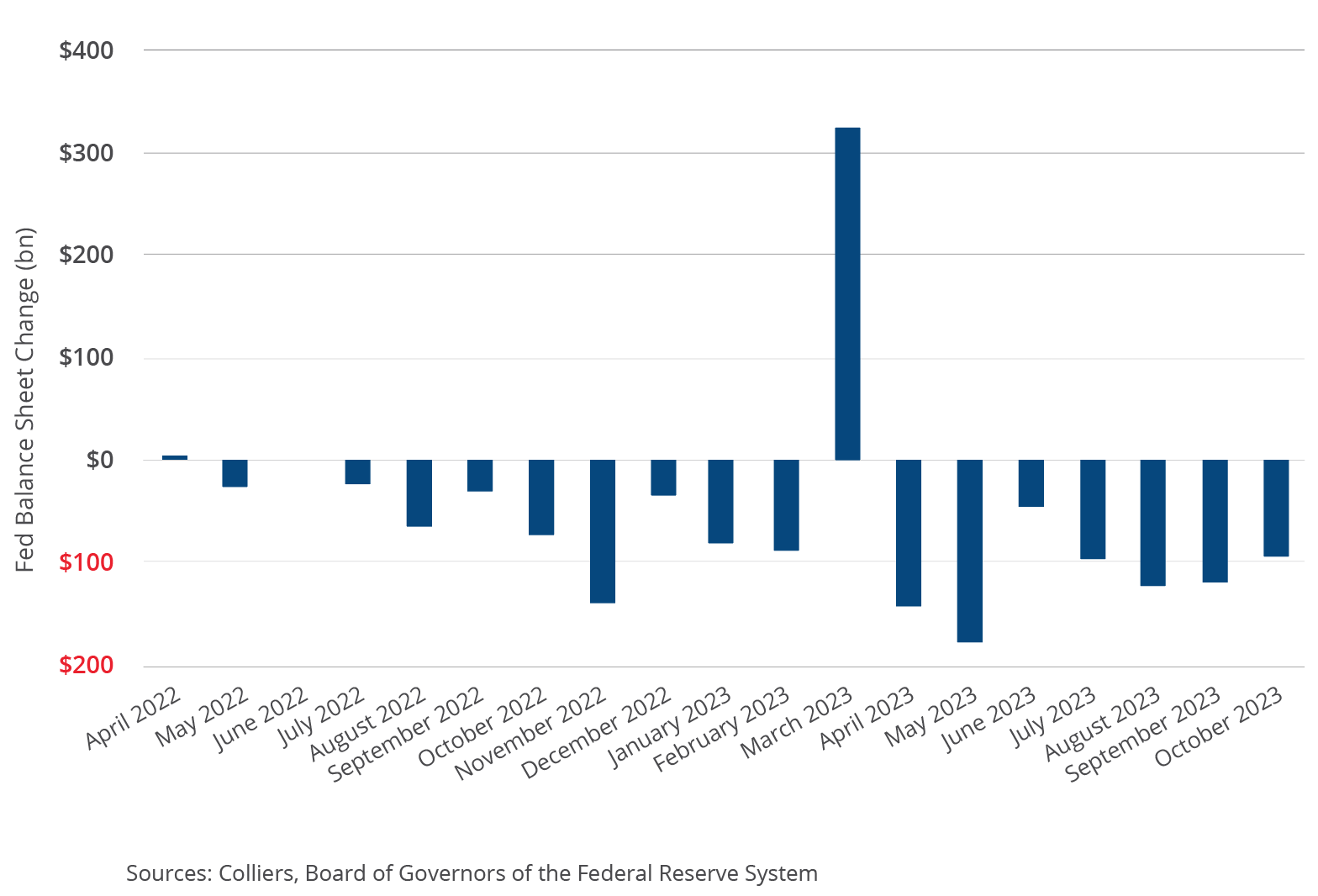

- Since April 2022, the Federal Reserve’s quantitative tightening (QT) has cut $1 trillion from its balance sheet through October.

- At $7.9 trillion, this brings total assets back to Spring 2021 levels, $3.7 trillion above pre-pandemic figures.

- Over the past seven months, the balance sheet has been reduced by an average of $114 billion per month.

- The Fed’s elevated balance sheet potentially leaves less room to address the next financial crisis.

- Private capital has a unique opportunity to fill the needs of the commercial real estate industry.

Monthly Change In Fed Balance Sheet

The Federal Reserve’s policy of raising interest rates and drawing down its balance sheet through QT has reduced liquidity in the overall financial system. How long this will last is an open-ended question. Despite this balance sheet reduction, the Fed’s holdings remain well above pre-pandemic levels. At the current pace, it would take another 33 months to return to early 2020 levels. Recent commentary from Fed officials suggests continued balance sheet reduction, though a defined target is unclear. The Fed will likely pause or reduce its overnight bank funding rate before ending its QT.

It’s no secret that the Fed’s aggressive rate hiking policy has caused challenges for commercial real estate investors. While maturing Treasuries have driven the Fed’s balance sheet reduction, MBS has also burned off the books. This combination has crimped overall liquidity in the market, opening the door for private capital to fill some of the void and presenting unique investment opportunities. While private capital sources are unlikely to offset the Fed’s actions fully, the funds on the sidelines offer a promising sign for the future.

Colliers Insights Team

Colliers Insights Team

Steig Seaward

Steig Seaward