant-friendly concession packages. Asking rents in most markets were either flat or declined in 2023. Given the rise in construction costs (materials, labor, and financing), increasing vacancy rates, and subdued demand prospects, there will be fewer groundbreakings than completions in the near term.

Funding conditions could perk up in 2024 and help give companies the confidence and ability to lease space. As conditions have stabilized, the S&P Biotechnology Select Industry Index (SPSIBI) value has risen from its 2023 trough and is generally in line with its early 2020 pre-COVID level. Early 2024 IPO activity could be indicative of a thawing in the public markets.

Aaron Jodka

Aaron Jodka

Long-term demand drivers for the life sciences industry are strong. Early IPO activity could indicate a thaw in the market.

Colliers has created a ranking system to provide further insight into the potential hierarchy of the major metro areas, using two groups of key criteria to determine the magnitude of opportunities.

The first group of factors indicates the local ecosystem’s ability to support and sustain growth in the industry. The individual criteria and weightings are as follows: 2020–23 venture capital funding (40% weight), fiscal year 2023 NIH funding (10%), and 2022 biomed degree completions (5%). The top markets by these metrics are Boston, the San Francisco Bay Area, and New York City, respectively.

The second group of factors is related to the life sciences real estate market in major metro areas. Specifically, the inventory size (40% weight) and the amount of space absorbed over the past three years (5%) are analyzed. Here, the San Francisco Bay Area, Boston, and San Diego rank as the top three.