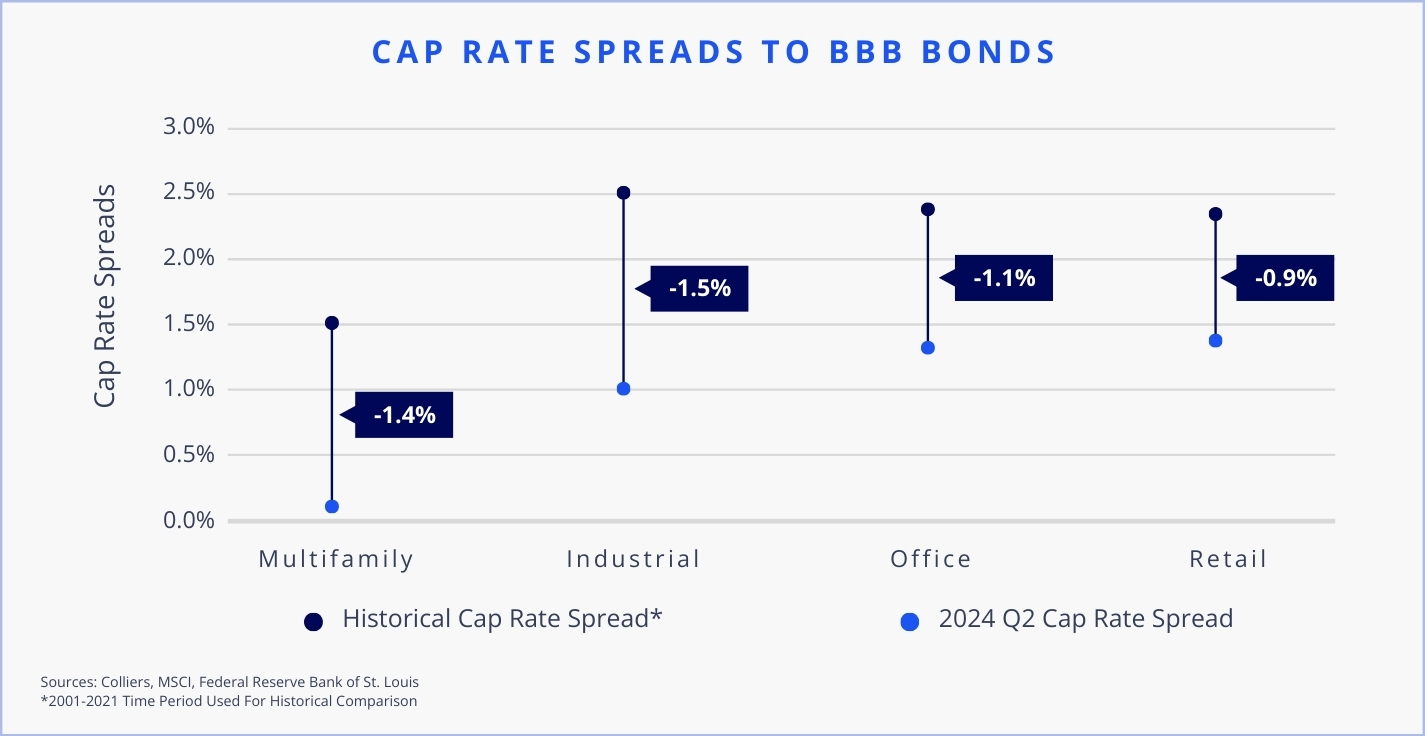

- Cap rate spreads to BBB bonds are adjusting.

- No asset classes had negative spreads at the end of Q2.

- Industrial spreads have moved the most, although they remain below long-term trends.

- BBB bond yields have fallen about 0.6 percentage points since the end of Q2.

- These factors are making real estate look more attractive.

Institutional investors have a range of options for deploying capital to maintain a diversified portfolio. Commercial real estate has often been compared to BBB bonds as an alternative investment. The “average” commercial real estate property has default risk baked into its tenant mix. Similarly, BBB bonds, which are on the lower end of the investment grade spectrum, also carry default risk. BBB bond pricing moves much quicker than commercial real estate, given that these securities trade on the open market and are constantly repricing. As a result, spot pricing can sometimes lead to fluctuations, but longer-term trends can help smooth this out.

Aaron Jodka

Aaron Jodka

Cap rate spreads have widened across all asset classes, making commercial real estate increasingly attractive to investors.

Over the past year, cap rate spreads to BBB bonds have generally come in. Multifamily, which previously had a negative spread, is now positive, while industrial has moved the most, up 0.8 percentage points. Retail also rose, while office has remained largely stable due to recent cap rate compression resulting from the trades of lower-occupied properties. All asset classes boast spreads below the long-term trends dating back to the early 2000s and the 2016-2019 pre-pandemic era.

Since the end of Q2, BBB bond yields have come in about 0.6 percentage points as bonds have rallied, while cap rates have remained relatively stable. This has made commercial real estate look more attractive to investors. One could argue that the maturation and expansion of commercial real estate as an investment class should lower spreads compared to history due to the wider availability of capital and competition. As the Fed prepares to cut rates, investors will be closely watching the balance between yield-producing assets, such as commercial real estate and bonds.