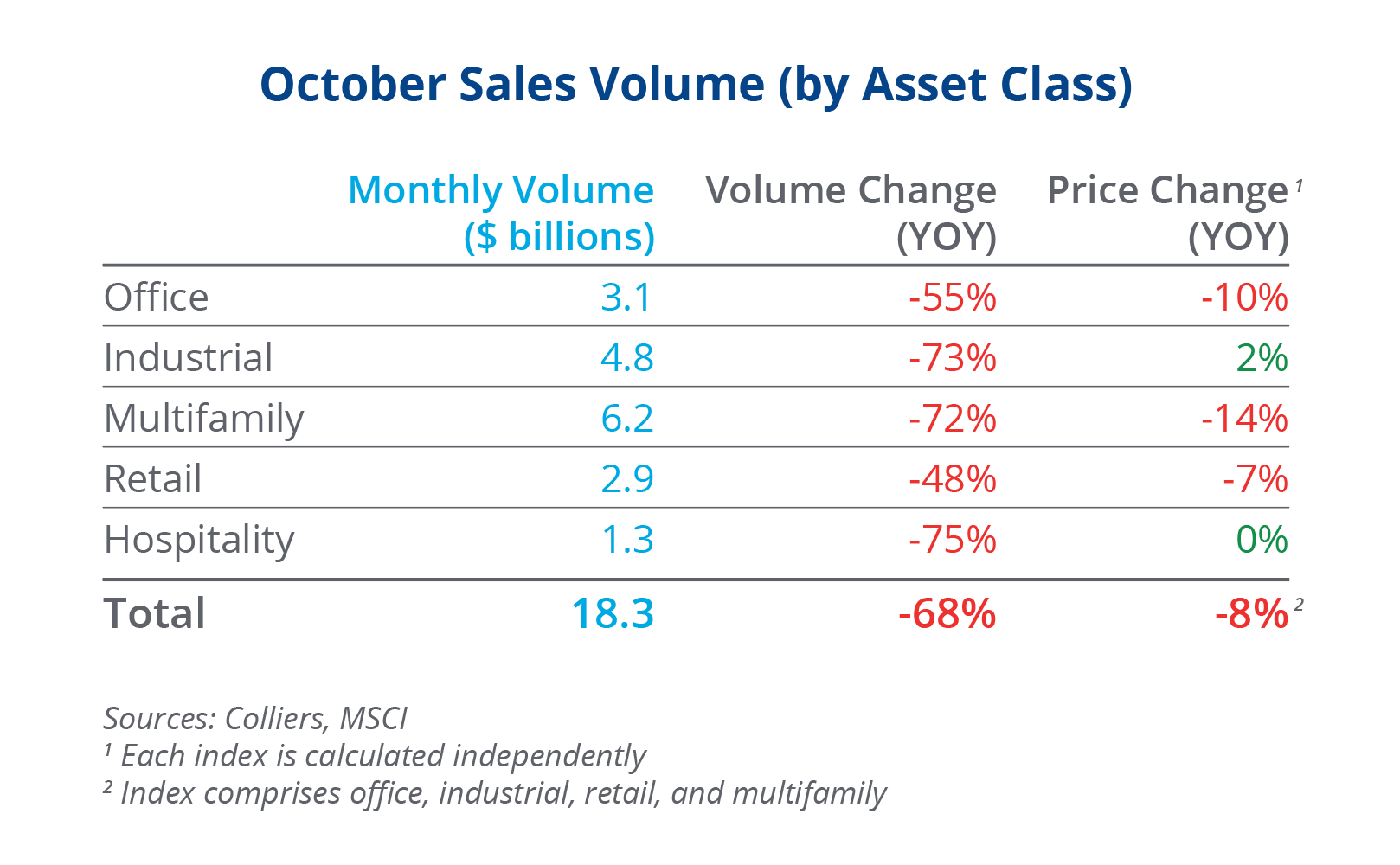

- October’s $18.3 billion was the weakest monthly showing in 2023.

- Total volume fell 68% compared to last year, while total transactions are down a similar amount, at 64%.

- This marks the third consecutive start to a quarter with a drop-off.

- No asset classes posted month-over-month increases in sales. Overall volume was down 45% compared to September.

- Volume in Q4 typically exceeds Q3. The only exceptions have been 2008 and 2022.

Office

Office volume was limited in October, with $3.1 billion trading. Only 188 properties transacted, the lowest monthly total since 2011.

Deals, while sparse, are still getting done. The largest transaction of the month was the sale of Metropolitan Square in Washington, D.C., for $381.3 million. It was a partial interest sale, with the buyer assuming the mortgage. Other trades took place in core office markets, including Manhattan, Boston, San Francisco, Palo Alto, and Miami.

Industrial

Industrial was not able to buck the broader trend of a sluggish October. The asset class ranks behind multifamily with a total volume of $4.8 billion.

Smaller portfolio deals drove activity in October, generally with less than five total assets. New Jersey racked up multiple sales, while California, North Carolina, and Minnesota had one each. All transactions clocked in at over $50 million in total consideration. The largest single-asset deal was Prologis’ acquisition of the 1.4 million square foot Airpark Logistics Center in Goodyear, AZ, for $184 million.

Multifamily

The perpetual asset class leader for volume, multifamily traded $6.2 billion in October, a 72% decline from last year. Deals are restricted, with 255 properties trading, the lowest figure since early 2011.

Several $100 million-plus deals closed in October, led by TA Realty’s two-property acquisition from Crescent Communities and Pearl Street Partners for $204.6 million. The properties are located in Cary, NC, and Nashville. Other prominent deals took place in Denver; Raleigh; Phoenix; Randolph, MA; Carrollton, TX; Knoxville, TN; Calabasas, CA; and Eugene, OR.

Retail

Of all asset classes, retail volume is down the least, off 48% compared to last year. Deals, however, decreased more substantially at 62%. Only 266 properties traded, the lowest number since the pandemic.

The largest deal of the month was a two-property transaction in Massachusetts to Urban Edge. It totaled 1.4 million square feet and traded for $314 million, or a 4.9% cap rate on next year’s income. In Naples, Hoffmann CRE sold 24 properties, 15 of which were retail, to M Development for a combined $184.4 million.

Hospitality

Hospitality volume is down 75%, the most of all asset classes compared to last year. To be fair, October was the highest month for sales in 2022.

The largest trade of the month was the newly crowned Hilton Boston Park Plaza, which sold for $370 million, or a 7.1% cap rate on last year’s income. Other significant deals took place in Manhattan, Miami, Boston, and Renton, WA. Unlike some recent office trades, each property sold for more than its previous price.

Aaron Jodka

Aaron Jodka