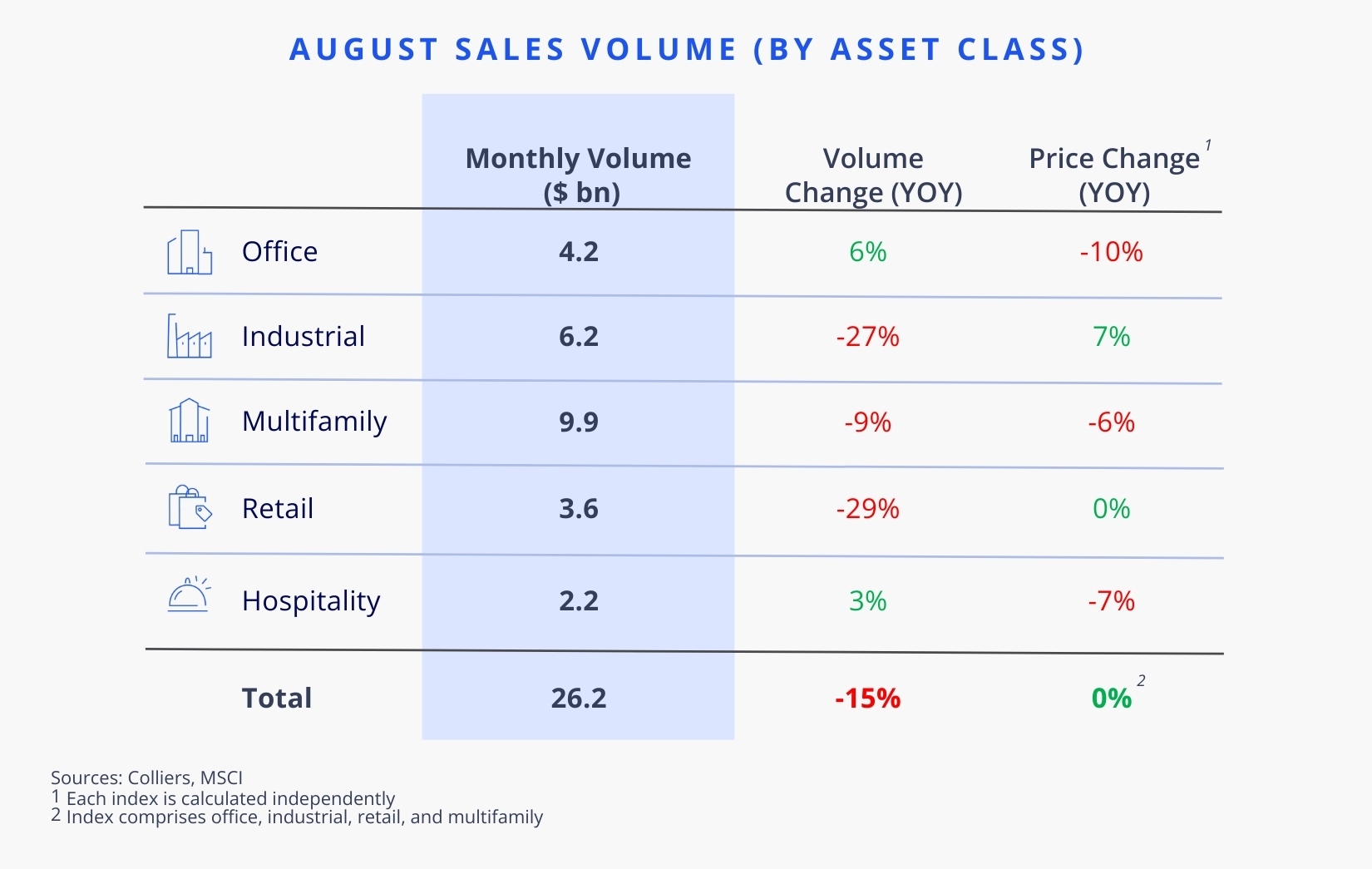

- Volume declined 15% compared to last August.

- On a month-over-month basis, all asset classes saw volume increases.

- The number of properties traded marked a new cyclical low.

- MSCI reports that, in aggregate, prices rose on a year-over-year basis.

- With the Fed announcing a 50-basis-point cut and more rate reductions to come, future volume is expected to rebound.

Office

Office may have found a bottom, at least in terms of volume. The asset class has now posted back-to-back months of stronger volume compared to one year ago. Total transactions remain low, but activity is increasing in the $100 million+ price category. User buyers were a theme in August. Microsoft acquired its 644,000 SF office at 1190 Macon Ave. in Mountain View, CA, for $330 million, or $513/SF. Meanwhile, in Miami, Miami-Dade County acquired 9250 W Flagler St., a 635,000 SF office complex, for $182 million, or $287/SF. The property is highly vacant. Other large buyers in the month included Beacon Capital Partners, 3Edgewood, JPMorgan Chase, Hines, Venture Global LNG, Nuveen, and Fashion Nova.

Aaron Jodka

Aaron Jodka

Office may have found a bottom, at least in terms of volume. Total transactions remain low, but activity is increasing in the $100M+ category.

Industrial

Industrial sales were down 27% compared to last August, with $6.2 billion trading. However, this represents an increase month-over-month. Industrial activity has seen some fits and starts, with year-over-year gains earlier this year giving way to declines over the past three months.

Portfolio activity was the name of the game in August, a good sign for future liquidity. KKR acquired a six-property, 2 million SF portfolio from Blackstone for $377 million. Meanwhile, EQT Exeter purchased a 26-property, 2.5 million SF small bay portfolio in Georgia for $270 million. EQT also acquired several other assets during the month in various locations, including Arizona, Pennsylvania, and Nevada.

Multifamily

With nearly $10 billion in monthly sales, multifamily is showing signs of stabilization. Volume was down 9% on the month, but once additional deal information flows in, activity will likely range from flat to slightly up, marking three consecutive months of volume increases.

One of the largest deals of the month was a five-property portfolio in Georgia and Texas that Equity Residential acquired from BREIT. In total, 1,569 units changed hands. In a separate transaction, Equity Residential bought three properties in Georgia and Texas from Blackstone, adding 1,025 units to its portfolio.

Retail

After a few months of broadly flat year-over-year sales volume, activity dropped off in August. To be fair, August and September posted some of the strongest monthly tallies in 2023. On a month-over-month basis, sales volume increased to $3.6 billion.

In one of the largest deals of the month, Publix acquired seven of its locations in Florida from PGIM. In total, the grocer purchased 606,000 SF of space for $223.9 million. Three malls also topped the list of recent trades: the Westfield Annapolis in Maryland for $160 million ($109/SF); Puente Hills Mall in City of Industry, CA, for $156 million ($214/SF); and Centennial Promenade in Centennial, CO, for $98.1 million ($119/SF). Different investment groups sold these properties to various buyers.

Hospitality

In four of the past five months, year-over-year sales volume has been positive in the hospitality space. In August, a total of $2.2 billion traded, an increase from the prior month and a slight uptick from the previous year. However, less than 100 properties traded overall, so while volume is showing signs of recovery, velocity has yet to.

Similar to recent months, a significant hospitality deal drove a large share of activity. Hyatt Hotels sold the 1,641 Hyatt Regency Orlando to RIDA Development Corporation and Ares Management for $1.07 billion. The deal also includes a 45-acre development site. In Manalapan, FL, Lawrence Investments bought the 310-room Eau Palm Beach Resort & Spa for $311.2 million, or $1 million per door. The two-property deal also included a small office, pushing the total price to $317.5 million.