- First quarter volume fell 15% from Q4, a better-than-normal performance.

- Dating back to 2002, the typical year-end to Q1 decline is 24%.

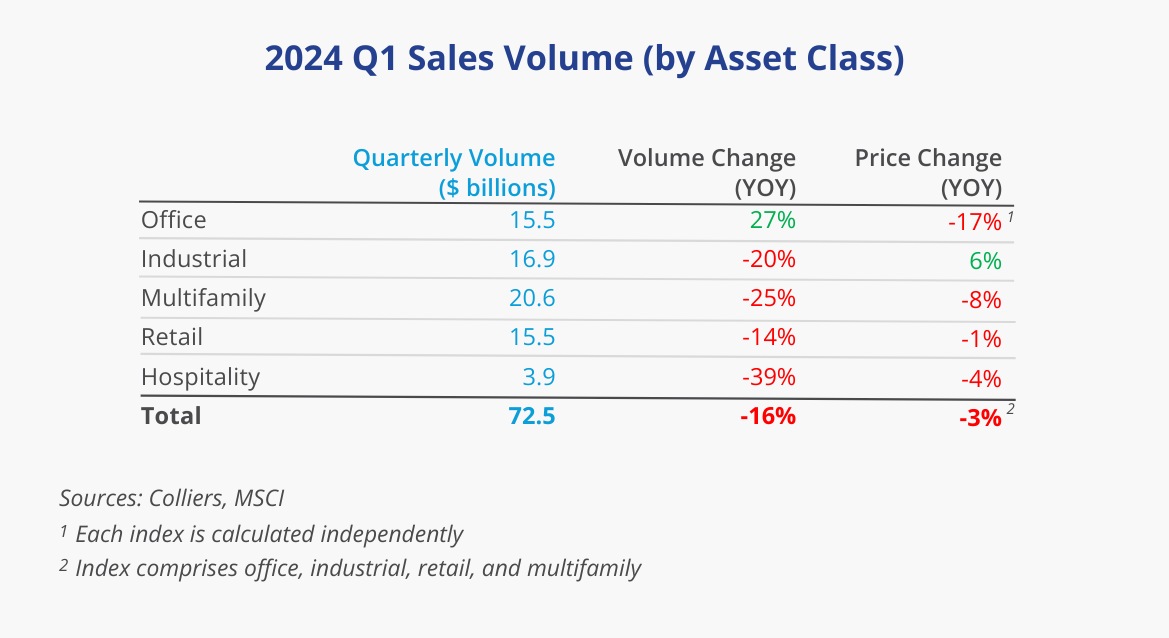

- MSCI reports that price declines continue to moderate, down 3% over the past year.

- Multifamily remains the volume leader, but industrial, office, and retail converged to start the year.

- The recent rise in the 10-year Treasury has some investors skittish, suggesting a more robust rebound is still in a holding pattern.

Outside of a weak February, Q1 volume showed signs of improvement. Volume was off 15% over the prior year and the same amount compared to Q4. Typically, there is a more significant decline in volume coming off year-end. Had February’s monthly volume been in line with January and March, total volume would have been similar to year-ago and year-end figures. The recent rise in the 10-year Treasury has put some deals on hold.

Aaron Jodka

Aaron Jodka

Office volume showed signs of improvement in Q1, up 27% from prior-year figures.

Office

Office volume showed signs of improvement in Q1, up 27% from prior-year figures, and somewhat skewed by a medical office transaction that drove about a third of overall activity. There have been some larger transactions inked, while discounts are also prevalent. Cap rates are on the rise, and transactional prices continue to pull back.

Industrial

Industrial volume was down 20% from year-ago levels but continues to show signs of stabilization. Transactional prices remain in line with the middle quarters of 2023, though cap rates are up. Investors are again looking at longer-term leases, which should provide additional liquidity in the market overall.

Multifamily

Multifamily remains the volume leader, with $20.6 billion traded in Q1. This figure is down 25% compared to last year but is a significant improvement from recent quarters, when volume was off roughly 50%-70%. Pricing has corrected, and cap rates have moved up about 100 basis points per transactional figures.

Retail

Retail posted a quarter-over-quarter increase in sales volume, though it is still down compared to last year’s Q1. The number of deals done showed a marked increase, returning to levels of activity representative of a healthy market. Transactional pricing has increased in recent months, but cap rates are also up.

Hospitality

Hospitality volume has been slower to rebound on a year-over-year basis. While conditions have improved incrementally, other asset classes have recently gained momentum. Transactional cap rates have been hovering around the mid-8% range in recent quarters, while price-per-door metrics are down.

Nicole Larson

Nicole Larson