- The U.S. flexible workspace sector behaves differently from its counterparts in markets overseas.

- Sector inventory dropped by 9.4% overall across the U.S., and up to 20% in certain markets.

- In mature markets like London, flexible workspace products are a must-have in properties.

- How landlords chose to deliver flexible workspace products within portfolios will vary based on their financial positioning, hold periods, and willingness to operate this space themselves.

- Pricing discovery is still being determined for investment sales.

Flexible workspace is poised to make a comeback. Considering markets across the globe, the flexible workspace sector in the U.S. differs from that elsewhere in recent quarters. In London the sector continued to grow throughout the pandemic. The flexible workspace sector is far more common there and is ubiquitous. In Asia that market has been stable, with growth resuming in recent months. That offers insight into what could transpire here in 2022.

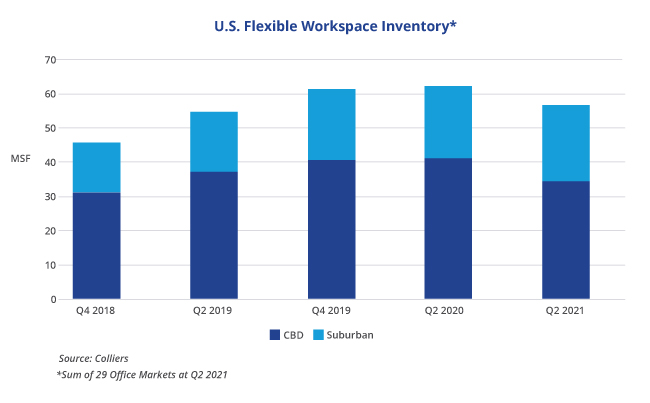

In the U.S., the flexible workspace market shrank since early 2020. In some markets such as Boston and New York space reductions approached or exceeded 20%. On average, across 29 markets in both CBDs and suburbs, the flexible workspace market contracted 9.4%, driven by the top 10 markets’ average space reduction of nearly 13%. Secondary markets, however, had a slight uptick.

If London and other mature markets are a guide, we can expect a flexible workspace sector rebound in the U.S. Since this space is seen as an amenity and a must-have for owners, landlords dealing with the uncertainty of a return to offices can use it to capture tenant growth and movement. Whether this space will be operated by a partner — think Industrious — or be landlord-run, such as Flex by BXP or Studio, will depend on hold periods and expertise running such an operation. Regional and local landlords are also starting to get into this space, ranging from true flex workspace to coworking to pre-built spec suites.

With office investment sales volumes rebounding, more tower deals will include flexible workspace products, which will help with price discovery. Overseas, flexible workspace does not lead to any pricing discounts, while before the pandemic signals were mixed about pricing in the U.S. As flexible workspace operators such as WeWork have reined in growth, that should shore up occupancies and overall fundamentals. It’s only a matter of time until flexible workspace is a key driver of U.S. office absorption again.

Aaron Jodka

Aaron Jodka

Nicole Larson

Nicole Larson