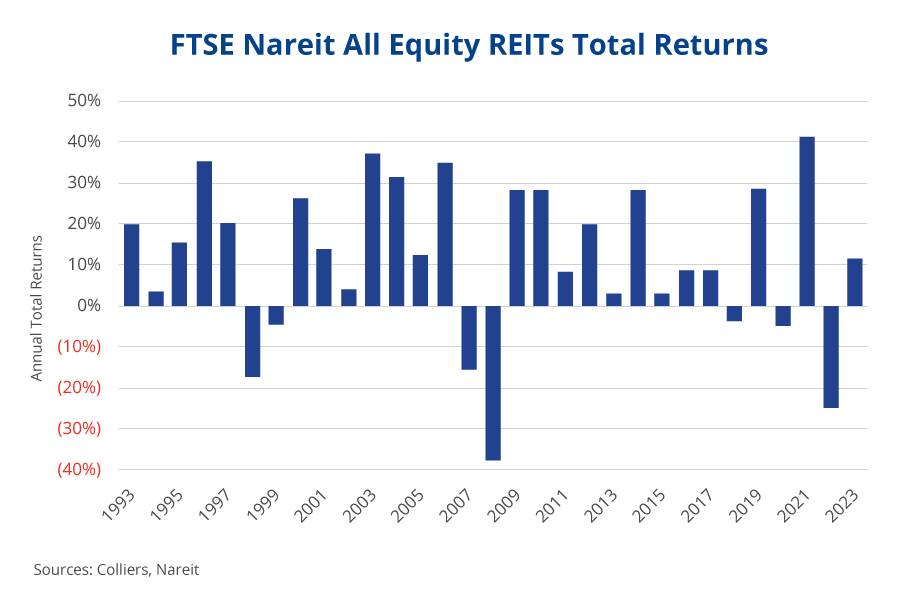

- After facing significant challenges in 2022, REITs bounced back in 2023.

- The FTSE Nareit All Equity REIT total return index climbed 11.36% on the year.

- Data centers led the way, increasing 30.08%, followed by lodging/resorts at 23.92%, and specialty, including movie theaters and outdoor advertising, at 22.28%.

- Only diversified REITs (-7.59%) and telecommunications (-1.52%) posted a decline on the year.

- With the Fed’s rate hike cycle easing and tremendous amounts of investor capital on the sidelines, there is increased potential for more REIT privatizations in 2024.

Publicly traded REITs are a closely watched leading indicator of private real estate. Given their very nature, pricing is far more volatile than the transaction market would indicate. However, REIT performance can provide valuable insight into current market sentiment. If 2023 is any indication, the market has found a bottom. The overall FTSE Nareit All Equity REIT index climbed 6.75% in price and 11.36% in total return, including dividends. Unsurprisingly, there were vast differences in asset class performance, with data centers and lodging/resorts coming out on top. Within retail, regional malls gained 29.94% on the year.

Very few sectors and segments posted declines on the year, including diversified REITs, seemingly punished for their lack of sector specialization, and telecommunications. Within sectors, freestanding retail posted a decrease of 1.54%.

Aaron Jodka

Aaron Jodka

“After facing significant challenges in 2022, REITs bounced back in 2023.”

Due to the higher cost of capital, REIT privatization slowed significantly in 2023. Only a select few entities opted for privatization; GIC and Oak Street secured STORE Capital, KSL Advisors acquired Hersha Hospitality Trust, and Centerbridge Partners, in collaboration with GIC, completed the acquisition of INDUS Realty Trust. Mergers were more commonplace, with Extra Space Storage combining forces with Life Storage, Realty Income Corp. with Spirit Realty Capital, and Healthpeak Properties with Physicians Realty Trust.

Will 2024 be a year of more privatizations? The cost of capital is expected to ease, especially money benchmarked to SOFR. In addition, investors are waiting to deploy near-record amounts of sidelined funds.

Aaron Jodka

Aaron Jodka

“Data centers led the REIT return index with a 30.08% increase, showcasing sector resilience.”