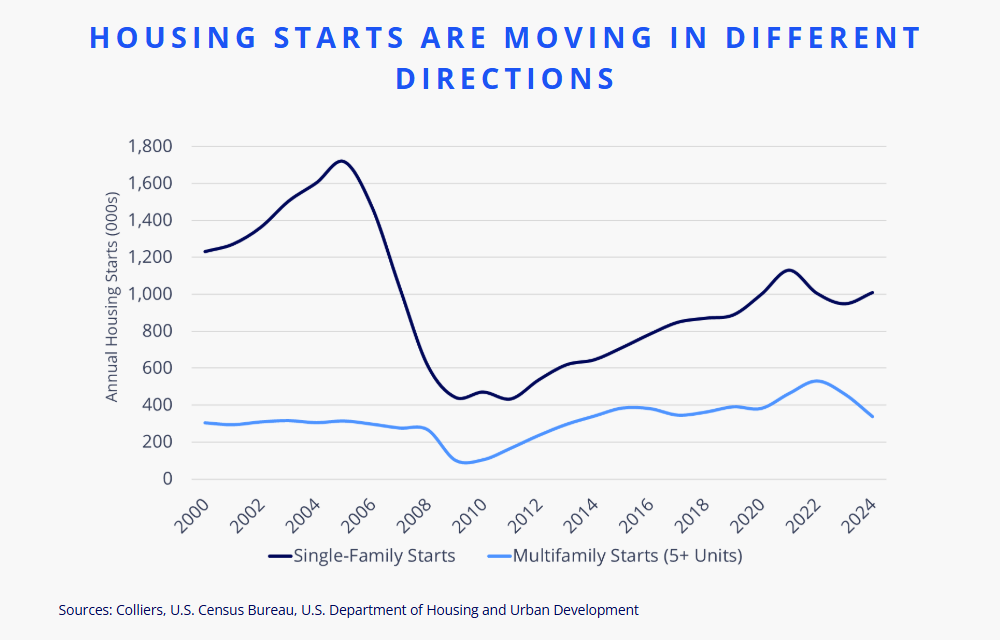

- U.S. housing starts reached 1.37 million last year, marking the 11th consecutive year they’ve topped 1 million.

- The composition of those starts is shifting, with multifamily units (5+) pulling back for the second straight year, while single-family starts have increased.

- Multifamily completions hit a multi-decade high of 588,000 units, the highest total since 1974, according to Census and HUD estimates.

- Single-family home completions have remained stable since 2022.

- With an elevated inventory of unsold homes, opportunities for single-family rental platforms appear to be growing.

In aggregate, the U.S. is underhoused, with various estimates suggesting a shortfall in the millions of units. With household formation outpacing construction in recent years, the market has struggled to keep up, driving up home prices and multifamily rents. The homeownership rate ended 2024 at 65.7%, slightly above pre-pandemic levels.

Green Street estimates there are roughly 45 million rental units nationwide, with the bulk of those in multifamily properties of 5+ units (21 million) and single-family homes (14 million), and the remainder in townhomes (2-4 units) and manufactured housing. The U.S. Census and HUD estimate that 588,000 privately owned multifamily units (5+) were completed last year—the highest total since 1974.

The cost of capital and construction remains elevated, suggesting the pullback in aggregate privately owned housing units will continue. Starts across all housing counts peaked in 2021 but have been trending downward since. Both single- and multifamily housing starts have fallen since 2021, though the multifamily slide is more acute. Multifamily starts totaled 337,000 units in 2024, down 36% from their 2022 peak, while single-family starts rose 6% last year, surpassing one million. With signs of unsold inventory building up, single-family rental platforms may have more options to expand their holdings.

Zillow estimates that the U.S. is underhoused by 4.5 million homes, while Freddie Mac pins the figure closer to 3.7 million.

Homebuilders respond to demand, and if it holds up, they will continue moving forward with new projects. Builder incentives and rate buydowns have been helpful; however, mortgage rates, which are high compared to recent years, along with near-record home prices per the S&P CoreLogic Case-Shiller U.S. National Home Price Index, have created challenges for potential buyers. This combination has kept demand for rental housing strong, a trend that does not look set to change in the near term, supporting multifamily and single-family rental strategies.

Colliers Insights Team

Colliers Insights Team

Steig Seaward

Steig Seaward