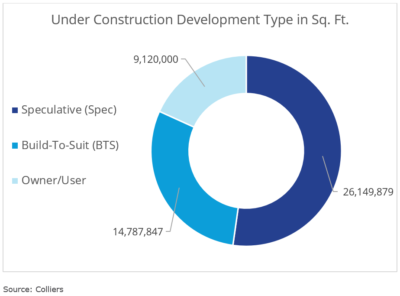

Office construction across the top 10 US markets rounded out Q2 2022 at 50.1 million sq. ft., with the San Francisco Bay Area (San Francisco combined with Silicon Valley) topping the list at 9.2 million sq. ft. of active construction. Speculative projects (spec) account for just over half of construction activity, indicating that developers have confidence in the future of trophy assets.

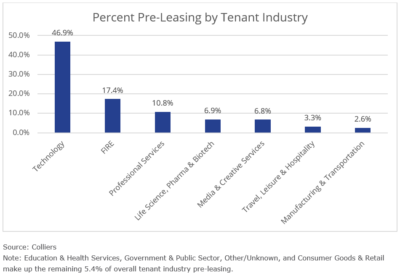

Preleasing activity, a leading indicator of construction demand, remains strong. Of the 50.1 million square feet of developments under construction, 59.0% of it is pre-leased. The top tenant industry is technology, accounting for 46.9% of the 29.5 million square feet of pre-leased inventory. Other leading industries are FIRE (Finance, Insurance, Real Estate) at 17.4% and Professional Services at 10.8%.

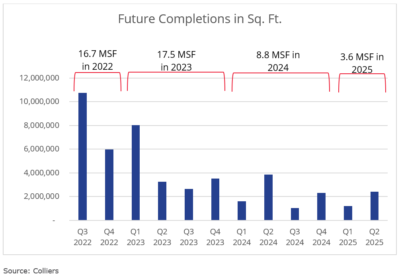

In Q2 2022, there were 9.0 million sq. ft. of completions and in this reporting period, Manhattan saw the most completions at 3.9 million sq. ft., of which 73.7% was pre-leased. In the second half of 2022, an additional 16.7 million sq. ft. of new inventory is expected to be added within the top ten office markets and 2023 is expected to be a banner year of completions with an estimated 17.5 million sq. ft. However, a recent announcement by Amazon that the company will halt some construction projects could impact future completion dates.

Colliers Insights Team

Colliers Insights Team

Sheena Gohil

Sheena Gohil Bob Shanahan

Bob Shanahan Dougal Jeppe

Dougal Jeppe Kai Shane

Kai Shane

Bret Swango, CFA

Bret Swango, CFA Michelle Cleverdon

Michelle Cleverdon

Aaron Jodka

Aaron Jodka