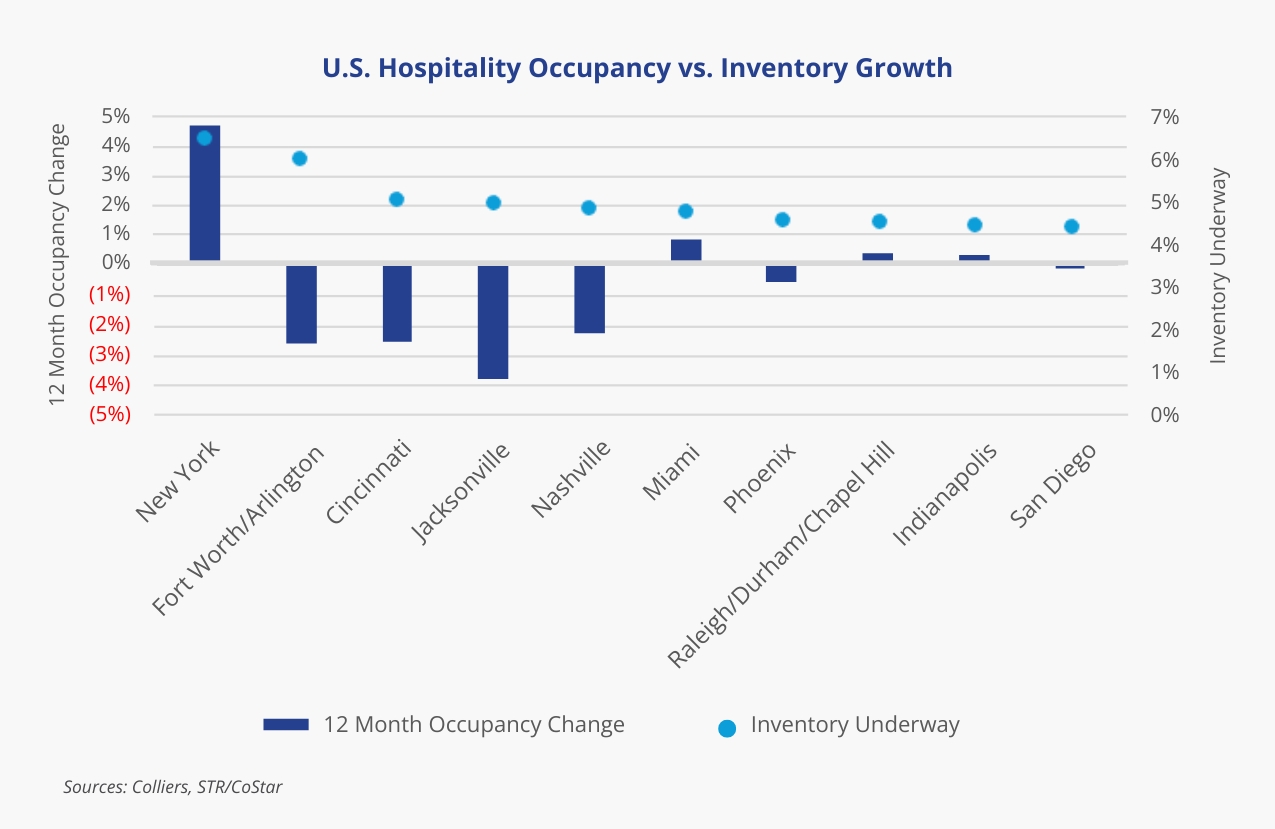

- Pockets of development have emerged across markets.

- New York leads the country in inventory underway.

- Over the past year, the Florida Panhandle, Fort Worth/Arlington, and New Orleans have led supply growth.

- Boston, New York, Oahu, Pittsburgh, and Washington, D.C., have experienced the most notable occupancy gains.

- Comparing recent demand trends with upcoming development can prepare investors for future market performance.

The hospitality market is holding up well overall. Nationally, occupancies have slipped, particularly in the economy and midscale segments of the market. There are clear differences in consumer confidence by income bracket, as reported by The Conference Board. Meanwhile, credit card delinquencies are rising, implying financial stress on the typical budget-focused traveler. Conversely, upper upscale, upscale, and luxury have seen increasing demand. Group bookings, including events, conferences, weddings, and team get-togethers, are supporting this surge. Many of these bookings have also been short notice, offering potential upside to occupancies and RevPAR growth in the months ahead. Over the past 12 months, markets such as New York (thanks to changes in short-term rental regulations), Boston, Washington, D.C., and Seattle have been among the strongest occupancy gainers. On the other end of the spectrum are the Inland Empire, Sacramento, Orlando, and Tampa, which have seen occupancies slip between 3.8 and 4.9 percentage points.

Aaron Jodka

Aaron Jodka

Comparing recent demand trends with upcoming development can prepare investors for future market performance.

Supply-side pressure hasn’t been significant nationally. However, many operators are expanding their brand offerings, and there have been pockets of supply. Over the past year, the Florida Panhandle, Fort Worth/Arlington, New Orleans, and Austin have led the country in deliveries, each with at least 2.2% growth. New York, Fort Worth/Arlington, Cincinnati, Jacksonville, and Nashville are expected to lead in future development, all with at least 4.8% of their inventory underway. Some of these markets have also posted the most significant occupancy declines over the past year, suggesting that property metrics will remain challenged in the near term.