- Since the heyday of the housing boom of the mid-2000s, retail construction has been relatively restrained.

- Overall, the amount of space per capita has decreased since 2006, per data from CoStar.

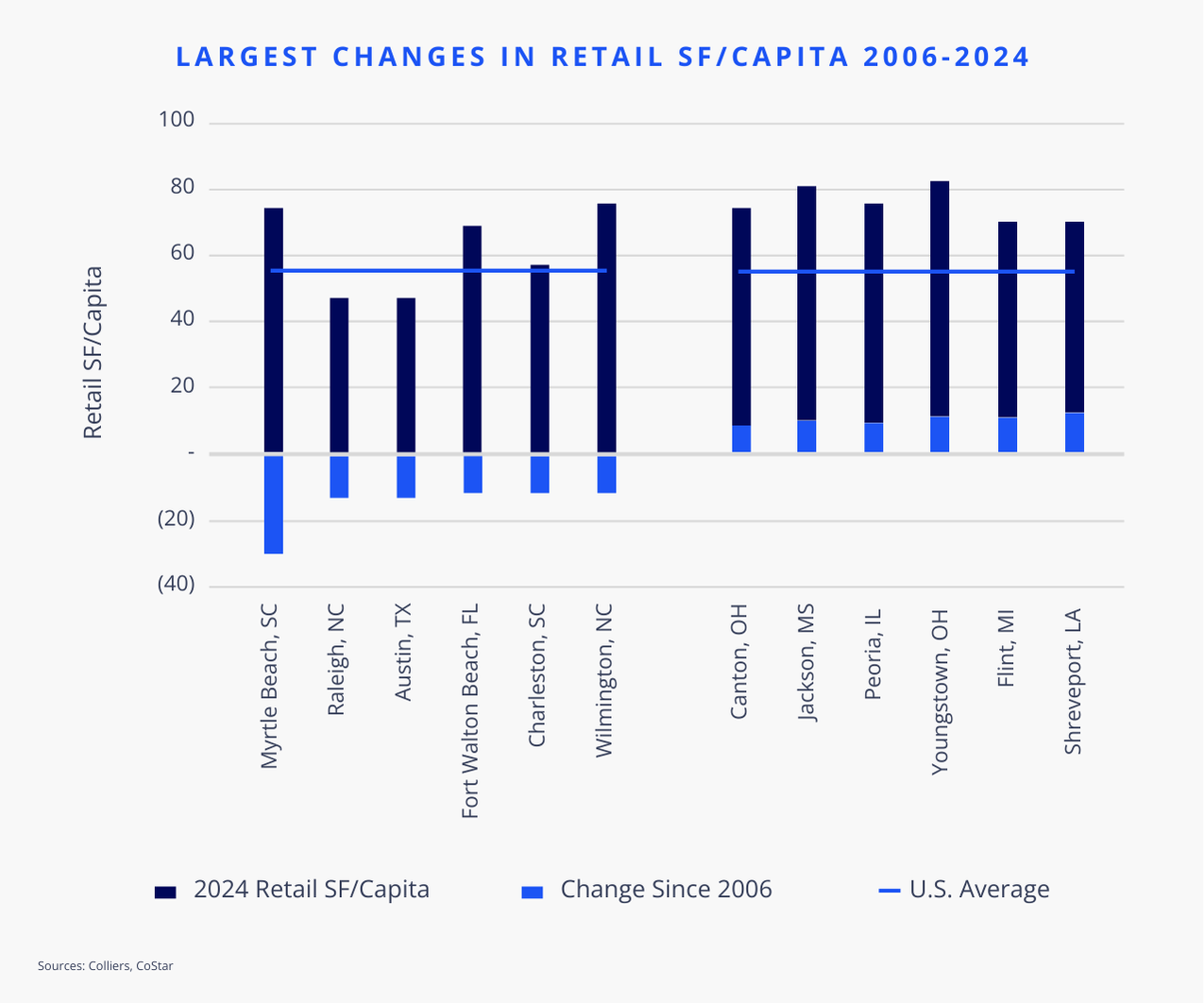

- Six markets have seen their SF/capita numbers shrink by at least 10 SF over that period.

- Two of the six are major markets, with space/capita numbers below the national average.

- Identifying markets with strong population growth and limited development could yield strong development potential.

It’s no secret that the U.S. has a lot of places to shop, leading other nations by a wide margin in terms of retail SF/capita. However, since the housing bust of the mid-2000s, development has been rather restrained. In fact, the amount of space per person has decreased only slightly, by nearly 1 SF, to 56 SF/capita, indicating that development has been in line with population growth on average. That’s where it gets interesting – looking at the markets that deviated from the norm.

Using data from CoStar for markets with at least 300,000 people as of 2024, six have seen their retail SF/capita figures drop by at least 10 SF. Myrtle Beach, SC, experienced the most significant decline at 26 SF. Raleigh and Austin come in next with a decrease of 11 SF each, while Fort Walton Beach, FL; Charleston, SC; and Wilmington, NC, all fell by 10 SF.

Of that group, only Austin and Raleigh have a lower SF/capita figure than the U.S., so one could argue the other markets have been over-retailed. However, it’s important to note they have also seen strong population gains, and some are tourist hotspots. This suggests that retail SF/capita metrics should be reconsidered, as shopping in these vacation areas extends beyond just permanent residents.

Aaron Jodka

Aaron Jodka

Markets with strong population growth and declining retail SF/capita metrics present intriguing opportunities for development.

On the other end of the spectrum are Shreveport, LA; Flint, MI; Youngstown, OH; Peoria, IL; Jackson, MS; and Canton, OH, which have seen their space increase by 8-11 SF over the same period. These markets have generally continued adding new retail to inventory despite population declines or, for Jackson, modest growth.

Markets like Provo, UT; Lakeland, FL; Greeley, CO; and Seattle have all seen their retail SF/capita figures fall at least 7 SF and have boasted below-average SF/capita numbers compared to the U.S. over time.

Identifying areas with strong population gains and declining retail SF/capita metrics could prove fruitful development grounds. Markets with below-average space to begin with suggest higher barriers to entry, which makes them even more intriguing.