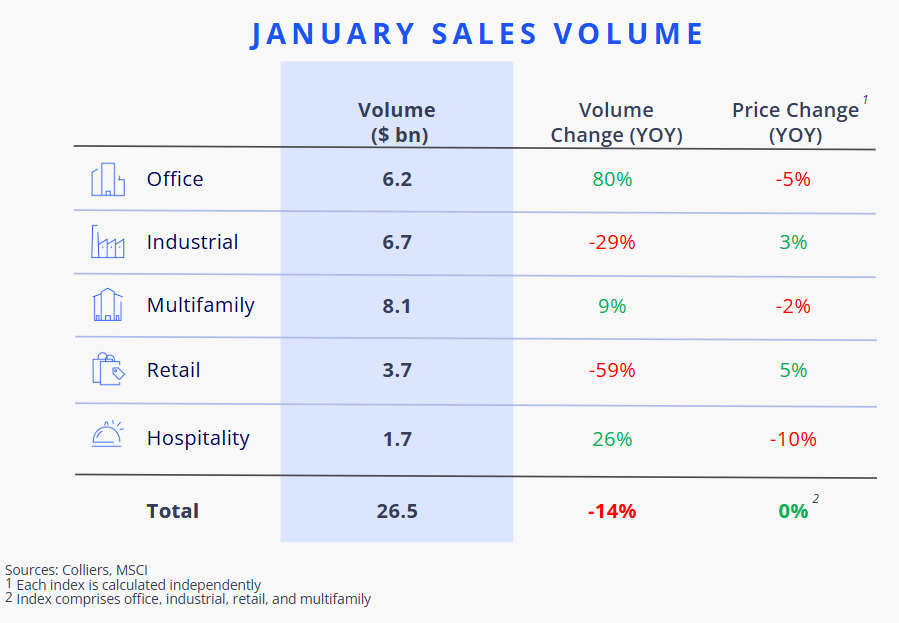

- Headline stats suggest a 14% decline in aggregate sales volume compared to last January, driven by a 42% dip in portfolio and entity deals.

- Single-asset transactions, however, were up 1%.

- Fewer than 1,800 assets traded, matching the lowest monthly total of 2024.

- Office volume increased 80%, followed by hospitality at 26%, and multifamily at 9%.

- Portfolios are starting to come to market again, suggesting that future months may see a marked uptick in such transactions, boosting overall volume.

Aaron Jodka

Aaron Jodka

Office volume surged 80% compared to last year, building on the momentum seen in late 2024.

Office

Office volume surged 80% compared to last year, building on the momentum seen in late 2024. A key driver was AT&T’s sale-leaseback of underused central office properties to Reign Capital for $850 million. An uptick of $100 million+ transactions in Manhattan, San Diego, Los Angeles, and Morristown indicates thawing market conditions. Chicago’s 1.6 million SF 600 West Chicago Avenue closed for $54/SF.

Industrial

Compared to the year prior, industrial volume fell 29% in the month. However, liquidity remains, with NBIM acquiring a 48-property portfolio from CPP Investment Board for $3.3 billion. This 14 million SF portfolio could signal more large-scale deals on the horizon, as EQT has listed a multi-billion-dollar offering.

In a single-asset deal, Disney purchased a 407,000 SF warehouse in Anaheim for $124 million, or $305/SF.

Multifamily

Multifamily’s hot streak continued in January, marking eight consecutive months of year-over-year sales increases. However, the 9% gain was the smallest in recent months.

Multiple smaller-scale portfolios traded to kick off the year, including Harbor Group International’s partial interest acquisition of an 11-property, 2,200-unit assemblage from The Garrett Companies and Telis Group for $630.5 million. Meanwhile, Palladius Capital Management purchased a 2,500-unit, 9-property student housing portfolio for $579 million.

Retail

Retail volume has fluctuated between gains and declines over the past six months. In January, retail volume was down 59% from last year, which was largely expected since 2024 kicked off with the highest monthly volume in years.

In the largest deal of the month, UNIQLO acquired its site at 666 Fifth Avenue in Manhattan for $352.5 million, or $20,382/SF. In recent quarters, retailers have acquired their storefronts, propping up Manhattan sales volume.

Hospitality

Hospitality volume rose 26% in January, marking back-to-back monthly gains. Deal volume remains limited, with only 77 properties traded in the month, the lowest total since the height of the pandemic. After a short pause, another resort sale boosted volume. A joint venture between Henderson Park, Salamander Hotels & Resorts, and South Street Partners acquired the PGA National Resort and Spa in Palm Beach Gardens, FL, for $422.5 million, or nearly $1.3 million/door.

Anjee Solanki

Anjee Solanki