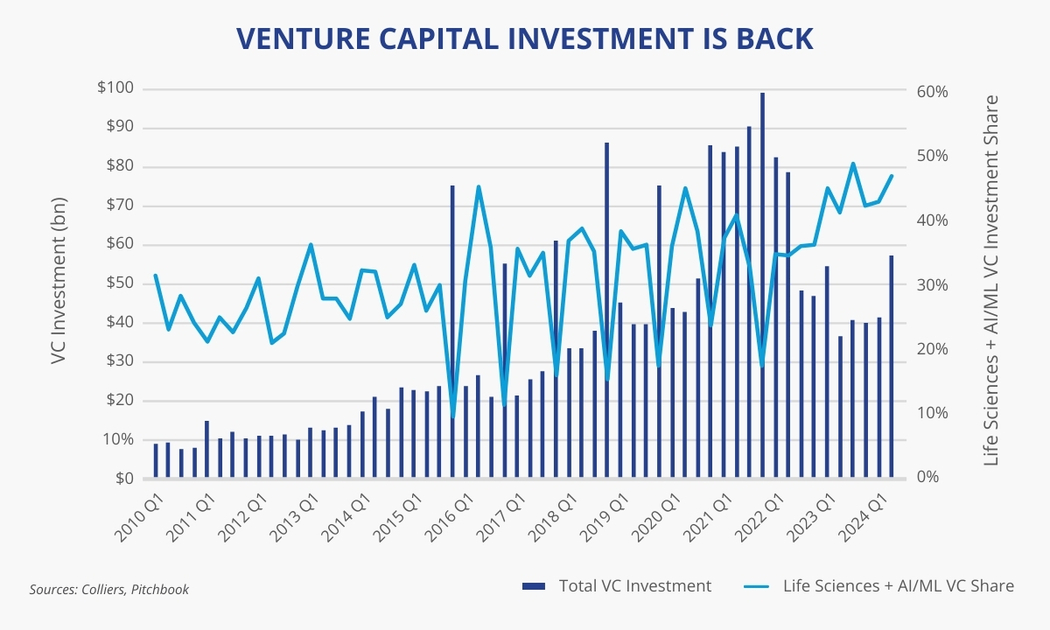

- After stabilizing the prior three quarters, total venture capital (VC) investment jumped in Q2.

- The second quarter marks one of the best quarters ever, aside from the 2020-2022 era.

- Artificial intelligence (AI) and machine learning (ML) have recently captured higher shares.

- Life sciences has rebounded strongly, with Q2 investment up 35% year-over-year.

- VC investment offers green shoots for future commercial real estate demand, especially in select markets.

When analyzing the current landscape of VC funding, it is evident there are signs of optimism, even emerging euphoria. VC investment in Q2 totaled a staggering $57.8 billion, a 56% increase from last year, per data from PitchBook. The most recent quarter’s figures have only been topped four other times, outside of the seven quarters between 2020 Q4 and 2022 Q2. What may be more telling are the specific sectors where investors are putting their money: life sciences and AI/ML. Combined, these two sectors captured 47% of VC investment in Q2. AI/ML has been all the rage of late and has topped life sciences in total investment in three of the past six quarters. Life sciences allocations are up 35% compared to last year, while AI/ML is up 141%. If broader search criteria are used to capture companies related to the industry, AI/ML increases even more.

Aaron Jodka

Aaron Jodka

Combined, life sciences and artificial intelligence/machine learning captured 47% of VC investment in Q2.

Given these trends of increasing VC investments and concentration within sectors, specific markets stand out. The key life sciences markets along the coasts, including Boston, San Francisco, San Diego, and Philadelphia, have the most extensive inventories and deepest labor pools. On the AI/ML front, data center development is soaring. While the focus remains on the nation’s leading market in Northern Virginia, it is spreading across the United States to cities large and small. On the office demand front, markets such as Seattle and New York have experienced absorption, but these have typically been smaller leases. San Francisco has been the main beneficiary.

Next week’s Quick Hits will explore the impact of AI/ML on the San Francisco office market.