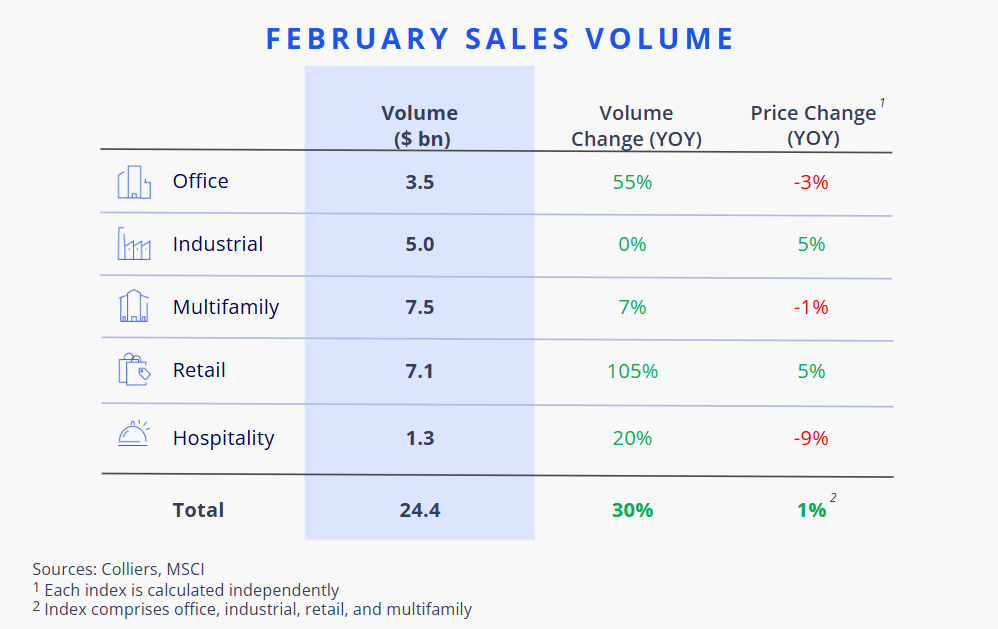

- Sales volume grew 30% year-over-year in February, with $24.4 billion trading.

- All asset classes posted gains compared to last year.

- Retail led the charge with a 105% increase in volume, followed by office at 55%.

- The total number of properties trading remains restrained.

- Recent economic noise, stock fluctuations, and general uncertainty are expected to weigh on activity in future data releases.

Aaron Jodka

Aaron Jodka

While all asset classes posted gains compared to last year, retail led the charge with an increase in volume of 105%, followed by office at 55%.

Office

Office continues to lead in year-over-year volume gains, with $3.5 billion in sales. CBD activity has been the standout, with sales up 217% in February compared to last year.

In one of the largest deals of the month, Sutter Health acquired a two-property, 565,000 SF portfolio in Emeryville, CA, from BioMed Realty for $450 million. The site includes space for future development. Other large trades took place in Fort Lauderdale, Tampa, Denver, and SeaTac, WA.

Industrial

Industrial volume was slightly ahead of last year’s total in February, with $5.0 billion transacted. However, the number of individual properties trading remains muted. MSCI reports cap rate compression in recent months.

Corporate operators drove the largest deals in February. Target purchased an under-construction building in Brighton, CO, for $231 million, while REI sold four properties to Madison Capital for $230 million. Meanwhile, in Lancaster, PA, two former LSC Communications properties traded for $130 million to Machine Investment Group.

Multifamily

Continuing to top monthly sales volume, multifamily posted a 7% annual gain, marking nine straight months of year-over-year sales increases. In total, $7.5 billion traded in February.

Individual assets led the charge during the month, with notable sales such as 525 West 52nd Street in Manhattan. Ares Management acquired the 392-unit property from Mitsui Fudosan America for $270 million. In Bethesda, MD, Peterson Cos acquired 8001 Woodmont, a 322-unit property, from JBG Smith for $194 million. Other large sales occurred in Foster City, CA; Union, NJ; Rancho Palos Verdes, CA; and Vienna, VA.

Retail

Retail led all asset classes in year-over-year sales gains, up 105%. A total of $7.1 billion traded, marking the highest monthly total since January 2024.

A substantial portion of the month’s activity was driven by Blackstone’s acquisition of Retail Opportunity Investments Corporation, taking the REIT private. Meanwhile, Blue Owl Capital acquired a 165-property sale-leaseback portfolio from South State Bank for $411.6 million. Other large deals transacted in Orange, OH, and Monterey, CA.

Hospitality

Hospitality posted a 20% gain in February, with $1.3 billion in volume. While the number of assets traded remains limited, it exceeded January’s total. However, both figures are lower than any month in 2024.

One of the month’s highlights was Columbia Pacific’s acquisition of the 153-room boutique hotel at 250 5th Avenue in Manhattan for $114.4 million. In Washington, D.C., Columbia Sussex Corp acquired the 406-room Westin at 1400 M St. NW for $92 million. Other major transactions took place in Port Saint Lucie, FL, Nashville, and Manhattan.