- Lenders extended $384 billion in loans from prior years into 2025, surpassing the total extended into 2024.

- Loan extensions now account for 40% of 2025’s maturities.

- As in past years, CMBS and banks were the most likely to extend loans.

- Multifamily, “other” sectors, and office ranked as the top three asset classes with the most extensions.

- While lenders are beginning to force sales and reclaim properties, a sizeable portion of 2025 maturities will be pushed into 2026 or later.

Lenders continue to extend loans into the future. According to the Mortgage Bankers Association (MBA), a total of $384 billion in loans were extended into 2025 from prior years, up from $270 billion in extensions last year. To determine these figures, we benchmarked last year’s MBA loan maturity report against this year’s totals. While this analysis may not be perfect—given that loans can be refinanced, renegotiated, or newly issued—one thing is clear: many loans are not paying off at maturity but are instead being pushed forward. Based on newly released 2025 maturity estimates, 40% of this year’s maturities have been extended.

Aaron Jodka

Aaron Jodka

Lenders extended $384 billion in loans to 2025 and $205 billion to 2026, a trend expected to continue for the foreseeable future.

A closer look reveals some expected trends—depositories (banks) and CMBS, CDO, and other ABS loans were the most likely to be extended. Notably, 54% of 2025’s CMBS maturities ($125 billion in extensions) were due in prior years, while bank loans clock in at 44% ($199 billion). Conversely, life insurance and agency loans (Fannie Mae, Freddie Mac, FHA, Ginnie Mae) were paid off, reducing total maturities by $8 billion.

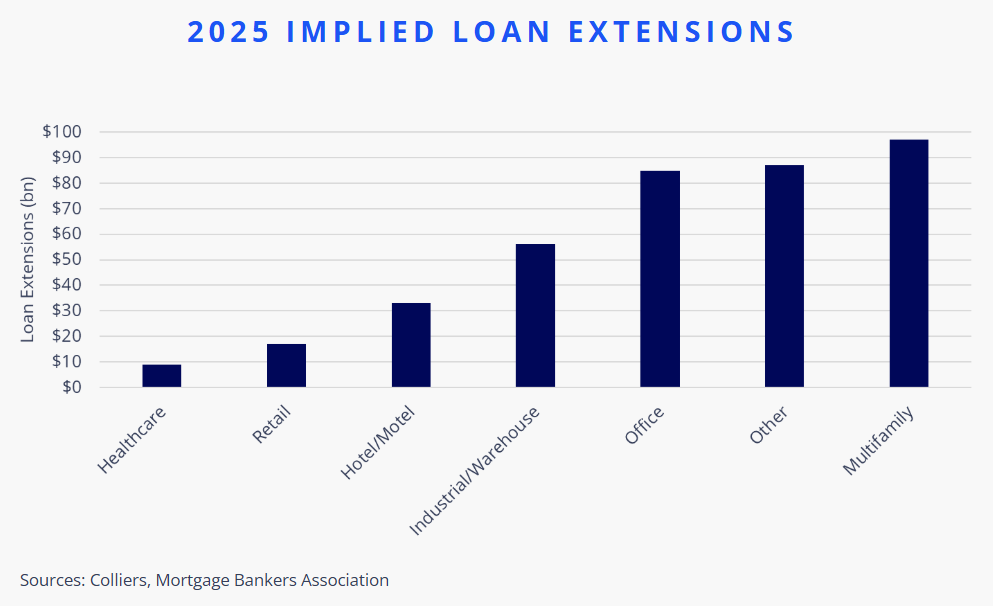

Office loans accounted for $85 billion in extensions, representing 45% of the $187 billion in 2025 maturities. However, multifamily had the highest volume of extensions, totaling $97 billion—about one-third of 2025’s $310 billion in maturities, the most of any asset class. Meanwhile, “other,” which includes self-storage, manufactured housing, and various alternative assets, saw $87 billion in extensions.

Loan extensions for industrial properties stand out, with 55% of 2025 maturities pushed from prior years—the highest share of any asset class. On the one hand, this makes sense given the heavy trading volume and overall stronger fundamentals, which make loan extensions a logical play. However, it is worth watching, as there have been few cracks in the industrial armor to date.

Lenders are beginning to respond to market conditions and price adjustments by forcing sales, foreclosing, and seeking alternatives beyond renegotiated loans. Still, $957 billion in loans will not pay off this year, and a meaningful share will be pushed into 2026, when $663 billion in loans come due.

Jeffrey Myers

Jeffrey Myers

Stephanie Rodriguez

Stephanie Rodriguez