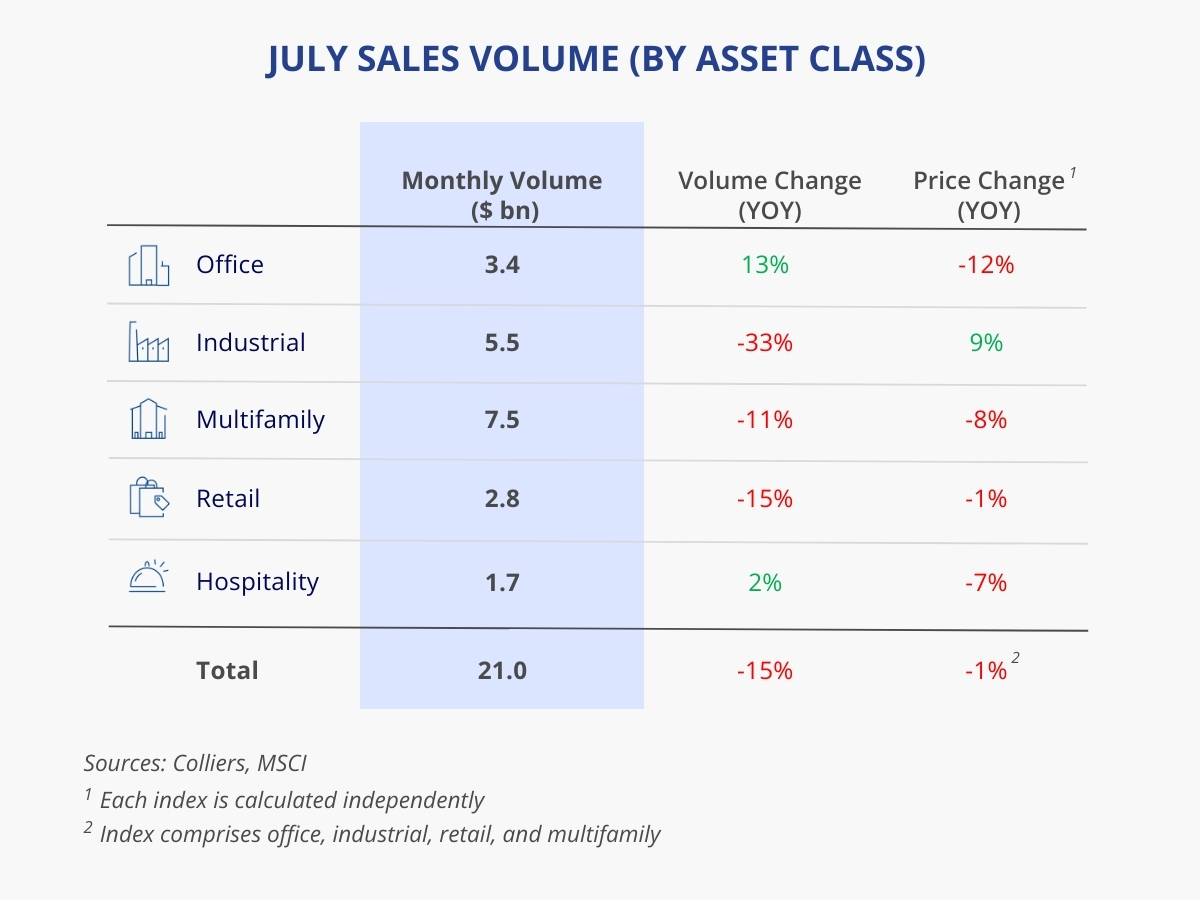

- Monthly sales volume remains jumpy and was down 14.8% year-over-year.

- Around 1,300 properties traded in July, the fewest so far this cycle.

- However, the average deal size is starting to creep back up and is close to 2016-2019 levels.

- Overall pricing is down 1% over the past year, indicating that value declines have mostly abated.

- Office posted the strongest sales increase of all asset classes, up 13%, while hospitality gained 2%.

Aaron Jodka

Aaron Jodka

Around 1,300 properties traded in July, the fewest so far this cycle. However, the average deal size is close to 2016-2019 levels.

Office

Office volume increased 13% over the prior July, largely due to a significant medical office portfolio trade. Healthpeak sold 59 assets for $674 million, accounting for approximately 20% of the month’s total volume.

Other large deals in July included tower trades in New York (180 Maiden Lane, $297 million) and Los Angeles (777 Tower, $120 million). While these assets traded well below replacement costs, their sales are a positive sign for the market.

Industrial

Volume has fallen in successive months after back-to-back gains in the months prior. However, in aggregate, the total volume through July is ahead of any period outside 2018-2023. Meanwhile, MSCI reports that cap rates are compressing, which aligns with what we are seeing on the ground.

While subdued, portfolio activity drove July volume. Brookfield Asset Management acquired a 128-property portfolio totaling 14.6 million SF from DRA Advisors for nearly $1.3 billion.

Multifamily

After a June surge, multifamily volume fell back to levels seen in March and April, with about $7.5 billion trading. Volume is off 11% from last year, suggesting a bottom is near.

The month’s most significant deals took place in New York. In Queens, a three-property, 557-unit portfolio traded from Cottonwood Capital to a joint venture of Cape Advisors, Pioneer Companies, and UDR for $444.3 million. In Manhattan, 20 Exchange Place, a 767-unit apartment tower, sold for $370 million.

Retail

Retail volume fell 15% compared to last year but has posted a year-over-year gain in two of the past four months.

Individual deals drove July volume, headlined by the sale of Country Club Plaza in Kansas City for $175.3 million. Simon Property Group and Macerich sold the asset to Ray W. Washburne. In Manhattan, Bando E&C acquired the retail condo at 2 Times Square for $99.3 million, or $3,817/SF, continuing the city’s retail hot streak. In Orlando, Lee Vista Promenade traded for $68.5 million.

Hospitality

Overall trading velocity remains muted, with 84 trades in July, the lowest of this cycle. However, volume was up 2% compared to last year, and in three of the past four months, sales have increased versus the year prior.

Similar to recent months, one large trade drove an outsized share of volume. Host Hotels acquired Turtle Bay Resort in Kawela Bay, HI, a 452-room property, from Blackstone for $725 million, or $1.6 million/key, at a quoted 5.3% cap rate.