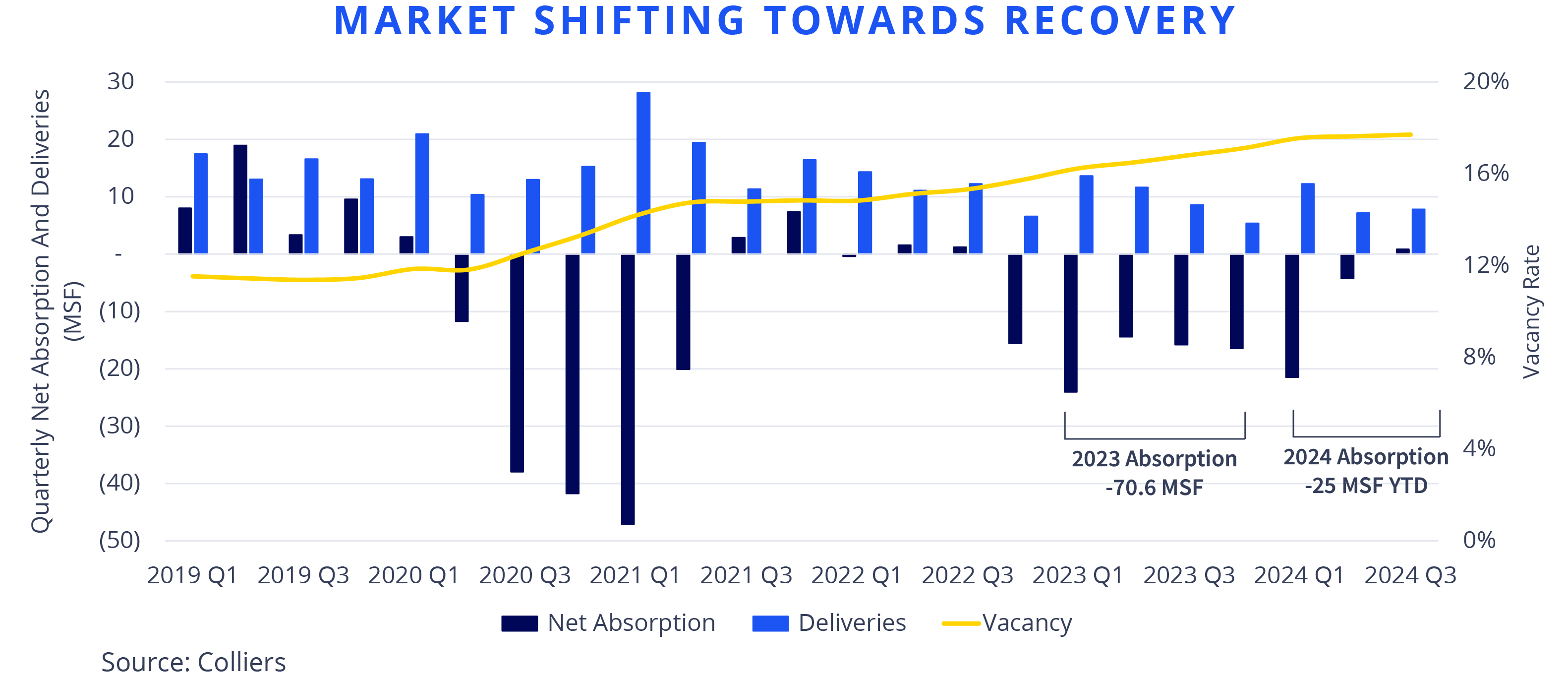

- For the first time since 2022 Q3, the U.S. office market posted positive net absorption.

- This follows a multi-quarter trend of less severe negative net absorption, with vacancies ending Q3 at 17.7%.

- With limited construction, stronger return-to-office metrics suggest further improvement in the quarters ahead.

- While not a remedy, office conversions will help on the margin by removing less competitive inventory from the market.

- With investment sales activity perking up, office looks to be an intriguing target.

After seven consecutive quarters of negative absorption that added 112 million SF to the market, the tides turned in Q3, with the U.S. office market posting 831,000 SF of positive absorption. While that is a far cry from the losses seen in recent quarters, it marks a continued trend of progress and shows that the vacancy rate is stabilizing nationally. Increased leasing activity is contributing to improved occupancy and absorption rates, while the slowdown in new construction deliveries is helping to limit the pressure of new vacant space. It is important to note that the composition of vacancy has changed. Large amounts of sublease space are no longer reentering the market as in recent years; however, as those leases expire, this space is being returned to the landlord. Simultaneously, some occupiers have removed sublease space from the market after realizing they needed it themselves. Stronger return-to-office metrics offer signs of continued improvement in the quarters ahead, supported by additional job growth.

Aaron Jodka

Aaron Jodka

Office fundamentals are beginning to stabilize, providing investors with long sought clarity.

Office conversions are gaining traction across the U.S., further supporting market conditions in the future. While this is not a cure-all, it will remove millions of SF of less competitive inventory, aiding the vacancy recovery. Investors have taken notice, with office posting the strongest quarter-over-quarter and year-over-year sales increases of all asset classes. Despite challenging headlines, the pendulum seems to be swinging back the other way, making the asset class an intriguing acquisition bet.

Marianne Skorupski

Marianne Skorupski