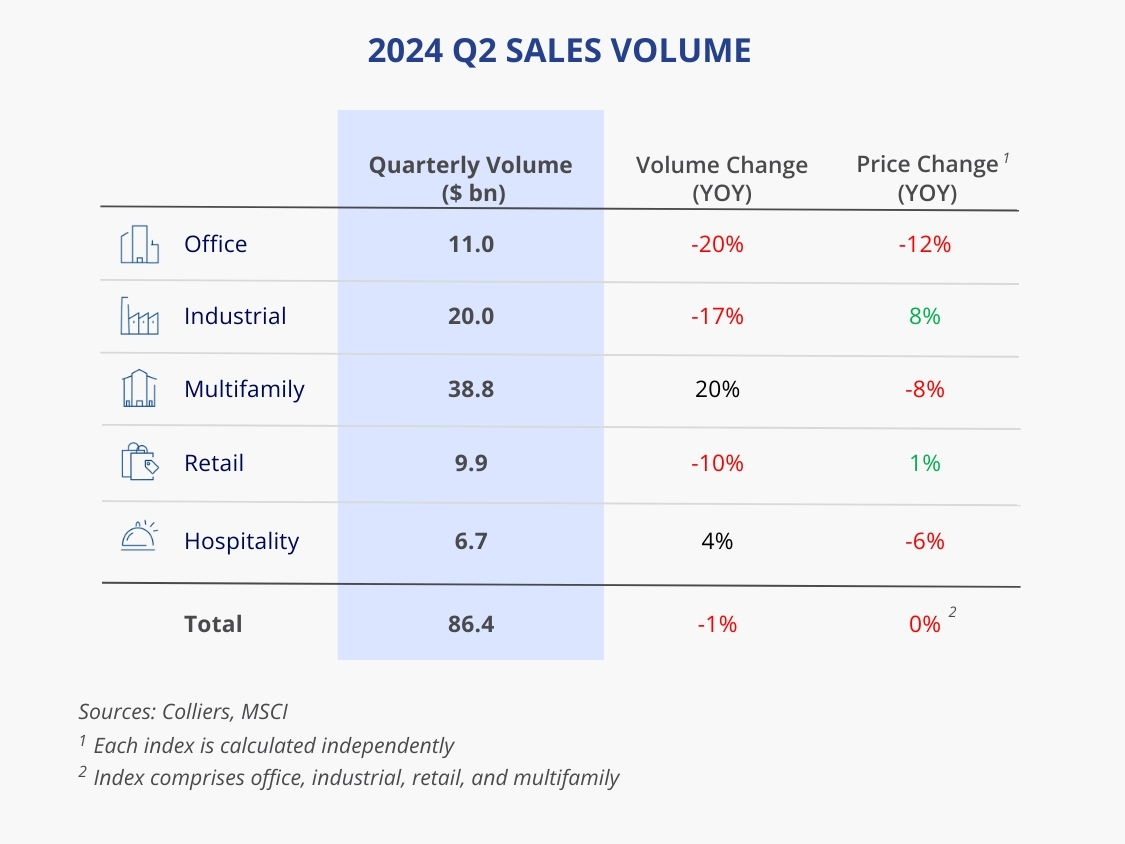

- Quarterly volume rose 15.8% in Q2.

- Meanwhile, volume was down just 1.2% year-over-year.

- MSCI reports pricing was flat in aggregate compared to last year.

- These indicators, along with other green shoots, suggest volume has bottomed.

- The market is closely watching the Fed, as rate cuts have been priced in for September.

Signs of recovery are emerging. Volume rose 15.8% in Q2 from Q1, the first meaningful increase since 2022 Q2. Sales were mostly flat compared to last year but will ultimately show a gain once the data settles. Portfolio and entity trades increased 24% over the past year, indicating that institutional capital is returning to the market. To be fair, had Blackstone not acquired AIR, volume would have been $10 billion lower, and quarter-over-quarter comparisons wouldn’t look as strong. Private capital continues to drive the market, but competition is beginning to increase.

Aaron Jodka

Aaron Jodka

Signs of recovery are emerging. Volume rose 15.8% in Q2 from Q1, the first meaningful increase since 2022 Q2.

Office

Volume rang in at $11 billion in the quarter, a decline of 20% compared to last year. Pricing continues to slip, though the velocity of transactions is showing signs of rebounding, particularly in CBDs. Notably, 13 of the top 25 markets for volume reported an increase in sales compared to last year. They range from growth markets like Atlanta, Phoenix, Charlotte, and Nashville to core markets, including Washington, D.C., Chicago, and Seattle.

Industrial

Industrial volume rose quarter-over-quarter, a similar trend to this time last year. Despite a 17% decrease in volume year-over-year, industrial boasts the most robust price increases of all asset classes. Pricing is up 8% over the past year and has steadily increased for four consecutive quarters. Of the top 25 markets for volume, 11 showed an increase in the first half compared to last year. Dallas is the lone major distribution hub posting a gain. Local and regional markets dominate the remaining 10.

Multifamily

Volume rose both quarter-over-quarter and year-over-year in the multifamily space. The large Blackstone/AIR deal played a significant role, causing portfolio and entity volume to soar. This trend is not likely sustainable, so some volatility is expected in the upcoming months. Multifamily shows the most substantial increase in markets, posting year-over-year volume gains. In total, 19 of the top 25 markets posted gains in the first half, including six that more than doubled.

Retail

Retail is still aiming for a sales bottom, as $9.9 billion traded in Q2, the lowest total this cycle. However, this is only a 10% decline from the previous cyclical low point in 2023 Q2. Volume is likely to face additional year-over-year pressure in subsequent quarters. However, pricing is showing signs of stabilizing, with a slight uptick of 0.7% over the past year. Additionally, 15 of the top 25 markets for first-half volume posted an increase from last year, many with gains of 100%-300%.

Hospitality

Similar to multifamily, volume increased on both a quarterly and annual basis. A total of $6.7 billion transacted, dominated by single-asset sales. Entity and portfolio deals were up 108% in Q2 compared to last year. Pricing continues to decline, down 5.7% per MSCI estimates. At the market level, activity is more of a mixed bag. Of the top 25 markets for volume, 10 posted year-over-year increases, nearly all of which were 100%-450% stronger. Two other markets were flat. Nashville, New York City Boroughs, Ventura County, CA, and Madison, WI, all set first-half records.